Bringing ESG and Climate Lenses to Latin America

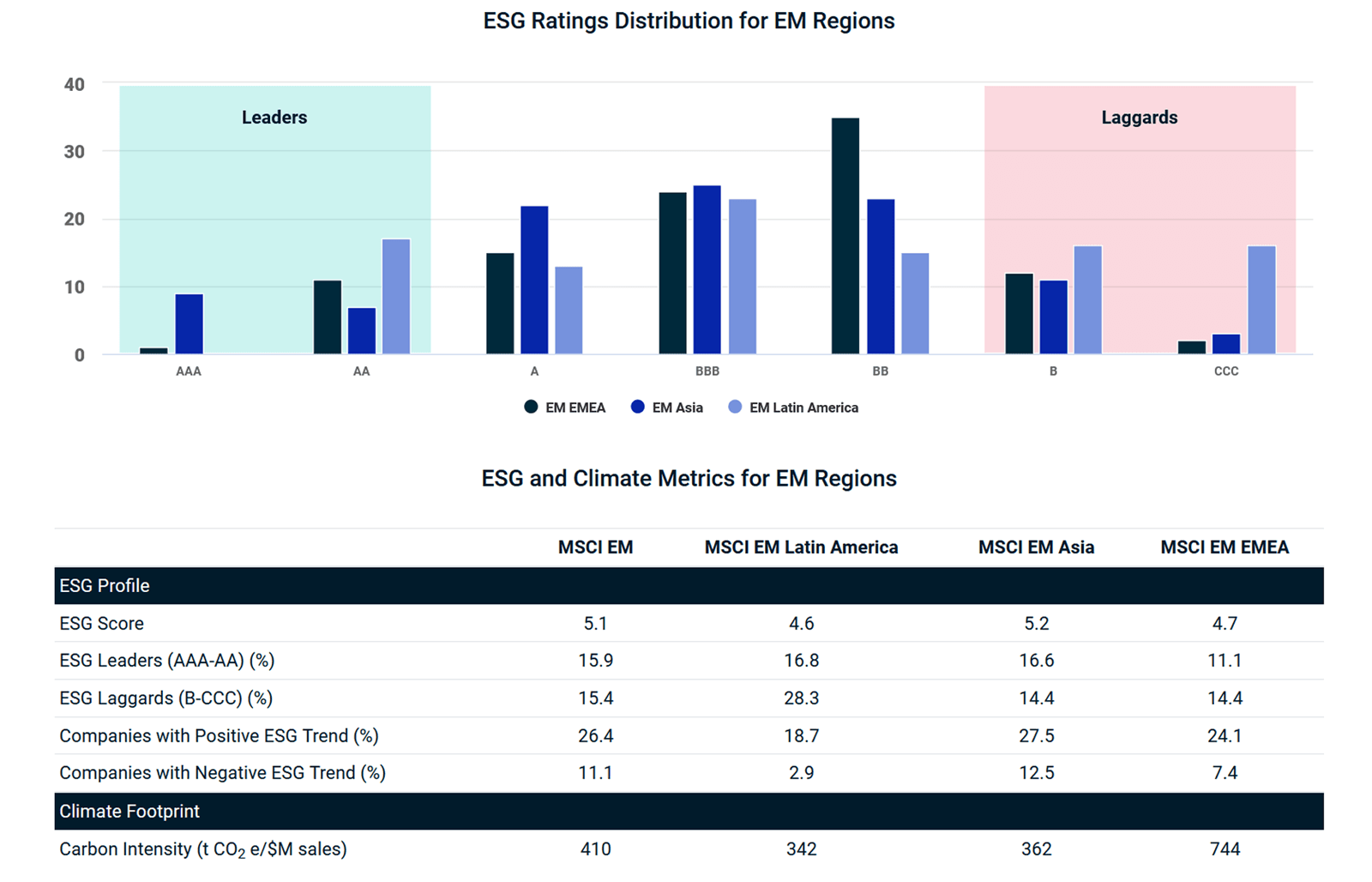

Although, on average, emerging-market (EM) companies have tended to have lower MSCI ESG Ratings than global peers, a more granular regional analysis can provide additional insights.

Among EM regions, Latin America showed a differentiated ESG profile. Although it had the lowest total ESG score, as of Sept. 30, 2021, it had the highest percentage of ESG leaders (16.8%) and the lowest percentage of companies with negatively trending ESG scores. Additionally, Latin America had the lowest carbon intensity for EM, as measured by tons of CO2 emissions per USD 1 million in sales.

These metrics provide a snapshot of ESG and climate differentiation for the MSCI EM Latin America Index when compared to other regions in the MSCI Emerging Markets Index.

ESG and Climate Differentiation for EM Latin America

*The universe of companies for each region is: for Latin America 100 constituents, EMEA 164 and Asia 1,154. Data as of September 2021.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Latin America: A Market with Unique Characteristics

Latin American stock markets have recovered strongly as the world starts to overcome some of the COVID-19 pandemic’s challenges — renewing interest in the region.

A Closer Look at Latin America’s Performance

Latin American markets have been historically more resilient during periods of financial distress such as the 2008 global financial crisis.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.