Industrial and Offices Led UK Property’s Fall in 2022

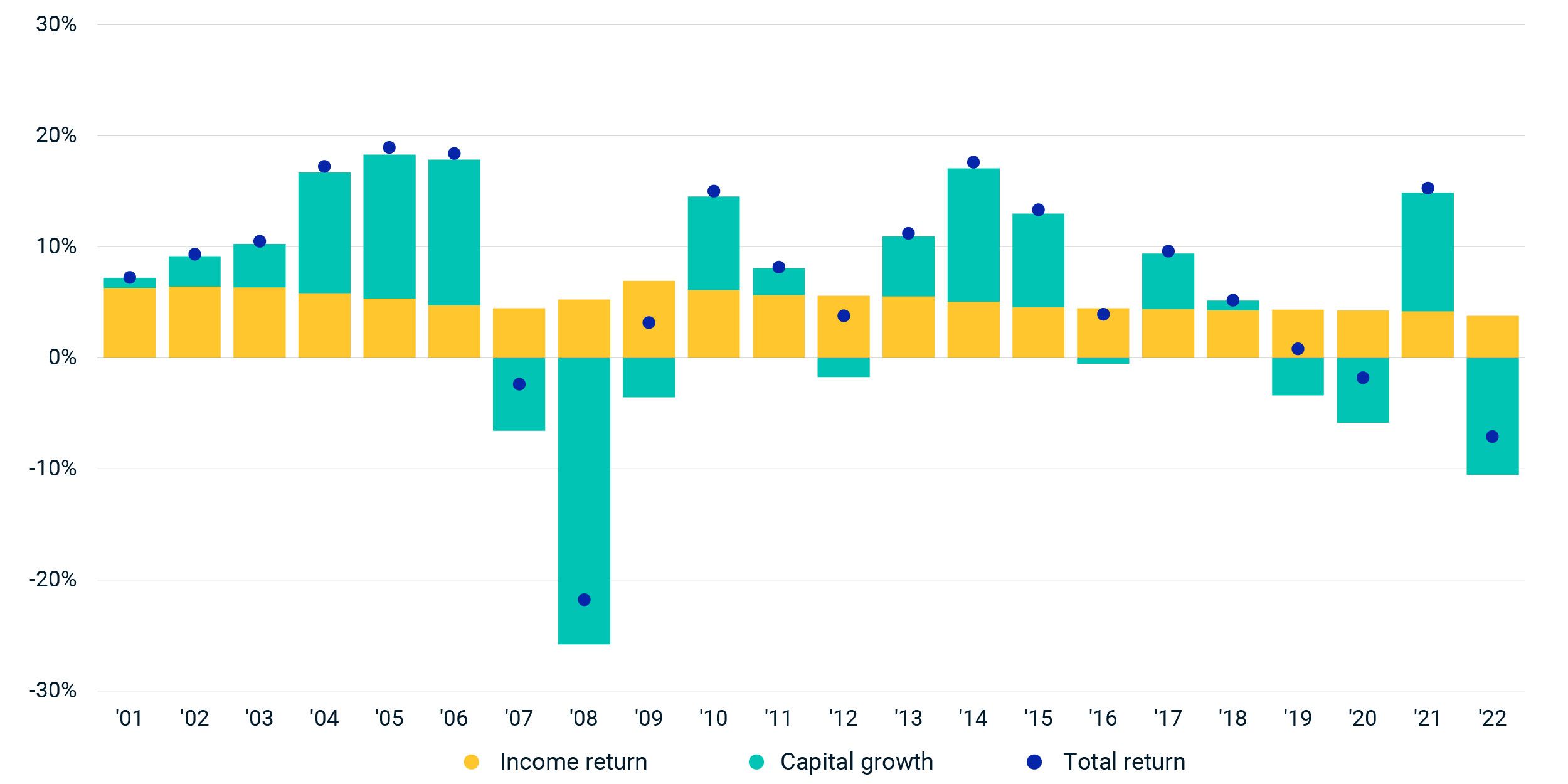

The 2022 performance of the MSCI UK Annual Property Index reflects what we have seen in the sagging U.K. monthly and quarterly indexes, with a decline of 7.1% for the full year.

The U.K.'s rising inflation and interest rates, slower economic growth than many of its peers and political challenges have weighed on U.K. commercial property, which already faced the structural changes caused by work from home, rising environmental standards and online retail.

Not as bad as 2008, but …

In contrast to what we have seen in the higher-frequency index releases, the annual index's results avoided the lows of the 2008 global financial crisis (GFC), when returns dropped below -20%. The less frequent valuation cycle skipped over the final few months of capital growth in the first half of 2022 and limited the decline in returns.

Although well above the lows of the GFC, the decline in capital values was the second-worst since 2000, with industrial and offices (over 50% of the index) the main culprits. The speed of the turnaround in the industrial sector was quite remarkable: It was the best performer in 2021, but the worst in 2022, dropping nearly 5,000 basis points. But the industrial segment remains buoyed by above-average rental growth, compared to other property types.

While total returns of all commercial-property types turned negative in 2022, the residential sector was the one bright spot, posting its 14th consecutive year of growth. Even though overall transactional growth dropped in the U.K. by 8% in 2022, capital investment in residential property continued. Additionally, volumes increased by 40%, as multifamily homes and student housing became more mature and investible.

Annual returns of UK property through 2022

Source: MSCI UK Annual Property Index (Unfrozen)

Subscribe todayto have insights delivered to your inbox.

2023 Trends to Watch in Real Assets

Five critical insights to help you navigate challenges ahead.

Prices of US Commercial Property Tumbled in January

Prices of U.S. commercial property fell in January at an annual pace of decline not seen since late 2010, after the global financial crisis.

Global Markets One Year After Russia’s Invasion of Ukraine

European equity markets were among the worst-hit by the Russia-Ukraine war, given Europe’s proximity, but were also the quickest to recover.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.