A Spotlight on Value Strategies

Popularized nearly 90 years ago, value investing has evolved into approaches that differ in investment process and execution. As investors look to pick from a roster of active value managers in a time of the style factor's resurgence, understanding the key differences in their methods can be insightful.

A trio of approaches

Three distinct value strategies that investors can choose from include the purchase of deeply discounted firms regardless of their quality ("deep value"), buying value firms that also tend to have sustainable business models ("quality value") or buying inexpensive, high-quality firms that the broader market is viewing positively due to constructive micro or macro influences ("quality value with catalyst").

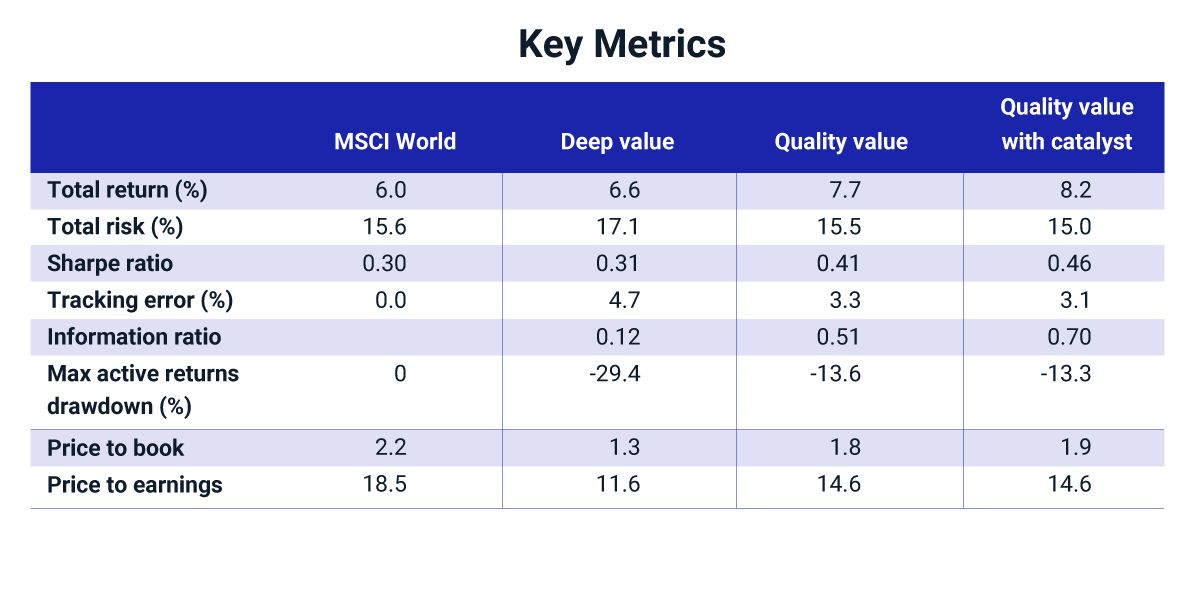

We simulated these broad fundamental approaches and reviewed their performance in developed markets over the last 20-plus years.1 Deep value held the cheapest firms but also tended to hold the most "value traps" and lowest-quality firms. In contrast, quality value was more defensive, providing a balanced mix of both inexpensive and high-quality firms. The result was a higher return with less risk, producing a less severe drawdown when compared to the deep-value approach.

The use of a catalyst is represented by the third value approach, which suggests that stocks can remain inexpensive without a spark on the horizon. We found that using analyst revisions as a catalyst generated the highest return, while also preserving the defensive characteristics of the quality-value approach.2

A comparison of key analytics

Gross returns annualized in USD. Dec. 29, 2000, to June 30, 2022.

Style distribution of the three strategies

Style tilts averaged monthly from December 2000 to June 2022.

Subscribe todayto have insights delivered to your inbox.

The Value of a Sector-Based Perspective

After years in the shadows, value stocks have emerged into the light this year, amid higher inflation and rising interest rates.

Analyst Sentiment as a Factor Consideration

An analyst’s equity opinion encompasses how a variety of different interrelated forces may impact the future performance of a company.

Value Construction as a Performance Driver

In a market environment fraught with recessionary concerns, the reversal in value investing’s fortunes after nearly a decade of lackluster performance has been a breath of fresh air for its long-standing loyalists.

1 For all three strategies, we followed a consistent optimization-based framework that aimed to maximize value factor exposure subject to a defined set of constraints. The deep value strategy was optimized to obtain highest value exposure. The quality value strategy first screened companies for positive quality score and then optimized to obtain highest value exposure. The quality value with catalyst strategy first screened companies for positive quality score and then optimized to obtain highest sentiment adjusted value exposure. The sentiment adjusted value exposure penalized companies with negative analyst sentiment.', 'Analyst revisions on companies was sourced from MSCI FactorLab.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.