How Do Small Caps Fit into a Deglobalized World?

In a recent blog post, we explored how investors could identify potential beneficiaries of global supply-chain realignment using MSCI Economic Exposure data. Relying on the same dataset, we have gauged how small companies around the world could be impacted by deglobalization. Our approach assesses the proportion of a company's revenues that were generated domestically, as of Sept. 29, 2023.

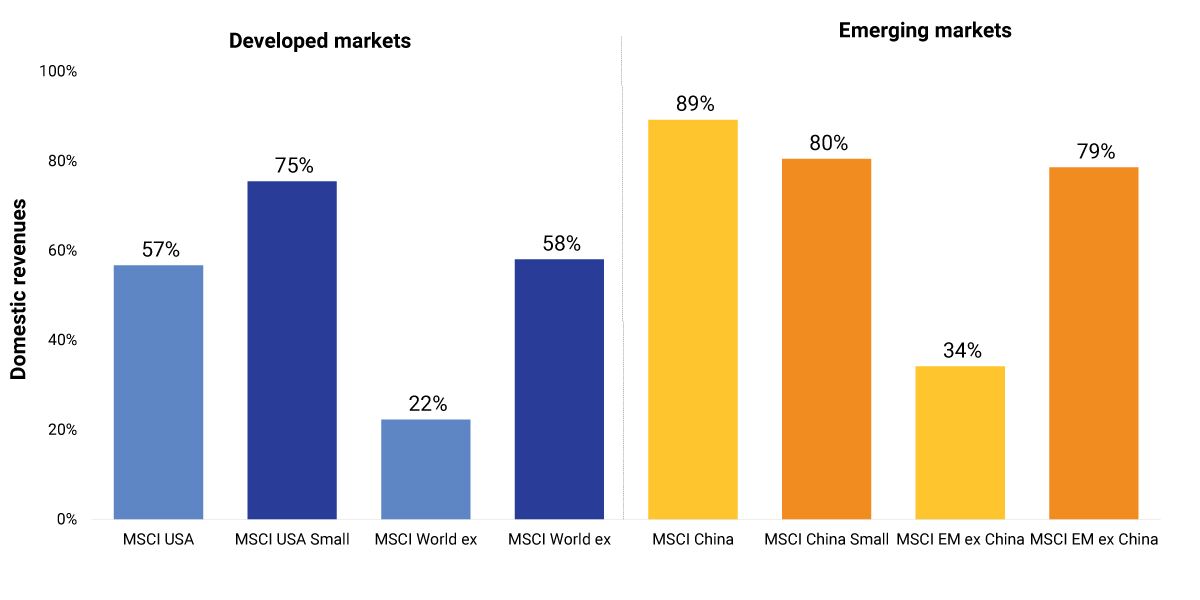

Small caps in developed markets (DM), represented by the MSCI USA Small Cap and MSCI World ex USA Small Cap Indexes, earned a much higher proportion of revenues domestically than the large caps in their parent indexes. This observation makes intuitive sense given the challenges a small company faces in expanding internationally. Thus, smaller, domestically oriented companies in DM could be shielded from the potential risks associated with international-trade disruption due to deglobalization.

EM small caps are not one-size-fits-all

Because China has a 30% market-cap share in emerging markets (EM), represented by the MSCI Emerging Markets Index, we separated China from the rest of EM in our analysis.

We found that small caps in China, proxied by the MSCI China Small Cap Index, had slightly higher international revenues than large caps in the MSCI China Index. A likely explanation is that Chinese firms have established themselves as major suppliers to the developed world.

As deglobalization has accelerated, multinational corporations have begun to relocate logistics to geographically closer nations (nearshoring), nations with which they have geopolitical ties (friendshoring) or their nation of origin (reshoring). As a result, certain Chinese firms, some of which may be small caps, could be vulnerable to this "shoring" trend.

In EM ex China, as in DM, small firms had lower international revenues than larger firms. In these markets, an approach that combines economic-exposure data with industry considerations and fundamental analysis could identify smaller firms in EM ex China that might be potential beneficiaries of supply-chain rewiring.

Small caps — except in China — had less global exposure than large caps

Data as of Sept. 29, 2023. The exhibit compares the MSCI USA, MSCI World ex USA, MSCI China and MSCI Emerging Markets ex China Indexes with the respective MSCI small-cap indexes.

Subscribe todayto have insights delivered to your inbox.

Who Benefits from Rewiring Supply Chains?

Certain industries are more susceptible to the effects of deglobalization. We explore how investors can identify potential beneficiaries of global supply-chain realignment considering industry, thematic and structural characteristics.

Is Dispersion in Small Caps Linked to Selection Opportunities?

Across regions — U.S., international and emerging markets — small-cap stocks have displayed higher cross-sectional volatility than other market-cap segments. Small caps’ wide dispersion indicates potentially fruitful stock-selection opportunities.

Small Caps’ Big Story in China

The China A shares market has grown rapidly, along with the number of small-cap stocks. We compare a market-cap-coverage approach to index construction vs. a fixed-number approach and find the former more consistently captured small-size exposure.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.