Correlations Within and Across Global Markets

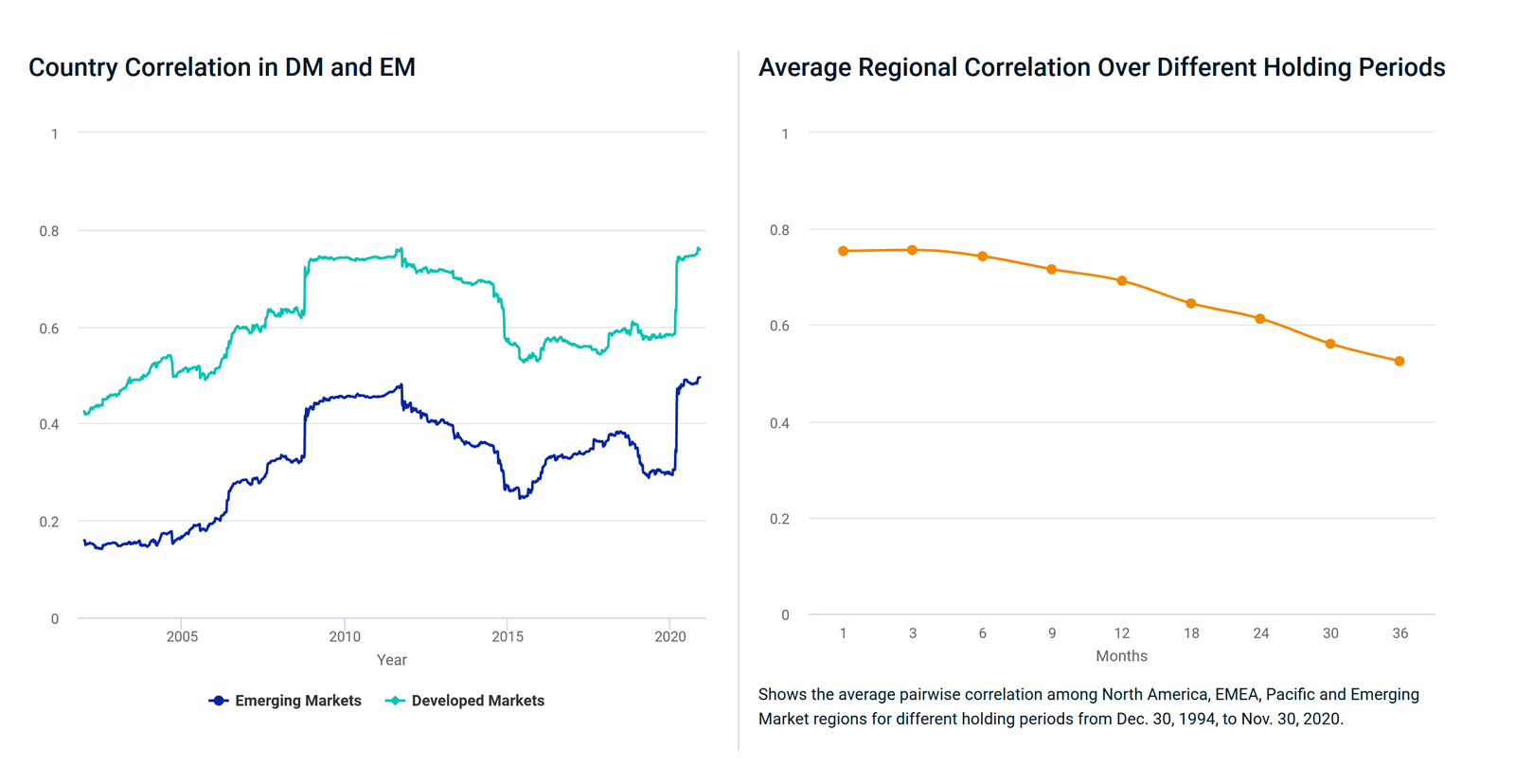

MSCI Research looked at average pairwise correlation between countries' USD returns within developed and emerging markets (EM) for the last 20 years. We saw similar cyclical behavior in the markets, but overall average country correlations in EM were lower through the period. Looking at the analysis by region (developed North America, developed EMEA, developed Pacific and EM) and holding period (i.e., one- to 36-month returns), we observe that the four regions were less correlated for longer holding periods than shorter ones. In essence, the effectiveness of diversification across regions may depend on the holding period used.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Evolution of Emerging Markets

Use our interactive chart to see how emerging markets’ share within global equities has changed over the past two decades.

The State of Global Investing

Over long periods, starting valuations and dividend growth have been primary factors in explaining equity market performance.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.