The Evolution of the Emerging Markets Universe

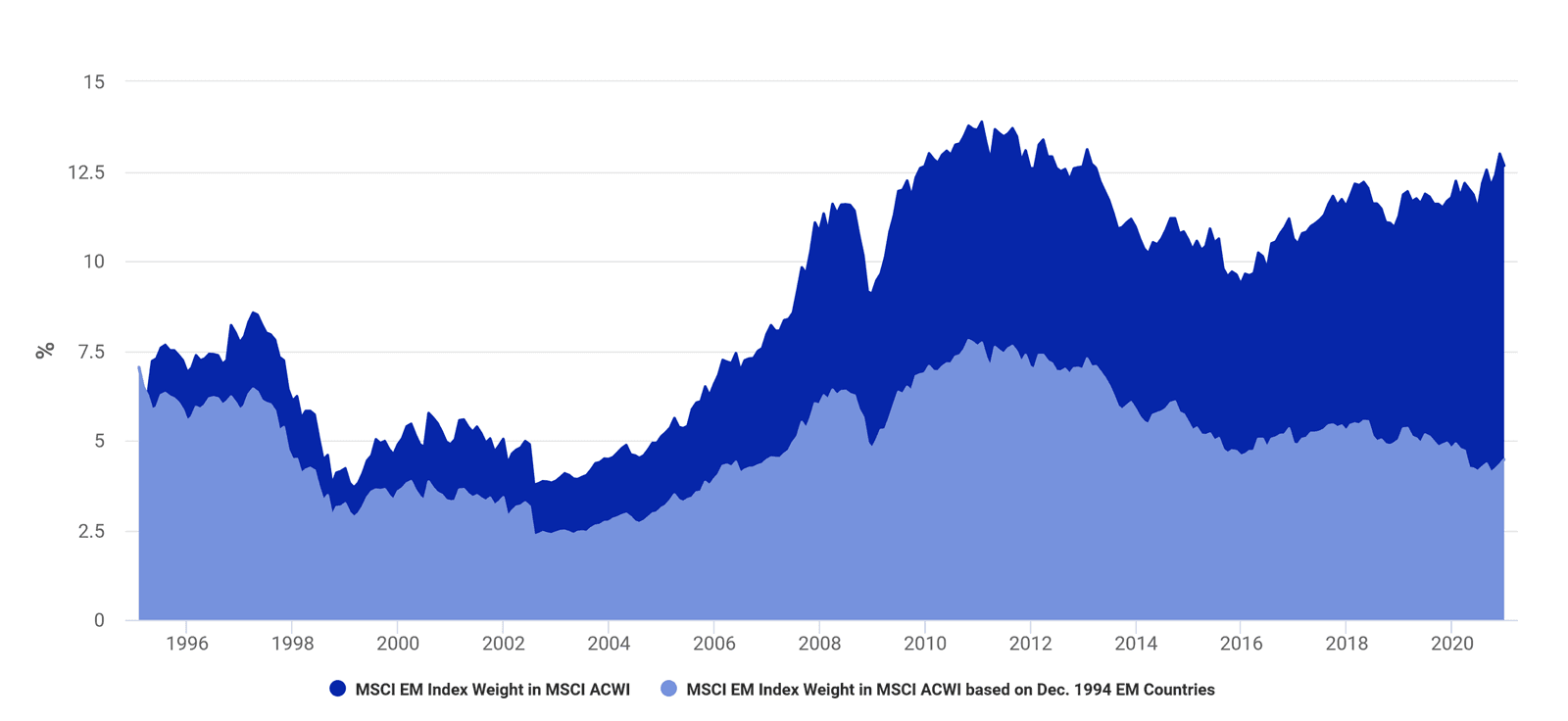

Global benchmarks have understated the economic importance of emerging markets (EM) at times. But looking at the evolution of the weight of the MSCI EM Index in MSCI ACWI revealed how the importance of EM in global asset allocations has grown. MSCI Research compared the global benchmark weight of the MSCI EM Index as of Dec. 30, 1994 to the weight of the EM Index as it continued to evolve through Nov. 30, 2020. The key driver for the EM's increased weight was the inclusion of new countries into the index over time, reflecting the fact that a greater number of countries become more accessible to foreign investors and grew in economic importance.

Data from Dec. 30, 1994, to Nov. 30, 2020.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Evolution of Emerging Markets

Over the past 20 years, emerging markets have increased significantly as a share of the MSCI ACWI Index.

The State of Global Investing

Over long periods, starting valuations and dividend growth have been primary factors in explaining equity market performance.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.