Say-on-Climate Update: Navigating the Winds of Change

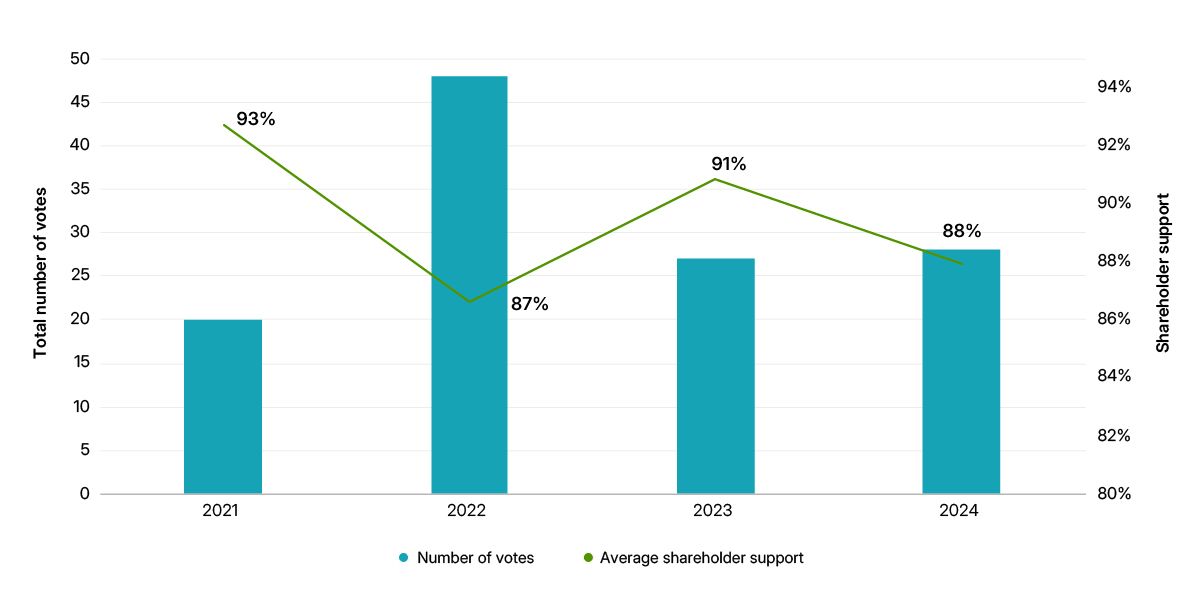

Since 2021, multiple high-profile companies have brought their climate-transition plans to an advisory, management-sponsored shareholder vote, opening a new engagement channel on climate issues. After a notable decline in the number of votes in 2023, those numbers stabilized in 2024. A deeper look at those numbers can help investors determine which way the winds may be blowing.

Stable number of votes, regional concentration

We identified 28 say-on-climate votes in the 2024 proxy season, one more than in the previous year. While well below the record set in the 2022 season (48), the number of companies willing to offer this avenue for shareholder engagement appears to have stabilized. In line with previous years, a large majority (79%) of 2024 votes took place at European companies, indicating a consistent regional concentration.

While shareholder support generally remained high, average support for these resolutions decreased, from 91% in 2023 to 88% in 2024. This suggests greater willingness on the part of some investors to formally oppose a company's approach to the climate transition. Shareholders also voted down Woodside Energy Group's climate-transition action plan at the Australian energy company's 2024 annual general meeting. This was the first-ever say-on-climate defeat in our analysis.

Average shareholder support declined in 2024 vs. 2023

Analysis covers companies in MSCI ESG Ratings coverage that have held management-proposed say-on-climate votes between 2021 and 2024. Shareholder support for a proposal means the percentage of votes in favor, accounting for votes against and votes withheld/abstained. Data as of May 2025. Source: MSCI ESG Research and company disclosures

Subscribe todayto have insights delivered to your inbox.

Is Say-on-Climate Losing Steam?

As proxy season nears, investors looking at how companies in their portfolios are working toward establishing and meeting climate goals may find it useful to note trends around shareholder say-on-climate proposals.

Who’s the Climate Expert on Board?

What’s the state of climate expertise on the boards of the companies in your portfolio? We provide a regional analysis and offer a framework to help investors make their own assessments.

Corporate Governance: Market Matters

Good governance is foundational to effective capital markets, promoting accountability, transparency and sound decision-making aligned with investor interests. But how do those potential benefits translate into market performance?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.