Energy-Transition Momentum Building in APAC

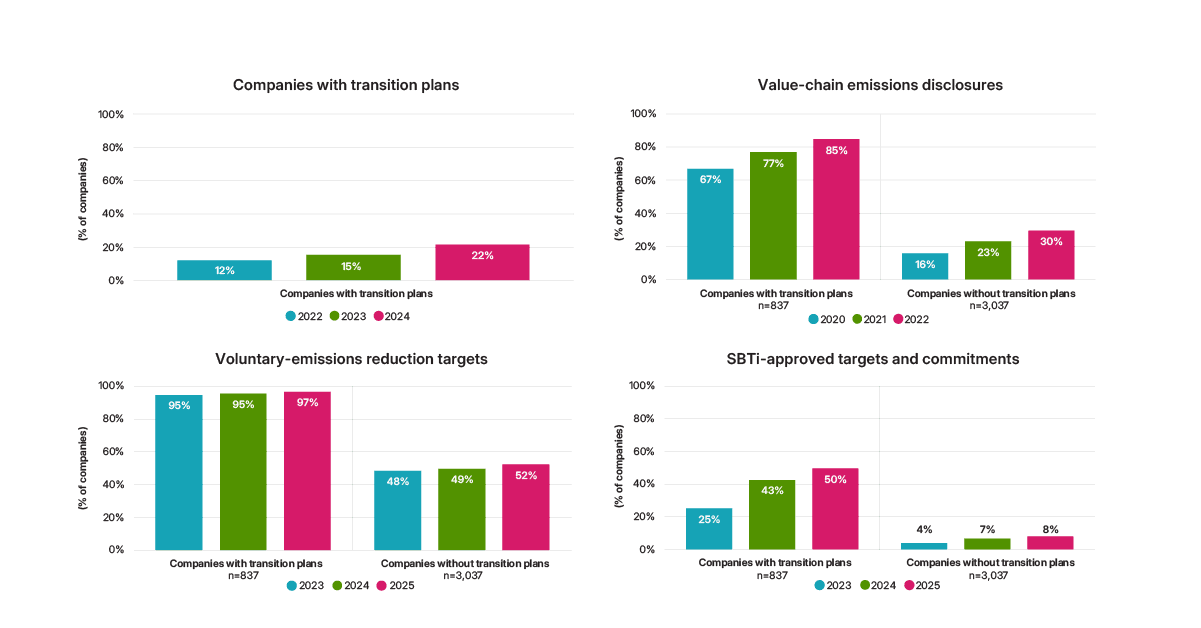

More companies across APAC are disclosing transition plans, potentially driven by the increased adoption by the region’s regulators of standards aligned to the International Sustainability Standards Board (ISSB).1 Between 2022 and 2024, the share of companies with such plans jumped to 22% from 12%. These companies are also significantly more likely to disclose value-chain emissions and set climate targets.

Of the companies with transition plans, around half have set, or committed to set, targets approved by the Science Based Targets initiative (SBTi). Such disclosures can help investors assess the credibility of these plans, improve decision making and enhance comparability across portfolio companies.2 Among the key climate metrics we examined, there are two that have shown significant improvement over the past three years:

- The disclosure of value-chain Scope 1, 2 and 3 emissions enables the measurement of progress against targets and has increased to 85% in 2022 from 67% in 2020.

- Target-setting and commitments based on the SBTi have doubled to 50% in 2025 from 25% in 2023, consistent with efforts to align with the Paris Agreement.

Disclosure of these two metrics can enhance the credibility of a company’s readiness to implement its transition plans. This increasing transparency and adoption of science-based targets signal a stronger commitment in APAC to credible decarbonization efforts. For investors, this momentum means improved visibility and comparability, enabling better-informed decisions to support climate objectives.

Data as of March 31, 2025. Analysis covers constituents of the MSCI AC Asia Pacific Investable Markets Index. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Navigating Climate Opportunities in APAC Transition Funds

Our analysis of APAC transition funds reveals varied climate exposures, transition themes and performance.

APAC ESG Ratings Leaders and Upgrades in 2024

APAC companies have shown substantial improvements in MSCI ESG Ratings in recent years, highlighting enhanced corporate awareness, increasing sustainability disclosures and strong upgrade momentum in markets such as China, Taiwan and South Korea.

Bringing clarity to climate investing

MSCI can help you understand, monitor and manage the risk and return of climate exposures with our integrated data, analytical tools, indexes and research insights.

1 Anja Ludzuweit and Raphael Klein, “Climate Risks and Opportunities Reporting Guide for Financial Institutions,” MSCI ESG Research, November 2024 (Client access only).

2 “Explore the Disclosure Recommendations,” Transition Plan Taskforce, April 2024.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.