Labeled Bonds: Quarterly Market Overview Q1 2023

Research Paper

July 14, 2023

Preview

In our quarterly series dedicated to labeled bonds, we break down the latest issuance trends and the overall market by multiple bond and issuer characteristics to identify key developments in this rapidly growing and increasingly diverse market.

After several muted quarters, labeled-bond issuance rebounded strongly in the first quarter of 2023. These instruments provide investors with an opportunity to add exposure to issuers investing in various environmental and social projects in their portfolio, without markedly altering its credit characteristics. This is because, all else being equal, most labeled bonds' carry very similar credit risk as conventional bonds from the same or closely comparable issuers. That also meant that while labeled bonds continued to differ significantly from conventional bonds of similar issuers in terms of their sustainability characteristics, their performance continued to be primarily driven by traditional fixed-income risk-and-return drivers.

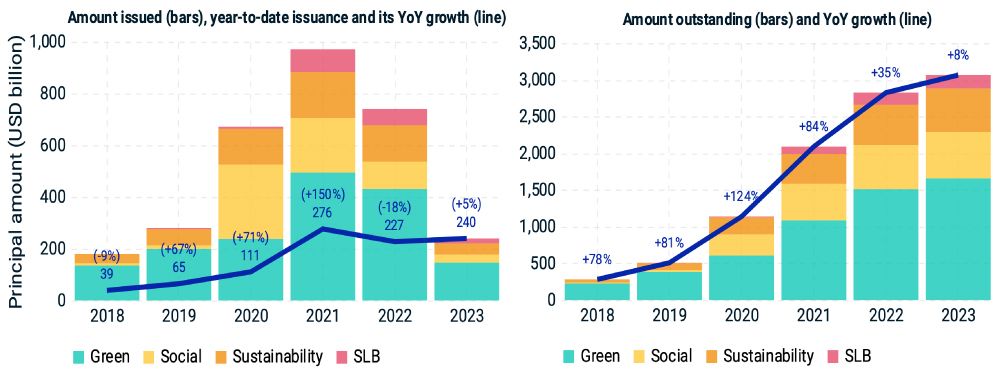

Gross labeled-bond issuance and amount outstanding (last five years and year-to-date)

Data as of March 31, 2023. Source: Refinitiv, MSCI ESG Research.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Green Bond Issuance and Cost of Debt

Given the rapid growth and increased presence of corporate issuers in the labeled-bond market, we outline the main reasons issuers may choose to issue these instruments.

Green Bonds and Climate — Towards a Quantitative Method

Participants in the green-bond market have traditionally examined a green bond's "use of proceeds" to check the legitimacy of these projects and whether the bond was created in line with the Green Bond Principles.

How Sovereigns Have Changed the Green-Bond Market

With the expansion of the global green-bond market, there has been a notable rise in the share of green bonds issued by governments. Sovereign green bonds now constitute over 20% of the Bloomberg MSCI Green Bond Index.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.