What Does EU Taxonomy Reported Data for 2023 Tell Us?

Last year was an important one for sustainable finance and the EU Taxonomy for sustainable activities.1 For the first time, non-financial companies reported on alignment with the Taxonomy's first two environmental objectives: climate mitigation and adaptation. In addition, financial companies disclosed how much of their assets were eligible for Taxonomy alignment.

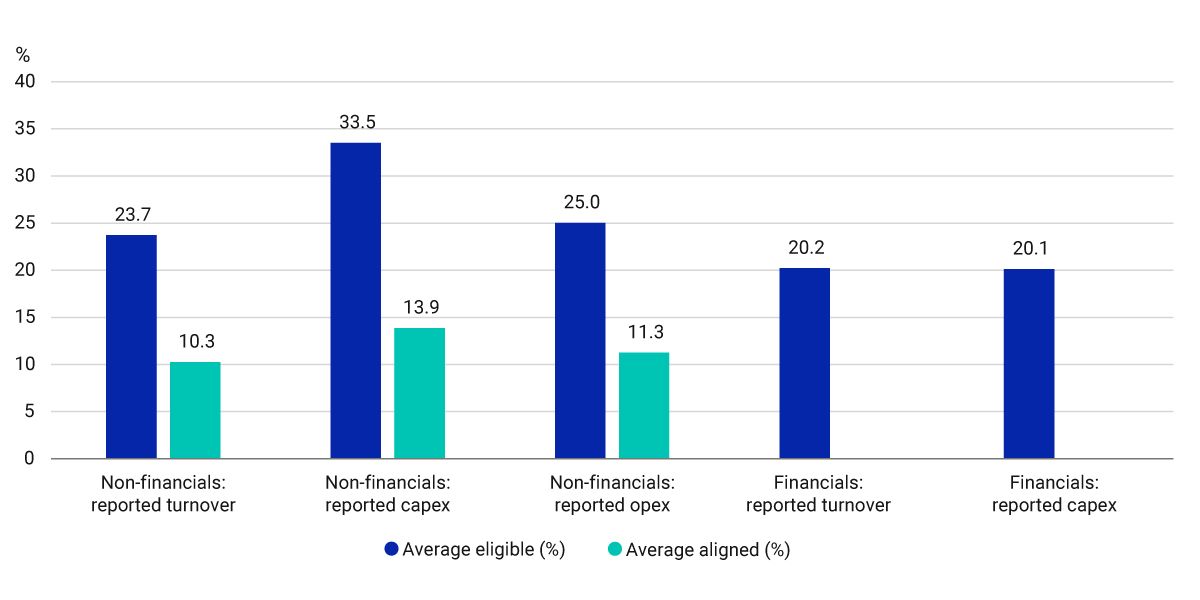

We analyzed the data reported by non-financial companies and found that:

- The average Taxonomy-aligned turnover was just above 10%.

- On average, less than half of the turnover from activities eligible2 under the EU Taxonomy was aligned,3 showing the potential to further enhance alignment over time.

- The average Taxonomy-aligned capital expenditure (capex) of around 14% was higher than the average aligned turnover, which is promising because it shows that companies are actually investing in green initiatives.

EU Taxonomy eligibility and alignment

Opex refers to operational expenditure. The analysis covers data reported by companies under the EU Taxonomy in 2023 for FY 2022. Data as of January 2024. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

EU Taxonomy Reporting Has Perplexed Issuers

Although the EU Taxonomy is a pivotal framework for assessing sustainability in economic activities, it remains a source of confusion. Its correct interpretation will be key to ensure that data is properly disclosed and reporting obligations met.

MSCI EU Taxonomy Reported Data User Guide

The objective of this guide is to help users understand and fulfil the reporting requirements under Commission Delegated Regulation (EU) 2021/2178 which supplemented Article 8 under the EU Taxonomy Regulation.

MSCI EU Taxonomy Methodology (Client access only)

MSCI’s EU Taxonomy Methodology has been designed by MSCI ESG Research in response to the EU Sustainable Finance Action Plan to identify companies generating revenue from business activities that are eligible and “potentially aligned” with the EU Taxonomy.

1 This information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your legal counsel and/or the relevant competent authority, as needed.2 An activity is eligible if it is listed in the EU Taxonomy and has Technical Screening Criteria described for it.3 A Taxonomy-eligible activity is considered aligned if it substantially contributes to at least one of the six climate and environmental objectives while not doing significant harm to the others and also meets minimum social safeguards.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.