Wealth Managers, Direct Indexing and ADRs

Wealth managers can add international exposure to their U.S.-based clients' portfolios in several ways. One way is via direct indexing of an international index, such as the MSCI EAFE Index. Another is to invest in American depository receipts (ADRs). ADRs are issued by U.S.-based banks or brokers and represent shares of a foreign company. They are priced and settled in USD. Each of these represents an option that may facilitate the operational complexity of a multi-currency portfolio and the associated exchange rates.

A third option is to create personalized portfolios using the prescreened liquid and investable constituents (370 ADRs) of the MSCI EAFE Expanded ADR Index. As of March 2022, when the universe was expanded to include level 1 ADR issuers, the index covered approximately 70% of the market capitalization of its parent index, the MSCI EAFE Index.

Has the MSCI EAFE Expanded ADR Index provided similar coverage and exposures as the MSCI EAFE Index?

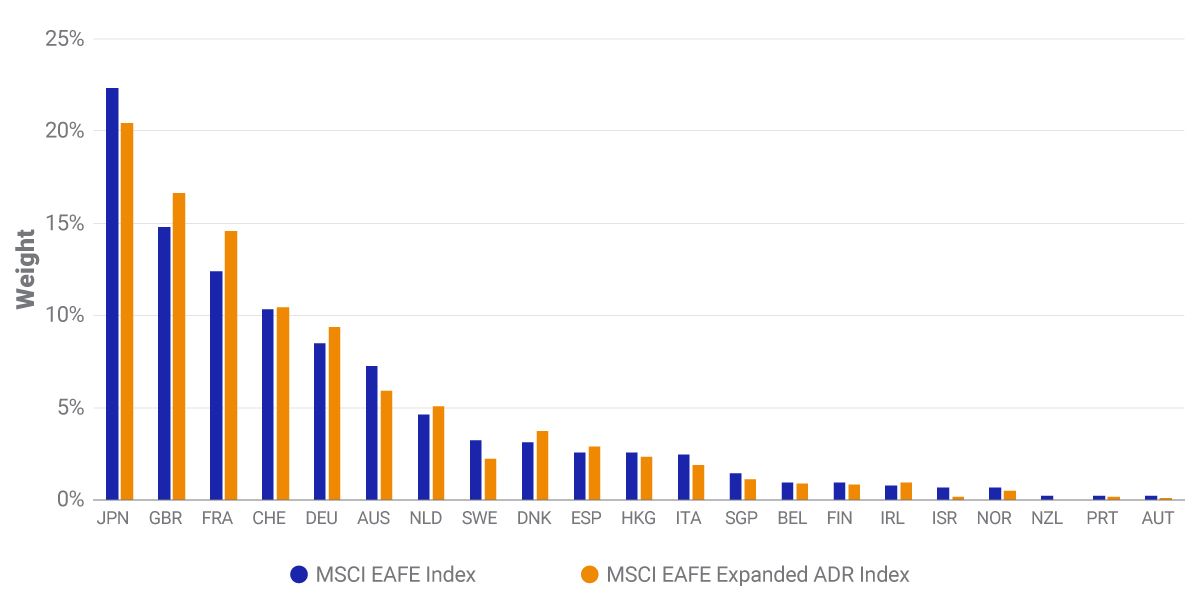

Our analysis shows that the country allocation of the MSCI Expanded EAFE ADR Index has approximated that of the MSCI EAFE Index, since its inception on March 27, 2022. On average, each country's coverage was 43% of its investable securities.

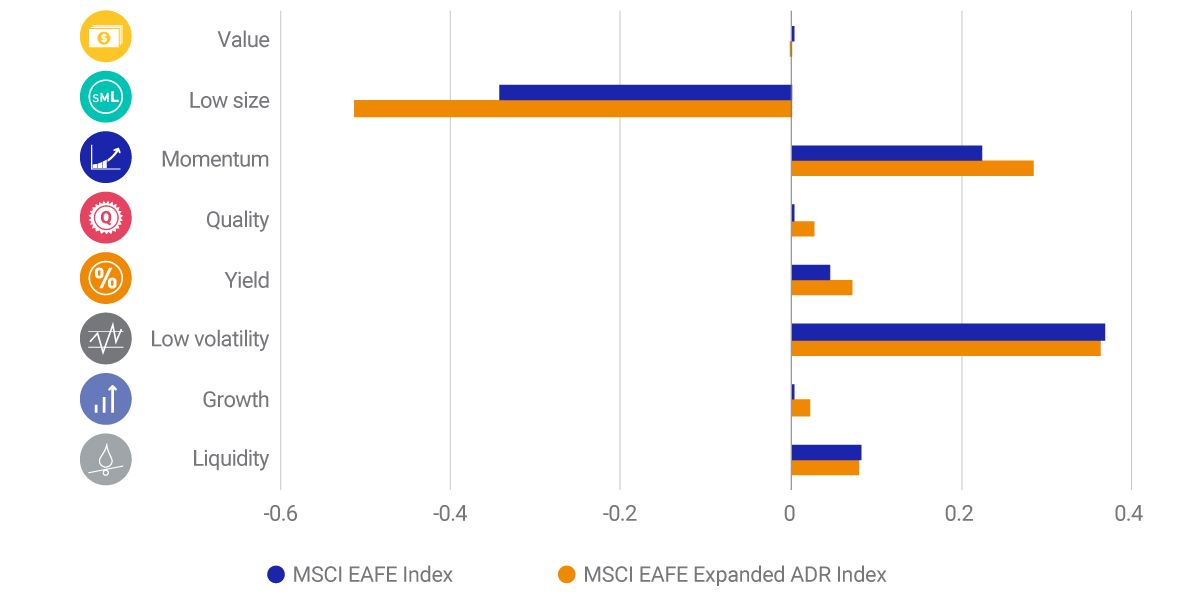

Likewise, the MSCI FaCS™ exposures of the MSCI Expanded EAFE ADR Index have been close to those of the MSCI EAFE Index. The main difference has been the MSCI EAFE Expanded ADR Index's greater exposure to large-cap stocks because ADRs have been typically issued by companies with larger market capitalizations.

Managers who consider complementing their clients' domestic allocations with international allocations via direct indexing may wish to examine how market capitalization and sector exposures are aligned with the clients' investment preferences.

Country allocations: MSCI EAFE Index vs. MSCI EAFE Expanded ADR Index

Data is as of May 10, 2023.

Average MSCI FaCS exposures: MSCI EAFE Index vs. MSCI Expanded ADR Index

A higher negative exposure to low size indicates that the MSCI EAFE Expanded ADR Index has greater exposure to large-cap stocks than the MSCI EAFE Index. Data is for the period from Sept. 27, 2022, to May 10, 2023.

Subscribe todayto have insights delivered to your inbox.

MSCI EAFE Expanded ADR Index

The MSCI EAFE Expanded ADR Index aims to target the performance of large and mid-cap companies in MSCI EAFE Index i.e., its parent index, represented by their corresponding American Depositary Receipts (ADRs).

Direct Indexing

Our direct indexing tools and capabilities are designed to help you satisfy your clients' unique needs, whether related to reducing carbon emissions of their portfolios or customizing their tax objectives.

Breaking Down the Direct Indexing Investment Process

Direct indexing is an investment process that registered-investment advisors and professional-wealth managers use to help them design portfolios for their clients based on knowledge of their clients’ particular circumstances.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.