Emerging Markets: Sector and Industry Diversity

Industry and revenue lenses can provide additional insights to investors beyond a traditional sector analysis.

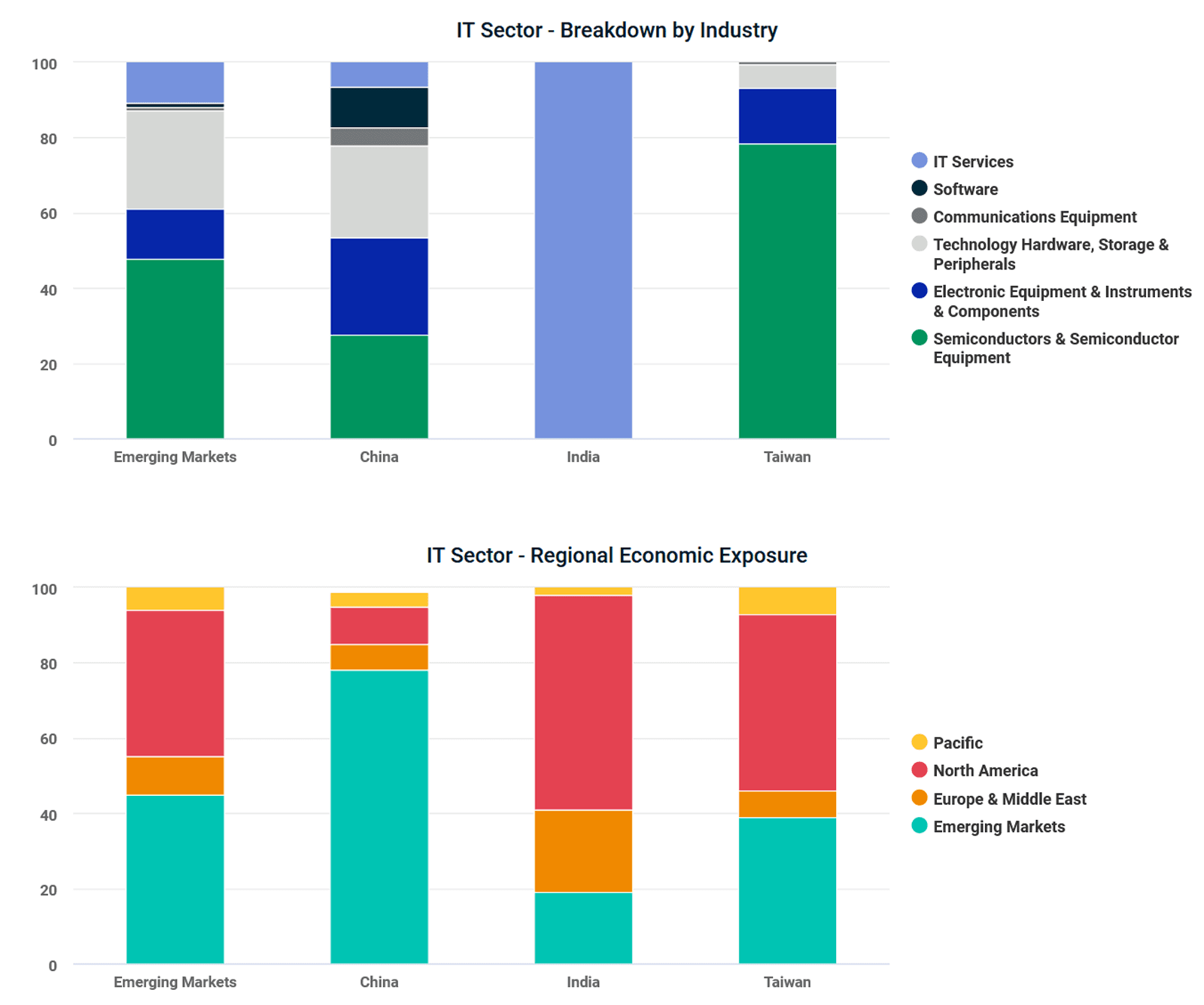

In emerging markets (EM), one of its largest sectors is information technology (IT) — at 21.1% of the MSCI Emerging Markets Index — which can be disaggregated into six industries (as shown in the first chart below). While the regional index provided exposure to all six of the industries, the three largest EM countries offered varied access. China had companies within every industry, whereas Indian and Taiwanese IT companies were more concentrated. Indian firms were generally service oriented, while Taiwan — led by Taiwan Semiconductors Manufacturing Company Limited — were semiconductor oriented.

Industry-exposure differences can also lead to contrasting economic exposures. While we found the IT sector in China was primarily domestically driven, most of the revenues for Indian IT companies came from the U.S., with the second-largest contributor being the U.K. It's a similar story in Taiwan, where U.S.-sourced IT revenues were dominant. However, despite these biases, domestic and regional demand remained important economic variables.

Historical Performance and Deglobalization

As central banks raise rates to combat inflation and economies start slowing down around the world, interdependencies at the country level will matter. And while the IT sector typically did well in periods of rising inflation, it lagged in periods of both rising inflation and lower growth. For context, the IT sector represents 17% of the overall country index in India, while it represents 70% in Taiwan.

Another consideration is the ongoing impact of deglobalization and its influence on supply chains, which are becoming more localized. As countries start to build and rebuild some of these manufacturing capabilities onshore,1 it may lead to headwinds for countries that are more reliant on manufacturing than services.

Sector and Industry Diversity within Emerging Markets

Data as of May 31, 2022. Source MSCI.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential increased importance of emerging markets. But many investors may be missing out on these opportunities.

US Inflation and Interest Rates: A Sectors’ Perspective

Inflation in the U.S. has accelerated over the last 18 months to a high of 8.5% in March.

Energy-Sector Drivers

Looking at sectors through a factor lens may provide additional insights for investors in terms of explaining performance.

1 Data as of May 31, 2022. Source MSCI.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.