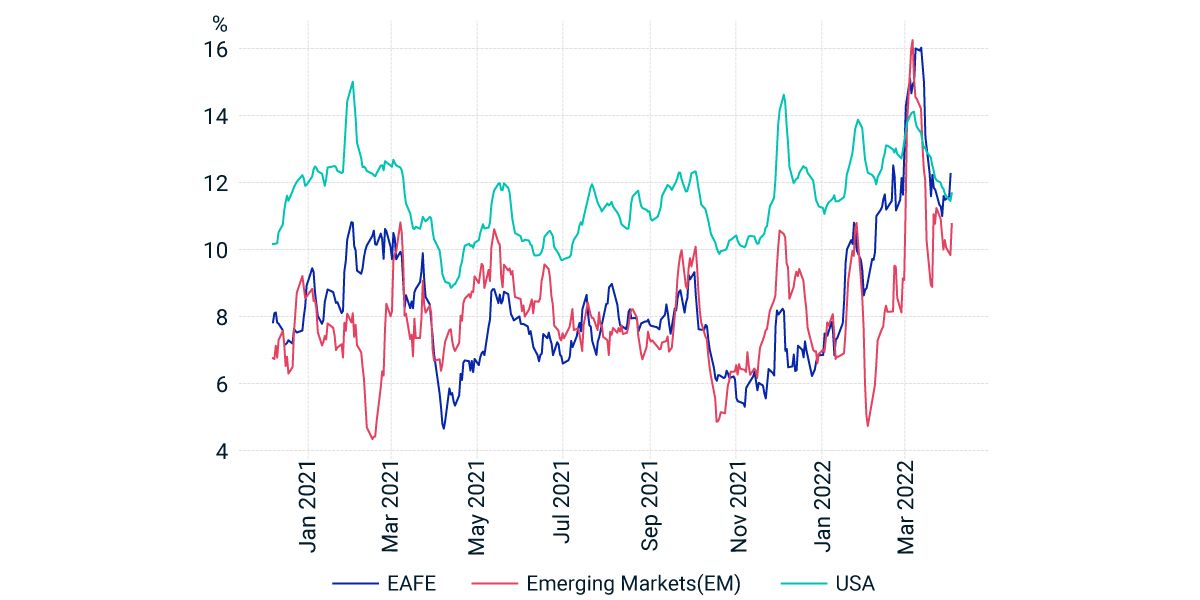

Markets Indicated Higher-than-Usual Downside Risk for EAFE and EM

Using option-implied-volatility skew — a measure often used to gauge downside vs. upside risk — we have seen a substantial increase in EAFE and EM index skew since the start of the war. While this measure has historically been more pronounced in the U.S. markets, the change there was rather muted. This may indicate heightened risk aversion for international exposures. While the skew has more recently come down for EAFE and EM, we still observe higher-than-normal downside risk in those regions.

Greater implied-volatility skew for EAFE, EM compared to respective histories

Implied-volatility skew has been calculated using the five-day moving average of the put-call implied-volatility spread of the 91-day 20-delta strikes. Options linked to the MSCI EAFE, MSCI EM and S&P 500 Indexes have been used for the EAFE, EM and U.S. skew calculations, respectively. Source: OptionMetrics

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.