Tariffs Expose a Rift in the Clean-Tech Supply Chain

China's export controls on rare earths in response to U.S. tariffs revealed vulnerabilities in the global critical-mineral supply chain, which underpins many advanced technologies, including clean-tech solutions. Export controls are not an outright embargo, but exporters must apply for licenses to sell rare earths outside China, which can affect all markets. If export controls are tightened further, clean-tech providers outside China may experience stagnant growth.1

A pause on tariffs, not on risks

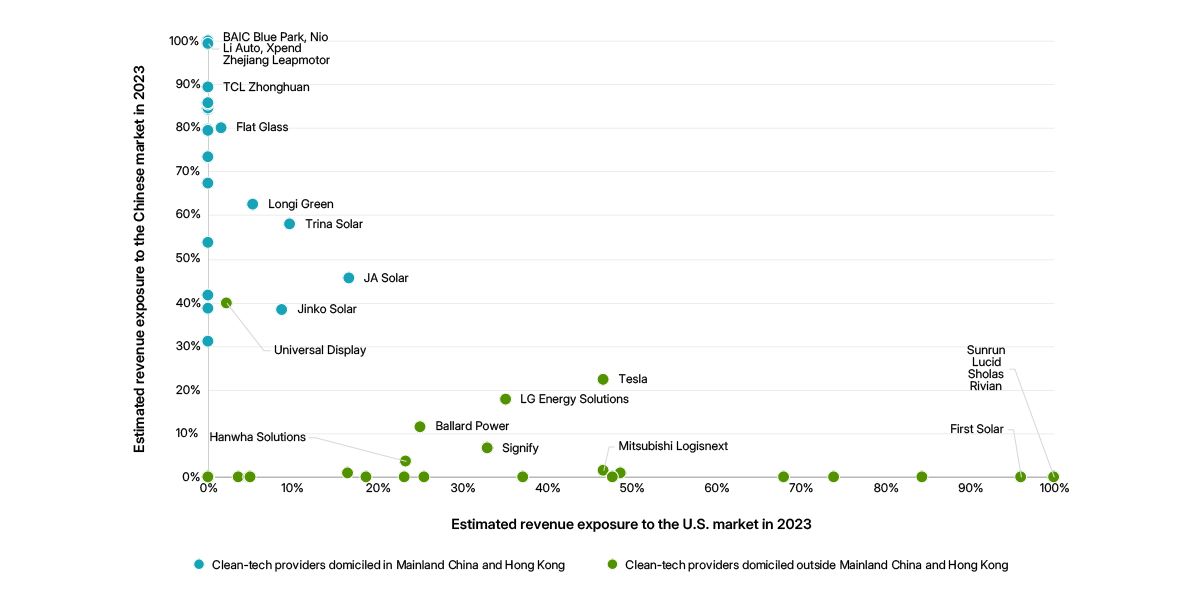

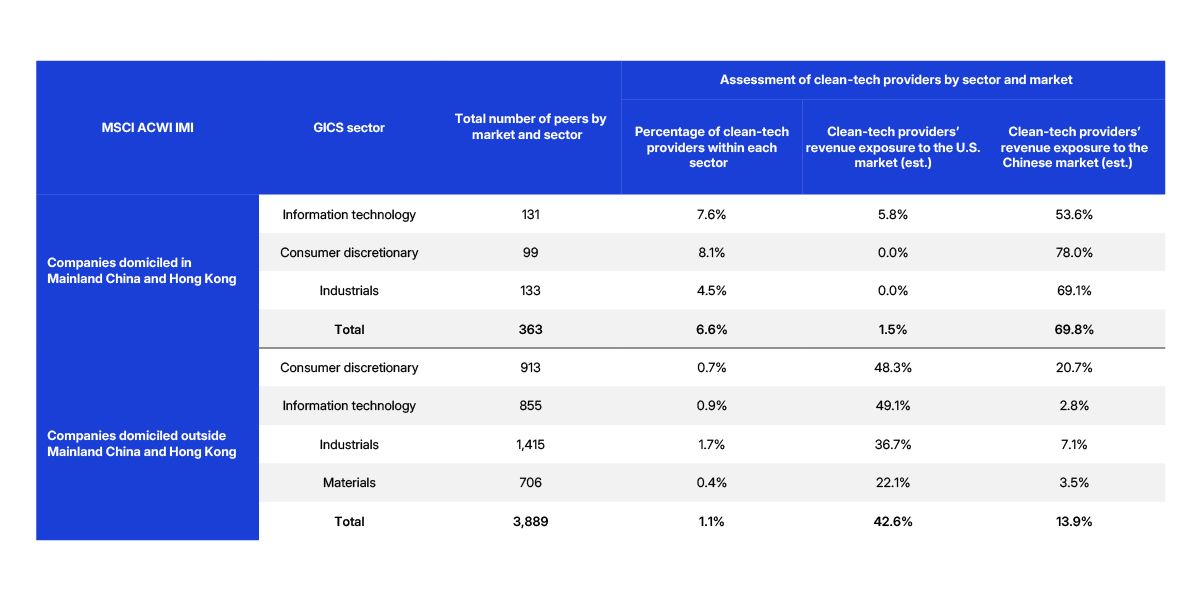

Although the U.S. and China agreed to a 90-day pause on reciprocal tariffs and eased the immediate tensions around export controls for rare earths,2 other tariffs remain in place and could continue to weigh on sales growth. As the chart illustrates, Chinese solar-panel makers such as JA Solar Holdings Co., Trina Solar Co. Ltd., JinkoSolar Holding Co. and LONGi Green Energy Technology Co. Ltd. derived sizable revenues from the U.S., where the impact of tariffs will be most felt. Meanwhile, most Chinese clean-tech providers in the MSCI ACWI Investable Market Index (IMI) generated more than half of their sales within the domestic market, as the table shows.

Lack of access to critical minerals may also spur the development of new technologies.3 Japanese carmakers have designed new vehicles that reduced reliance on rare earths in response to China's rare-earths export restrictions to Japan in 2010.4 And, while still in the nascent stage, the making of perovskite solar cells is reliant on iodine rather than rare earths.5

The ongoing trade war will likely play a key role — whether by accelerating the diversification of critical mineral sources,6 spurring innovation in clean technologies, reinforcing China's dominance in the global critical-mineral supply chain or potentially through all these factors. Companies positioned to adapt to supply-chain disruptions or capitalize on emerging alternative technologies may offer significant opportunities for investors, or elevated risks depending on their exposure.

The US-China split among top clean-tech providers

Data as of April 14, 2025. Using MSCI Sustainable Impact Metrics, this research defined constituents of the MSCI ACWI IMI that generated over 50% of their revenues from clean-energy technologies as clean-tech providers. In this research, clean-energy technologies reliant on critical minerals included renewable-energy equipment, electric vehicles, energy-storage systems and LEDs. Source: MSCI ESG Research

