Evading the Hawks: Bond Momentum Investing

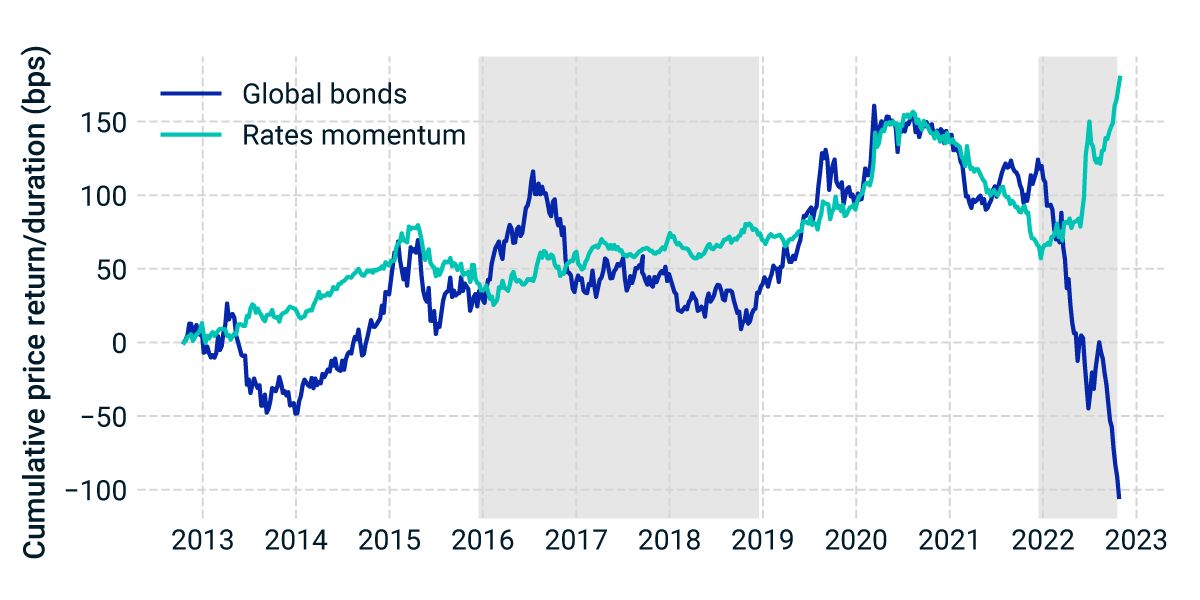

Rates investors who follow a momentum strategy buy sovereign bonds with relatively strong recent performance and sell those that have had relatively weak recent performance. Between Dec. 10, 2021, and Oct. 14, 2022, rates-momentum investing generated a positive price return of 122 basis points (bps) per unit of duration. This was by far the strategy's best 10-month return in the past decade and provided a bright spot amid the darkness of a global rout in sovereign bonds.

Looking at deeper history, since 2012, trend-following in bonds tended to do well, overall, in periods of central-bank tightening (shaded in the exhibit below). While we can't see the future, one thing is clear: When global fixed income investors have been squeezed by hawkish central-bank policy, rates momentum was a defensive play.

Rates-momentum performance diverged from global bonds in tightening cycles

Subscribe todayto have insights delivered to your inbox.

Has global sovereign rates momentum headed in reverse?

Systematic government-bond strategies tilted toward momentum have performed well year to date.

Building Balanced Portfolios for the Long Run

We are witnessing the rise of private assets to the core of many asset allocations from a peripheral “alternative,” and we have entered a new period of heightened macro uncertainty.

Central Banks Add Muscle to the Inflation Tug of War

We explore the sometimes volatile, push-pull relationship between investors and central banks as each looks to navigate extreme inflation in the U.S., the eurozone and the U.K.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.