Global Real Estate Mostly Resisted Headwinds

The myriad headwinds that the global commercial real estate market has faced in 2022 — soaring inflation, higher interest rates, post-pandemic workplace arrangements, geopolitical tensions and more — might have slowed transactions. This has largely not been the case for deals priced USD 10 million and greater, however, as the charts below show.

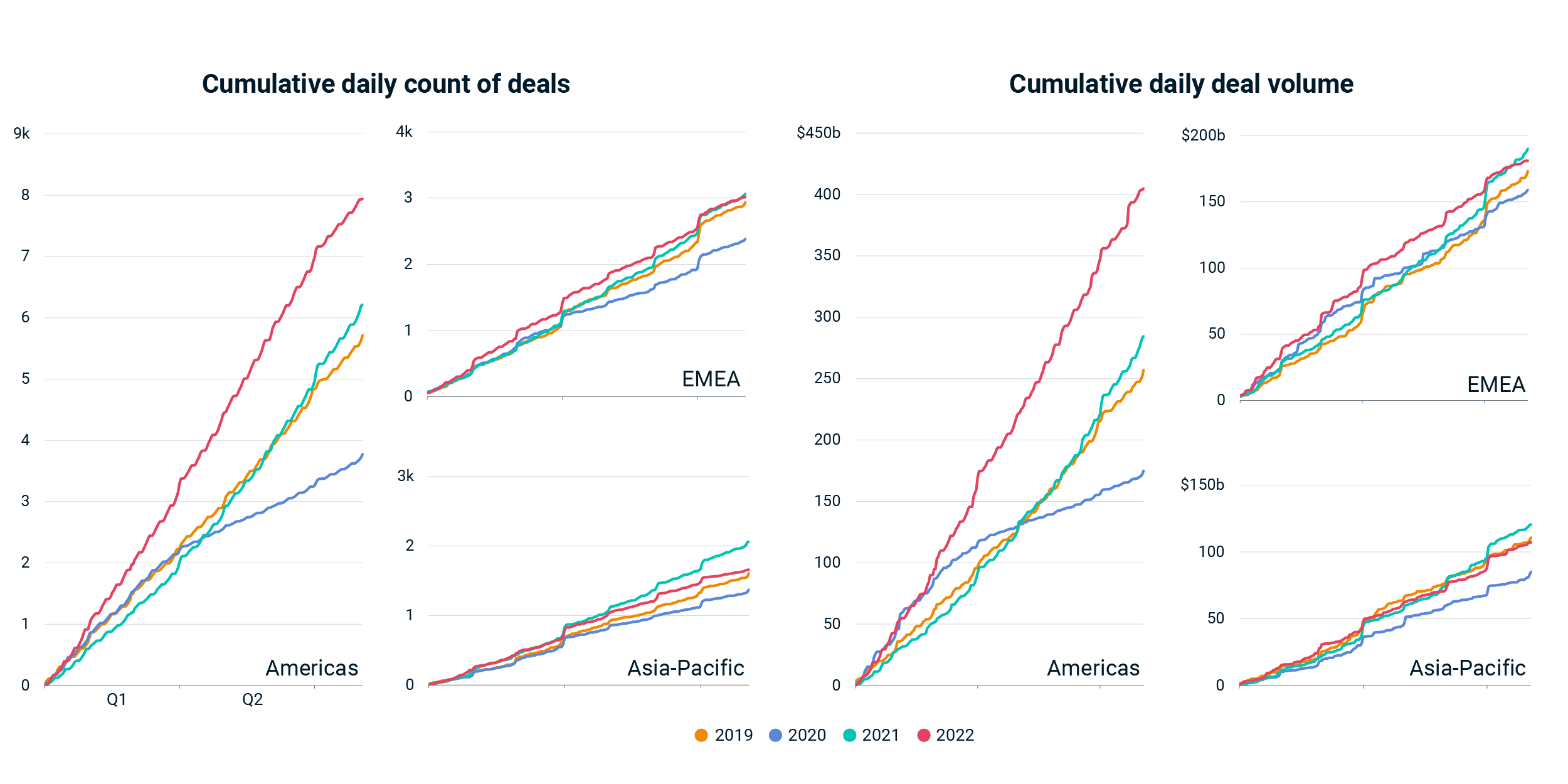

The Americas continued to defy predictions of a major slowdown, with deal volume and the number of transactions through the end of July well above the record-setting pace of 2021, although it should be noted that it was in the final quarter of last year that deal volume accelerated significantly.

Asia-Pacific — the region least affected by high inflation and energy-supply issues — has struggled to keep pace with previous highs, especially in the number of deals that have been executed. As of the end of July 2022, the region was well below 2021's pace. Volume declines were not as significant up to this point.

Maybe the most surprising aspect of the global deal flow is Europe, the Middle East and Africa (EMEA), with Europe facing a series of seemingly market-chilling events since the start of the year. Despite fears of a summer slump as inflation rates across Europe spiked, the U.S. dollar volume of deals actually maintained the pace of previous years. The count of deals has also largely kept in line with 2019 and 2021 momentum.

Flow of larger commercial-property deals pressed on

Daily cumulative deal volume and deal count through day 213 of each year (Aug. 1, 2022). Deals of USD 10 million and greater, for all major property types excluding development sites. Data at Sept. 7, 2022.

Subscribe todayto have insights delivered to your inbox.

Global Real Estate Returns at a Turning Point?

Global real estate returns accelerated to 17.8% on a 12-month rolling basis in the first quarter of 2022 despite the growing headwinds of geopolitical tensions and associated rising inflation and interest rates, the debut results of the MSCI Global Quarterly Property Index show.

How US Real Estate Purchases Changed During the Pandemic

One notable consequence of the COVID-19 pandemic was a shift in real estate investors’ preferences. Comparing broad-market purchase activity in 2019 to that in 2020-2021, we observed a shift away from sectors like retail, office and hotel/hospitality and toward sectors like industrial and residential.

The Signal for Industrial Property Amid E-Commerce Noise

E-commerce sales grew at an exponential rate for most of the period from 2002 to 2019, and then got kicked into overdrive by the COVID-19 pandemic.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.