US-China clean-tech revenue insights by sector

Data as of April 14, 2025. Sectors refer to the Global Industry Classification Standard (GICS®) sectors. GICS is the global industry-classification standard jointly developed by MSCI and S&P Dow Jones Indices. Using MSCI Sustainable Impact Metrics, this research defined constituents of the MSCI ACWI IMI that generated over 50% of their revenues from clean-energy technologies as clean-tech providers. In this research, clean-energy technologies reliant on critical minerals included renewable-energy equipment, electric vehicles, energy-storage systems and LEDs. Clean-tech providers’ revenue exposure to the markets was calculated by aggregating their estimated sales generated within those markets. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Aerospace, Defense and Tariff Turbulence

Tariffs and tangled supply chains: This week, we explore how commercial aerospace and defense companies are navigating a new wave of trade restrictions. From Boeing to Lockheed Martin, what do transparency and oversight mean when the stakes — and the sky —are high?

The Physical Risks of Reshoring

From car factories to aluminum smelters to textiles, the purported goal of the Trump administration is to 'reshore' American manufacturing. It’s a goal, in part, supported by his predecessor, Joe Biden, who enacted the CHIPS act to bring semiconductor manufacturing back to America. So, let's say manufacturing does come back and companies expand their current factories to meet demand. What climate-driven risks—water shortages, extreme heat, or flooding—will these sites face, and where will those hazards hit hardest? We’ll explore the answers on this episode of Sustainability Now!

Mapped or Missed? Navigating Tariff Uncertainty

Traceable supply chains can offer clarity amid trade-policy volatility, aiding businesses in forecasting costs, navigating tariffs and reducing investor risk.

1 “China has a weapon that could hurt America: rare-earth exports,” The Economist, April 10, 2025.2 “China Loosens Grip on Magnet Exports, Relieving Carmakers,” Wall Street Journal, May 16, 2025.3 “China has a weapon that could hurt America: rare-earth exports,” The Economist, April 10, 2025.4 “Honda’s Heavy Rare Earth-Free Hybrid Motors Sidestep China,” Bloomberg, July 12, 2016.5 “The resource demands of multi-terawatt-scale perovskite tandem photovoltaics,” Science Direct, April 27, 2024.6 “Ukraine, US sign minerals deal sought by Trump,” Reuters, May 2, 2025.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.