Distress in US Commercial Property Grew at a Slower Rate

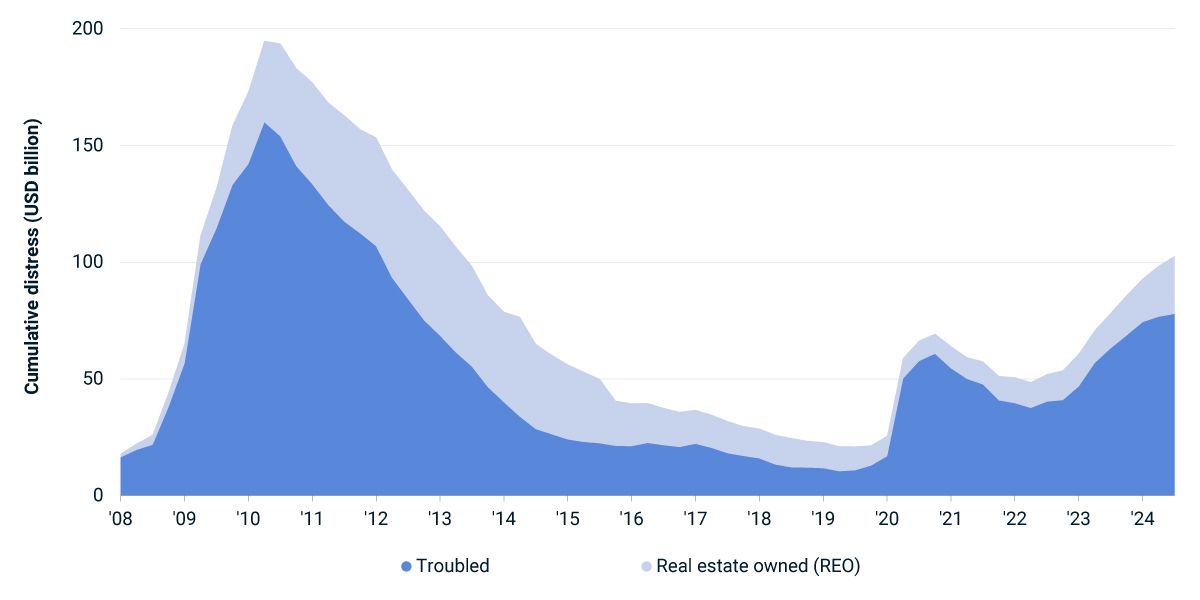

The balance of distress in the U.S. commercial-property market grew again in the third quarter of 2024, though at the slowest rate since the fourth quarter of 2022. The value of distress, which encompasses both financially troubled assets and assets taken back by lenders, reached USD 102.6 billion by the end of the third quarter, with new inflows to distress outpacing workouts between property owners and lenders by USD 4.3 billion.

Trouble centered in offices

Offices constituted nearly half of the market distress as of the end of September, at USD 50.2 billion. Higher lending rates have pummeled U.S. property pricing and dealmaking since 2022, and offices have come under extra pressure because of wilted demand for workplaces. Outstanding retail-property distress was the second-largest behind office, at USD 20.2 billion, followed by apartment at USD 14.2 billion. New inflows of trouble in the office market were lower during the third quarter than they had been since the end of 2022. Few resolutions took place during the quarter, however, leading to a net addition to office distress. More distress was resolved than new trouble emerged for the apartment and retail markets in the quarter.

Potential distress, which may precede full-blown financial trouble, stood at USD 260.9 billion at the end of the third quarter, more than double the value of the pool of distress. Unlike the balance of distress, however, the value of potential trouble declined from the prior quarter. The apartment market represented USD 75.9 billion of the potential distress, ahead of office with USD 65.0 billion.

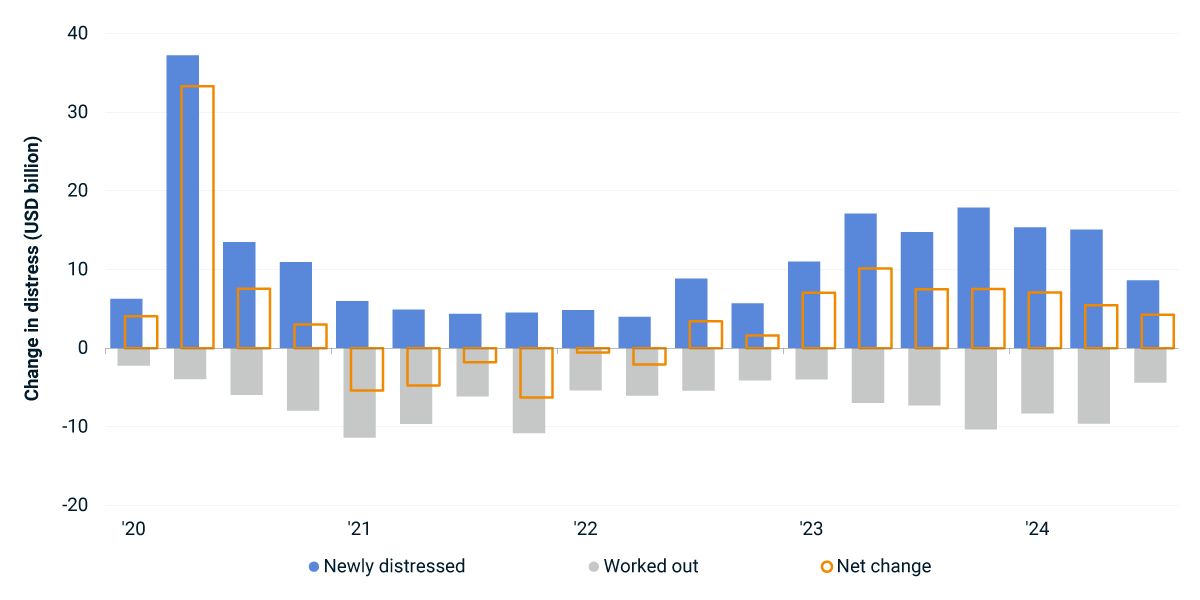

Addition to distress slowed in Q3

Data as of Oct. 22, 2024.

Total distress surpassed USD 100 billion

Assets classified as “real estate owned” have been taken back by lenders through foreclosure. Data as of Oct. 22, 2024.

Subscribe todayto have insights delivered to your inbox.

Real Estate Debt, Distress and, Dare We Say, Hope?

We examine the state of the real estate debt market, including hot-button topics, such as central bank rate setting and low-occupancy office buildings, while not losing focus on other market drivers and other market segments.

The What and the When Matter for the Losses of Real-Estate Lenders

Not every lender in U.S. commercial real estate is at risk over their exposure to the sector. We illustrate how the timing of loan originations and the property types of the collateral can make a difference for lenders.

Mortgage Debt Intelligence

Mortgage Debt Intelligence (MDI) is the largest searchable database linking properties, loans, borrowers and lenders to provide a 360° view of property debt and distress.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.