Bringing a Style Lens to Small Caps

Another way to deepen our understanding of small-cap stocks is to look at them through a style-factor lens. As MSCI Research covered recently, style-factor indexes, such as value and growth, remain relevant as benchmarks to measure the performance of value- and growth-investing managers. So how has the style-factor dimension played out in the small-cap space?

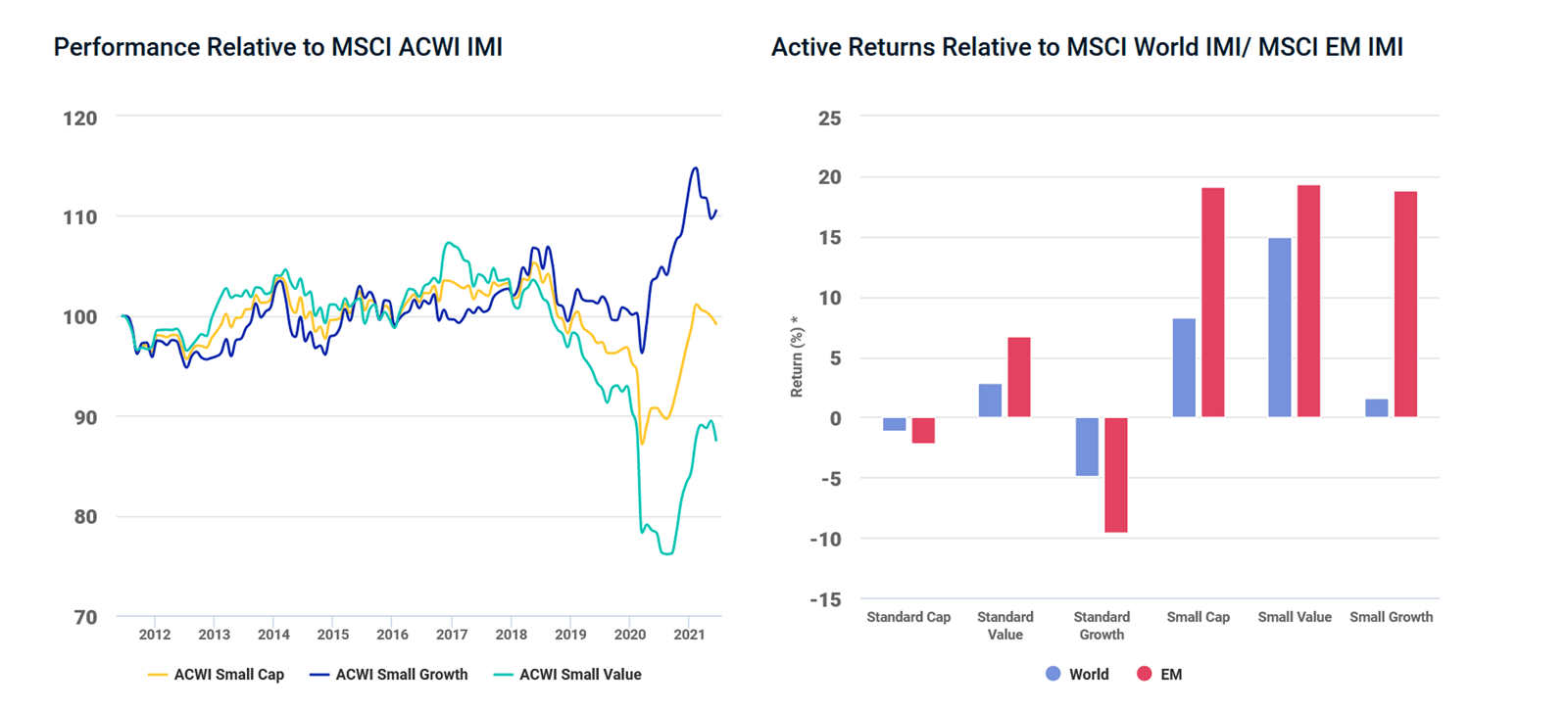

Many market participants recognize that small caps and value companies have often played a strong part during economic recoveries, and this recovery has been no exception. The economic indicators and reopening of the global economy, following the roll-out of COVID-19 vaccines in November 2020, have marked a strong comeback in the performance of small-sized companies — which outperformed large- and mid-cap stocks across developed and emerging markets — and in the resurgence of value companies over their growth counterparts.

Another way to deepen our understanding of small-cap stocks is to look at them through a style-factor lens. As MSCI Research covered recently, style-factor indexes, such as value and growth, remain relevant as benchmarks to measure the performance of value- and growth-investing managers. So how has the style-factor dimension played out in the small-cap space?

Bringing a Style Lens to Small Caps

Data from Oct. 30, 2020, to Jun. 30, 2021. Standard refers to large- and mid-sized companies. IMI includes both standard and small caps.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends to Watch

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Risk and Volatility in Small Caps

We recently looked at small caps through the lens of historical performance during economic recovery. To complement that analysis, we look at total risk or volatility.

Addressing the Lower Liquidity of Smaller Stocks

Investability and tradability, are two vital touchstones of our Global Investable Market Indexes (GIMI) construction methodology.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.