Are Bonds and Equities Finding Harmony Once Again?

How have the sharp swings in inflation over the past few years impacted the return relationship between U.S. bonds and equities?

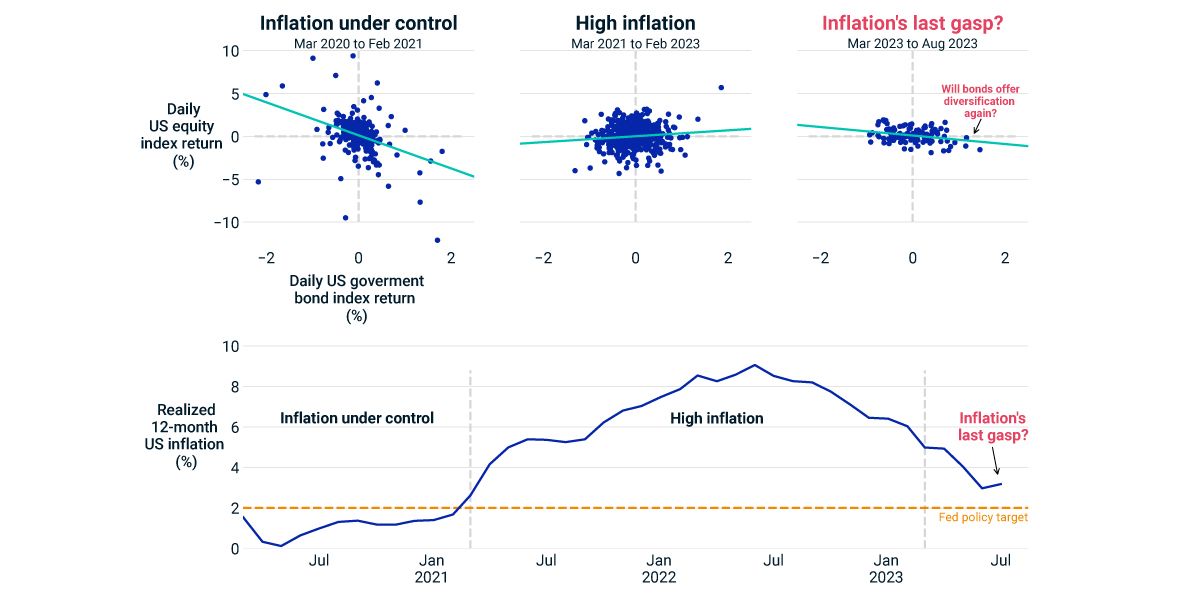

For the 20 years prior to the onset of the COVID pandemic, bonds offered important diversification benefits to investors with multi-asset-class portfolios, tending to rise in value when equities fell. During the first year of the pandemic, market volatility soared, but once again bond returns tended to move in the opposite direction to equities. Notably, inflation remained relatively stable during this period, albeit a bit below the Federal Reserve's 2% target.

Enter historic levels of inflation

The interplay between bonds and equities underwent an abrupt change between 2021 and early 2023, a period marked by the highest rates of inflation in 40 years. Rather than returns being negatively correlated (stock prices come down, bond prices go up), bonds and equities tended to move in the same direction. Bonds did not act as an anchor, but as a dead weight, and some investors began to question bonds' diversification benefits.

Between March 2023 and early August, the bond-equity relationship again shifted, this time with a slight tendency for returns to move in opposite directions. And while this relationship was weaker than before 2021, bonds' stabilizing impact became more evident in this period of receding inflation.

Investors have breathed a sigh of relief this year as inflation inched closer to the Fed's target. With inflation potentially back under control, bonds could regain their reputation as portfolio diversifiers, serving as hedges against equity-market volatility.1

Will bonds start offering diversification again?

U.S. equity returns are represented by the MSCI USA Index, while returns of U.S. government bonds are represented by the MSCI U.S. Government Bond Index. The yellow lines represent the line of best fit between returns. Inflation is represented by the one-year U.S. consumer price index (%).

Subscribe todayto have insights delivered to your inbox.

Bond Performance in 2023: A Midsummer Reflection

The good news for bond investors is that year-to-date U.S. returns have been positive. But bond returns were not as good compared to inflation, and bonds have continued to lag equities.

Macro Scenarios: Resilient US Economy but Downside Risks Loom

Investor sentiment has improved since the recent banking turmoil, and a soft landing for the U.S. economy seems possible. But there is geographic fragmentation, with China’s post-lockdown recovery potentially stalling. What could it mean for markets?

Has Inflation Affected the Bond-Equity Relationship?

The sharp rise in inflation over the past year and a half, combined with growing concern over the U.S. economy’s strength, may prompt investors to rethink basic assumptions underlying portfolios comprised of bonds, equities and other asset classes.

1 According to MSCI’s Macro-Finance Model, the Fed’s credibility stabilizes long-term inflation risk, which in turn drives the bond-equity correlation negative.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.