The Options Market Has a Story to Tell

The MSCI Emerging Markets (EM) Index has fallen 11.7% year to date through March 11. For further insight into equity markets, we can turn to the options market, which has historically served as a window into investors' views.

Currently, options linked to the MSCI EM Index have repriced downside risk (puts) relative to upside risk (calls), despite retracement in the underlying markets. This suggests option markets have priced in more risk to the downside, as opposed to recovery, at least in the short term.

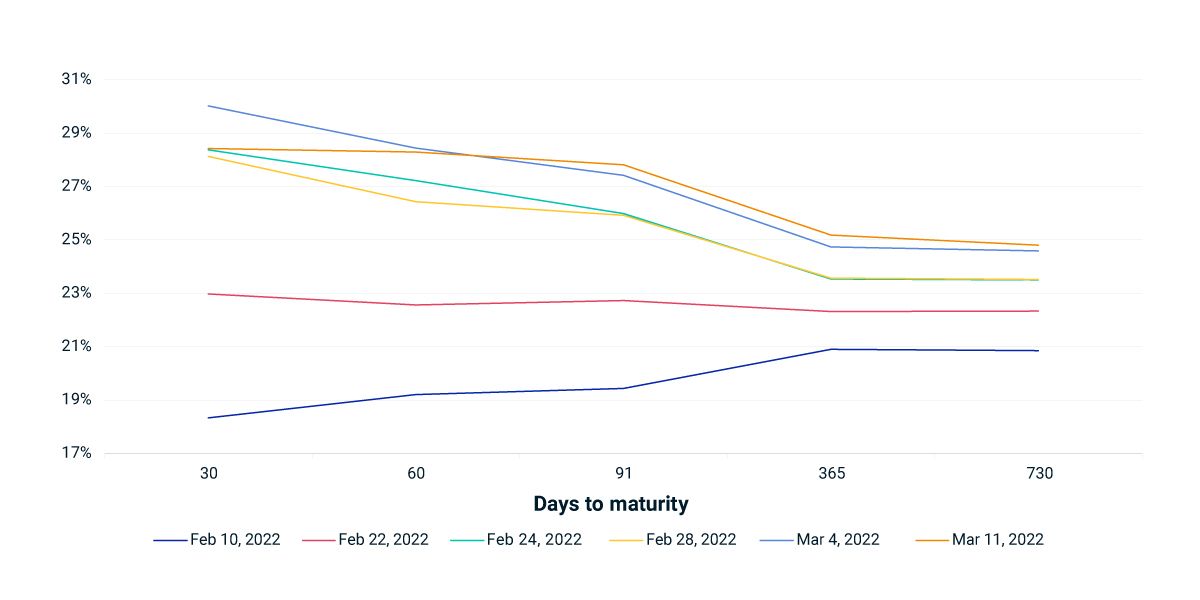

How does the options market expect volatility to change over time? For that, we can look to the volatility term structure implied in options linked to MSCI EM Index. This measure inverted on the day of Russia's invasion of Ukraine, highlighting higher short-term volatility risk. And, as shown below, volatility term structure has shifted up, implying an increase in expected volatility for emerging markets in both the short and long term.

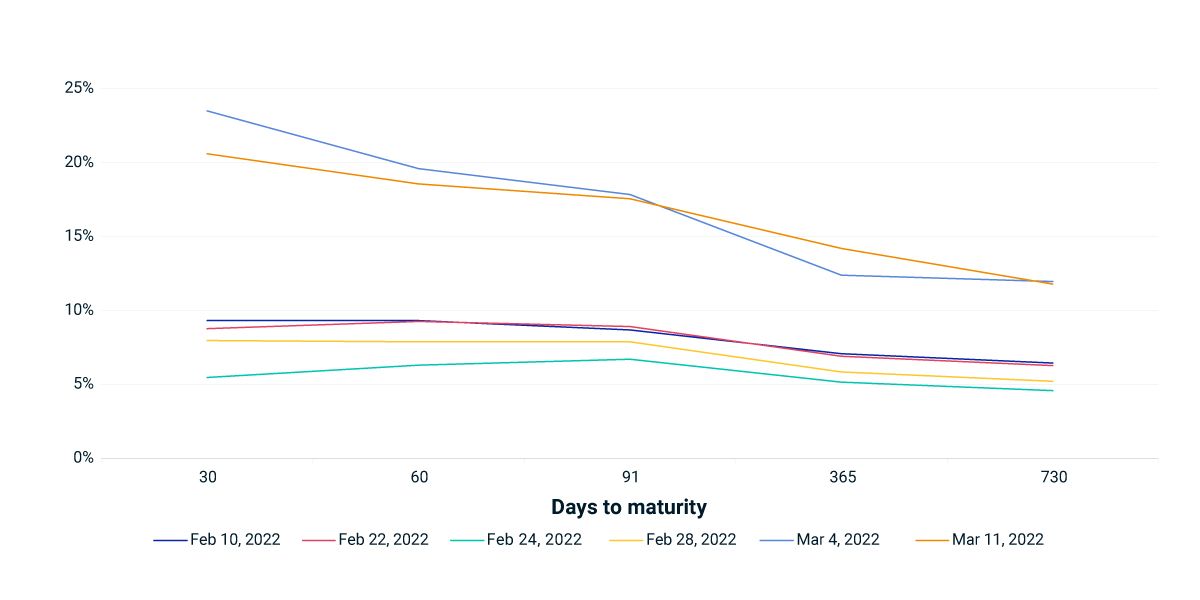

Implied Volatility Skew

Skew has been calculated using the put-call implied volatility spread of the 20-Delta strikes. Source: OptionMetrics

Implied Volatility for Listed Options Linked to the MSCI EM Index

Source: Optionmetrics. Implied volatility is based on the average implied volatility of 1-month 50-delta call and put options.

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.