Opportunities Through Nature-Based Solutions in APAC, but Shortage of Projects

For investors looking to support carbon sequestration or ecosystem restoration, nature-based solutions (NbS), which use natural features or processes to promote adaptation and resilience, can offer such opportunities.1 These two goals are not always mutually beneficial, however. For example, NbS projects that introduce alien species or monocultures (which offer a high capacity for sequestering carbon) instead of endemic species may result in unintended or even negative consequences for ecosystems.2

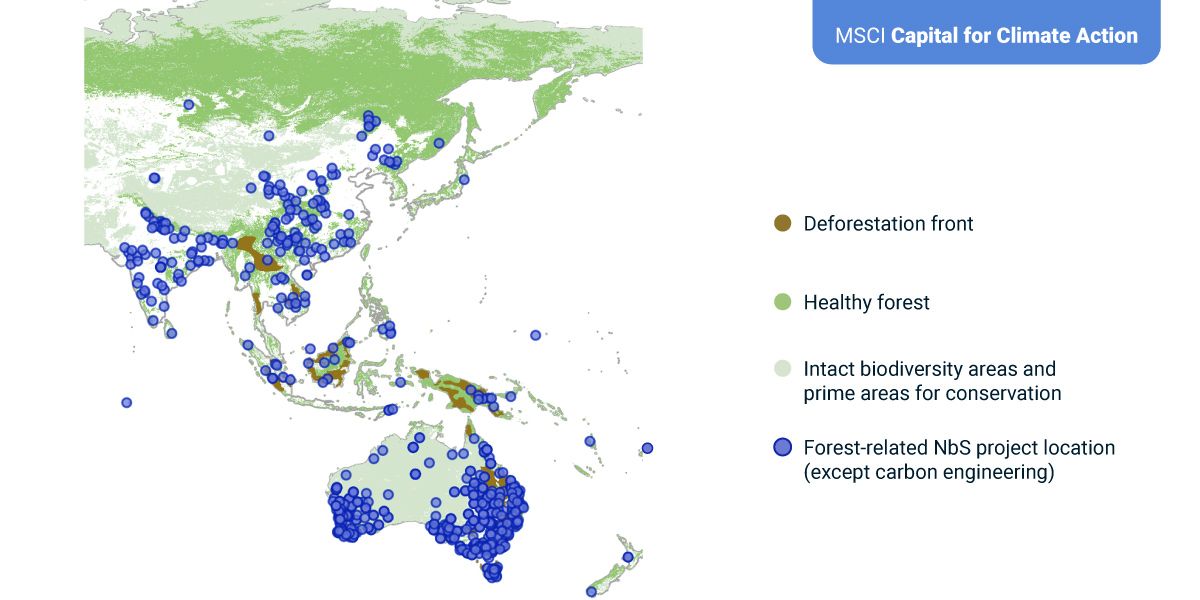

Investors may therefore wish to differentiate potential NbS investments using the biodiversity or ecosystem characteristics of a particular location. The map below illustrates how forest-related NbS projects in the Asia-Pacific (APAC) region are distributed relative to healthy forest areas with intact biodiversity (dark green), areas with a high conservation potential (light green) and deforestation fronts (brown). Our data shows that around 75% of APAC-based NbS projects were located near these biodiversity-sensitive areas,3 the majority of which (89%) were in Australia. Collectively, Malaysia, Indonesia and the Philippines had only 19 NbS projects listed on major global registries,4 with 12 located near deforestation fronts.

Accelerating APAC's efforts to address nature-related risks will ultimately require broader implementation of registered NbS projects, beyond Australia.5 If executed at scale, such projects would offer more scope for investors to direct capital toward emissions reduction and the restoration of ecosystems.

Locations of forest-related NbS projects in APAC relative to biodiversity-sensitive areas

Categories and locations of biodiversity-sensitive areas were sourced from the MSCI Biodiversity Screening Metrics. Further information on how these regions were classified is provided in the MSCI Biodiversity Screening Metrics methodology. Locations of NbS projects were sourced from MSCI Carbon Markets data, which covers carbon projects and transactions from all the major registries around the world, representing over 98% of projects registered (as measured by tonnes of CO2 equivalent). For this analysis, we included projects related to afforestation/reforestation, forest management and REDD.plus, but excluded carbon engineering. For more details, please refer to “Carbon Projects and Transactions: Data and Methodology,” MSCI Carbon Markets. Data as of March 25, 2024. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

MSCI Capital for Climate Action APAC Conference

MSCI Capital for Climate Action APAC Conference is coming to Singapore, where investment and financial leaders from across the region will bring clarity to the low-carbon transition and the challenges and opportunities ahead.

Biodiversity Risks and Opportunities in Asia Pacific

The Asia Pacific region is at the heart of the global biodiversity crisis. Using MSCI ESG Ratings, we assess APAC companies on their exposure to biodiversity risks. But these risks may also offer opportunities to address the impacts of biodiversity.

Voluntary Carbon Markets — the APAC View

Amid the debate over the voluntary carbon market’s role in corporate decarbonization, we investigated trends in the Asia-Pacific region. Which are the markets leading the way and what role are the region’s authorities playing?

1 Veronica Lo and Ashley Rawluk, “Enhancing Biodiversity Co-Benefits from Nature-Based Solutions,” International Institute for Sustainable Development, July 6, 2023.2 Jesús Aguirre-Gutiérrez, Nicola Stevens and Erika Berenguer, “Valuing the Functionality of Tropical Ecosystems Beyond Carbon,” Trends in Ecology & Evolution 38(2): 1109-1111.3 Of the 3,228 nature-based carbon projects in our coverage, 33% (1,063) were located in APAC. Of these 1,063 projects, 75% (800) were located within 1.5 km of biodiversity-sensitive areas, as defined in the MSCI Biodiversity Screening Metrics methodology.4 MSCI Carbon Markets data covers carbon projects and transactions from all the major registries around the world, covering over 98% of currently registered projects (as measured by tonnes of CO2 equivalent). For this analysis, we included only forest-related NbS projects and excluded carbon-engineering projects. For more details, please refer to “Carbon Projects and Transactions: Data and Methodology Note,” MSCI Carbon Markets.5 Pernile Holtedahl, “Nature Investment as a Response to the Climate Crisis: Opportunities in Southeast Asia,” Imperial College London, June 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.