Staying on Course for Climate Targets

Quick take

2 min read

July 17, 2024

Edward White

Having a detailed understanding of a portfolio's exposure to carbon emissions provides investors insight into potential asset-level risks related to the global climate transition and a clearer picture of how a portfolio is positioned relative to climate-specific targets and objectives.

Two fundamental questions climate-conscious investors often ask themselves when building portfolios are: Are the companies I invest in planning ahead by setting emissions-reduction targets? And, how are these companies performing against those targets?

The MSCI ACWI Select Climate 500 Index is designed with these two questions in mind. At each rebalance, the index follows a rules-based optimized methodology as it seeks to achieve the following: reduce the annual greenhouse-gas-emissions intensity of its constituents; increase the weight of companies with carbon-emissions-reduction targets approved by the Science Based Targets initiative (SBTi); and minimize tracking error and meet other constraints.1

How has the MSCI ACWI Select Climate 500 Index performed?

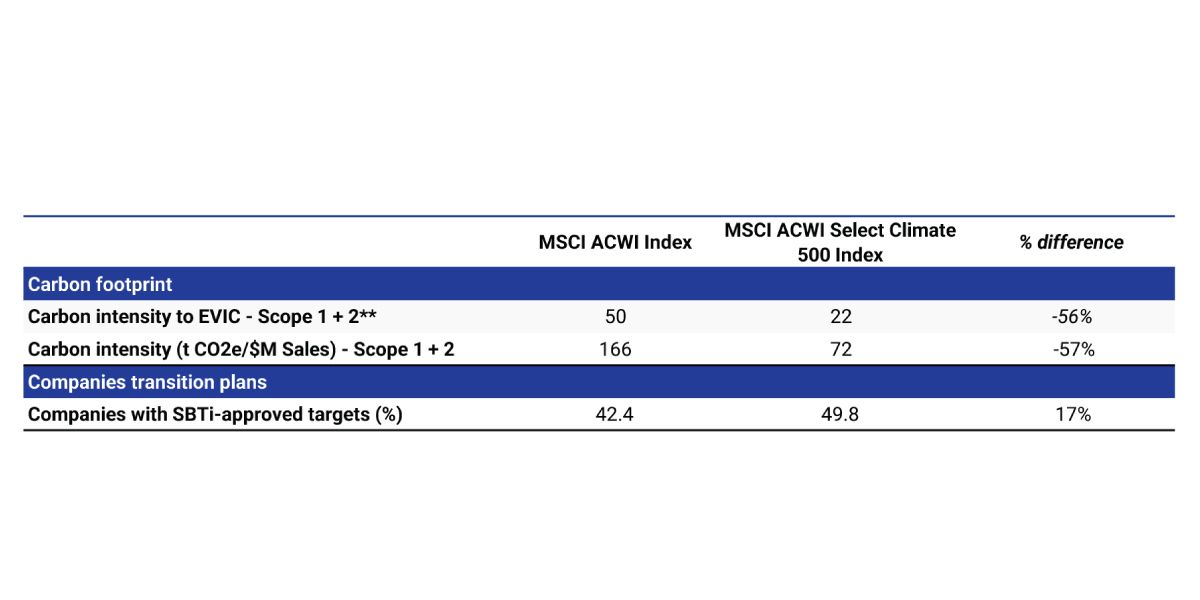

As of May 31, 2024, the MSCI ACWI Select Climate 500 Index had 50% lower carbon-emissions intensity (relative to enterprise value including cash, or EVIC, and sales) compared to the MSCI ACWI Index. Additionally, based on aggregate weight, the index had 17% more companies with emissions-reduction targets approved by SBTi, as compared to the MSCI ACWI Index.

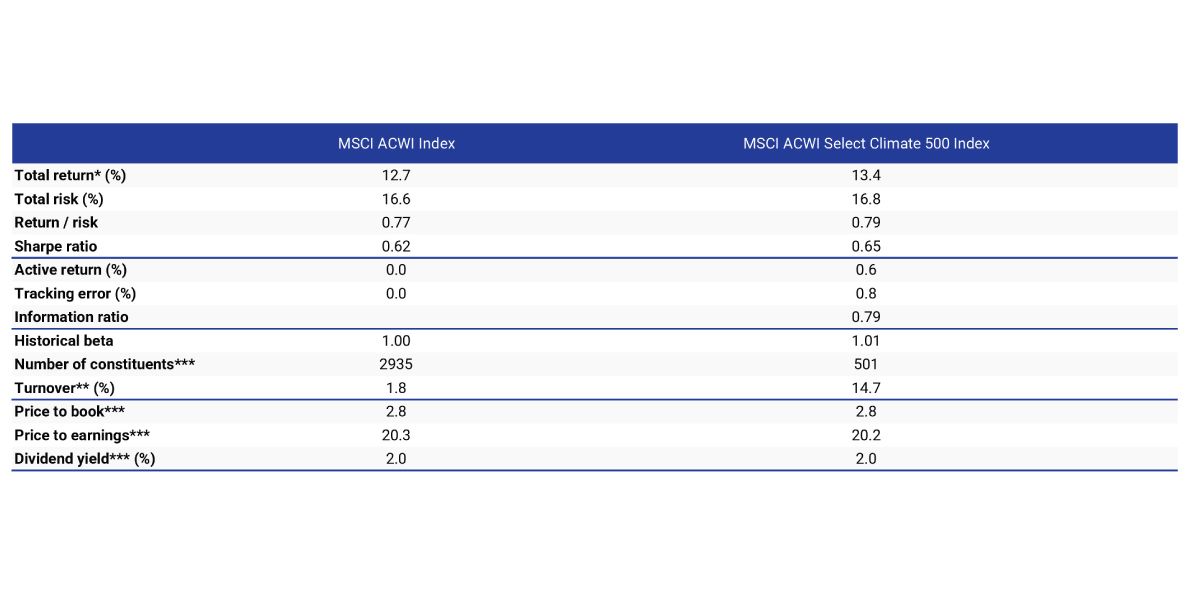

Based on the backtested index performance from June 30, 2020, to June 4, 2024,2 the MSCI ACWI Select Climate 500 Index returned 13.4% (compared to 12.7% for the MSCI ACWI Index) and had a Sharpe ratio of 0.65 (compared to 0.62 for the MSCI ACWI Index).

Climate metrics

Key metrics

* Net returns annualized in USD ** Annualized one-way index turnover over index reviews *** Monthly averages. Data from June 30, 2020, to June 4, 2024.

Subscribe todayto have insights delivered to your inbox.

MSCI Select Climate 500 Index fact sheet

The MSCI ACWI Select Climate 500 Index is designed to support investors seeking to reduce their exposure to the greenhouse gas emissions and increase exposure to companies with their emission reduction targets approved by Science Based Targets initiative (SBTi).

MSCI Select Climate 500 Index methodology

The MSCI ACWI Select Climate 500 Index (the ‘Index’) is designed to support investors seeking to reduce their exposure to the greenhouse gas emissions and increase exposure to companies with their emission reduction targets approved by Science Based Targets initiative (SBTi)

Investment Trends in Focus: Revisiting MSCI’s Five Key Themes for 2024

Chief Research Officer, Ashley Lester and team assess the evolution of the five key themes affecting investors in 2024. What does the landscape look like for the second half of the year?

1 For complete details, see the MSCI ACWI Select Climate 500 methodology. 2 The MSCI ACWI Select Climate 500 Index was launched on Dec. 15, 2023. Data prior to the launch date is backtested test (i.e., calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between backtested performance and actual results. Past performance — whether actual or backtested — is no indication or guarantee of future performance.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.