Ukraine Conflict and Fed Action

As trading stopped following Russia's invasion of Ukraine, we looked to the markets on two key questions:

- How could the invasion impact Federal Reserve rate hikes to address inflation?

- How might Fed action change if oil prices rise significantly?

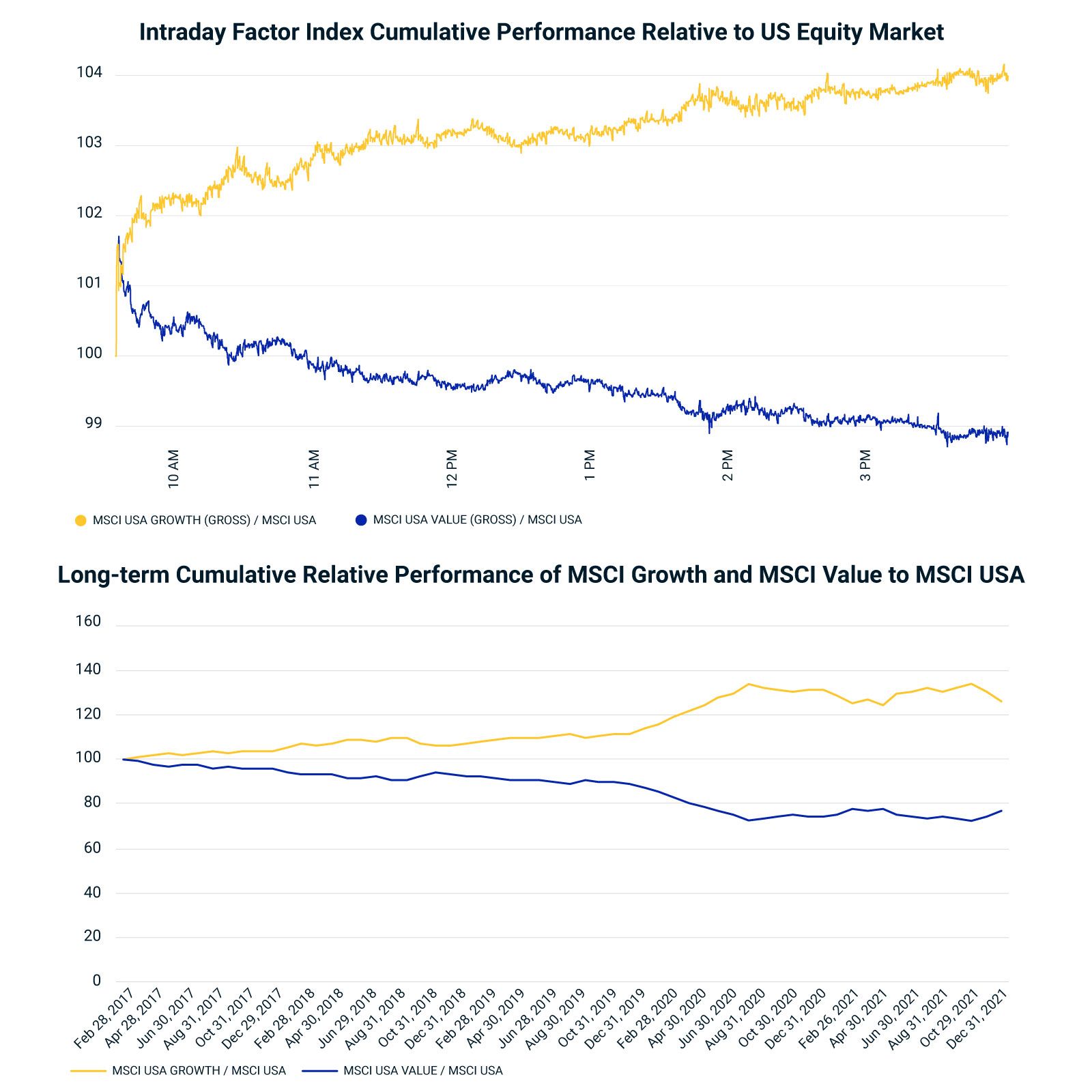

Factor performance provides insight into investor sentiment

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.