Long-Term Performance of MSCI ESG Ratings in Japan’s Equity Market

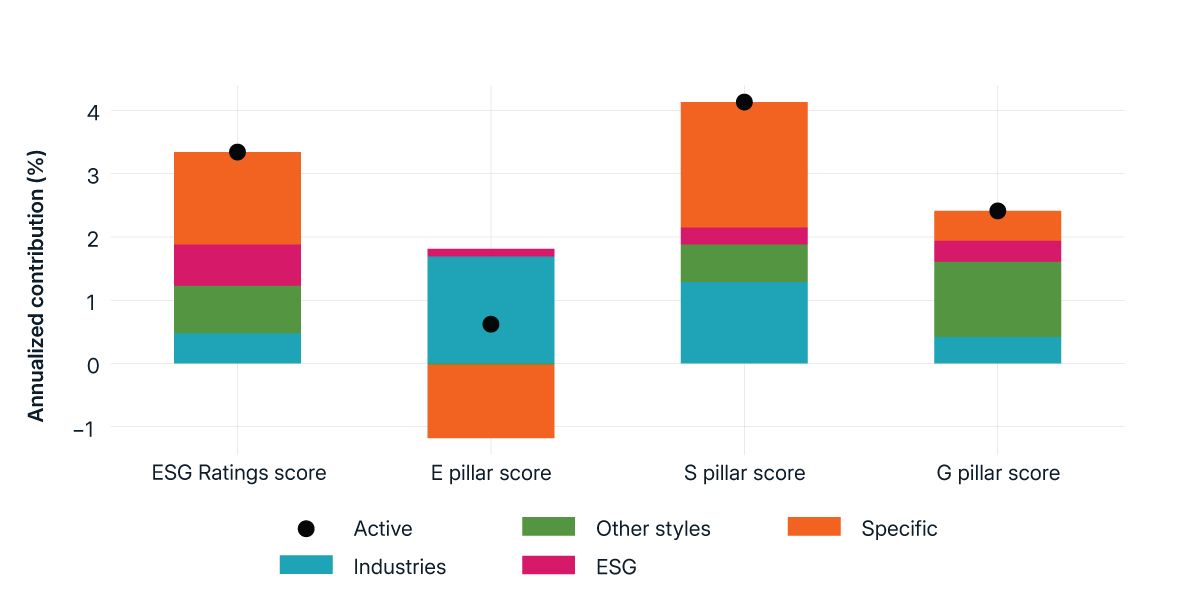

Over the past 12 years, Japanese companies with higher MSCI ESG Ratings have outperformed their lower-rated peers. We ranked companies in the MSCI Japan Index on their approach to financially relevant sustainability risks for each month from Dec. 31, 2012, to Dec. 31, 2024, and compared the subsequent equity-market performance of the top and bottom quintiles. Over that period, companies with the highest MSCI ESG Ratings score (top quintile companies) outperformed their lower-scored peers (bottom quintile companies) by an active annualized return of around 3.2%. The same was true for each pillar within MSCI ESG Ratings — companies with higher environmental, social or governance pillar scores were generally associated with stronger market performance.

To understand the contribution of the ESG factor to the overall active return of top quintile companies relative to bottom quintile companies, we decomposed the active return into different factors. We found that the ESG factor contributed positively to active returns of the top quintile, with annualized contributions of 0.65%. We performed similar analysis with the individual pillar scores and observed positive annual contributions of 0.12% for environmental, 0.27% for social and 0.33% for governance. This outcome was driven by both a positive exposure to the respective score (ESG factor or pillar scores) and its strong performance.

These findings suggest that integrating ESG factors into investment decisions may have enhanced long-term returns in the Japanese equity market. Investors looking for sustainable performance may wish to consider companies' MSCI ESG Ratings.

Quantifying the impact of ESG in Japan’s equity market

Data from Dec. 31, 2012, to Dec. 31, 2024. Equal-weighted quintiles are created every month based on adjusted scores in the MSCI Japan Index. Each quintile comprises an average number of 60 securities across the analysis period. Scores are first standardized by Global Industry Classification Standard (GICS®) sector and then size adjusted. (GICS is the global industry-classification standard jointly developed by MSCI and S&P Global Market Intelligence.) The graph shows performance attribution of active return of top quintiles versus bottom quintiles using the MSCI Japan Equity Factor model. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

MSCI ESG Ratings in Global Equity Markets: A Long-Term Performance Review

Controlling for sectors, regions and company size, we assessed the financial performance of MSCI ESG Ratings in global and developed markets and found that companies with higher ratings outperformed their lower-rated counterparts over the long term.

Long-Term Performance of MSCI ESG Ratings in APAC Equity Markets

Over the long term, companies with higher MSCI ESG Ratings have outperformed in the Asia Pacific equity markets. Among the three pillars, governance demonstrated the highest outperformance, followed by the social and environmental pillars.

Long-Term Performance of MSCI ESG Ratings in European Equity Markets

Based on a quintile analysis for MSCI ESG Ratings for the MSCI Europe Index, we found that companies in the highest quintile have consistently outperformed those in the lowest quintile since 2013, when these ratings were first introduced.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.