Real Estate Pricing Could Mask Climate-Change Risk

Real estate investors are increasingly aware of the risks posed by climate change, but they may not realize just how much the potential risks vary, even for a relatively homogeneous group of assets.

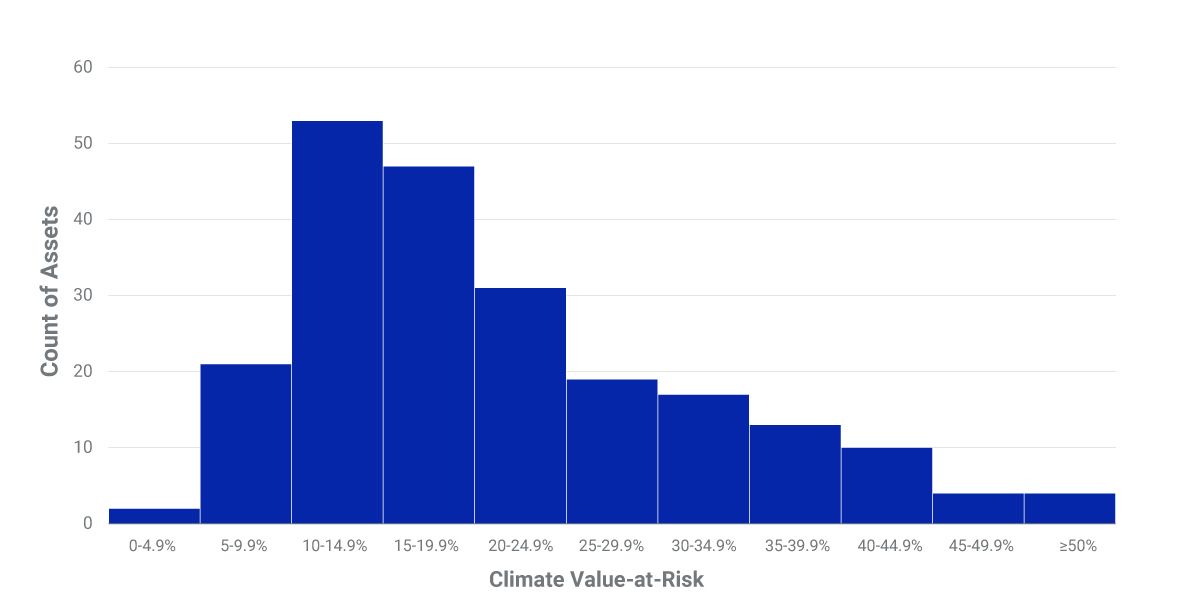

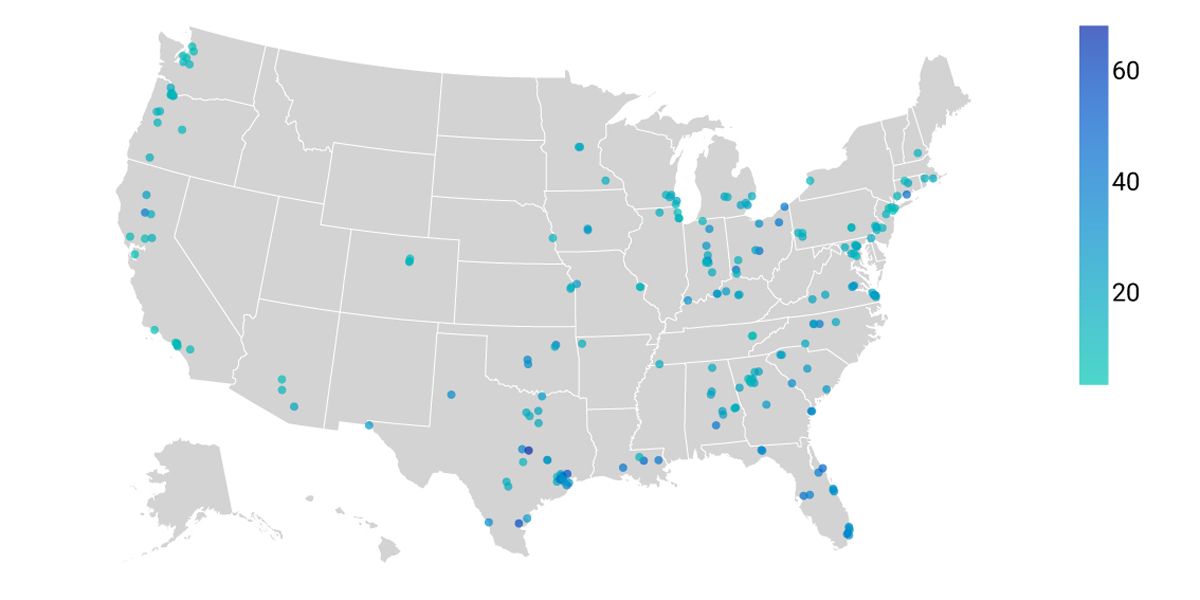

To illustrate this, we have taken a sample of 221 U.S. properties from the MSCI Real Capital Analytics database and estimated their potential exposure to climate-change risk using the MSCI Climate Value-at-Risk Model. All the assets in our sample are of a similar property type (garden apartments) and all were refinanced or sold in the first half of 2022 at similar cap rates (4.8% to 5%). Despite the similarity of the assets in terms of property type and pricing, the results show that climate change remains a potentially unpriced risk, with a wide distribution of climate value-at-risk scores.

The author would like to thank Wyatt Avery and Haley Crimmins for their contributions to this piece.

Distribution of sample climate value-at-risk scores

Sample properties’ locations and climate value-at-risk scores

Subscribe todayto have insights delivered to your inbox.

Net-Zero Alignment for Multi-Asset-Class Portfolios

Asset owners with net-zero pledges are committing to short- and medium-term carbon-footprint reduction targets for their portfolios.

Real Estate Climate Solutions

We help real estate investors integrate climate, performance and risk analysis to build more sustainable portfolios.

Measuring Climate Risk in Real Estate Portfolios

As a long-term asset class with fixed asset locations, private real estate may be especially vulnerable to both physical and transition risks from climate change.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.