No Planet B: Financing Climate Adaptation

Video

December 2, 2021

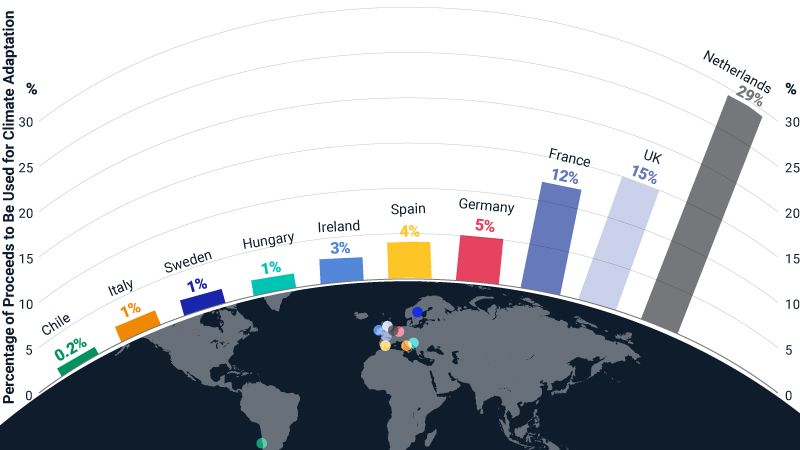

Extreme natural disasters loom even if we succeed in limiting global warming to 1.5 degrees C to 2 degrees C above pre-industrial levels. Already, Californians are choking on smoke, North Africans are running out of water, Southeast Asians are fleeing from floods¹ and major cities around the world risk inundation as sea levels rise. Unfortunately, there will be no escaping the need for projects that help us adapt to a changing climate. As governments and supranationals issue bonds to pay for them, they could drive a large-scale expansion of the green bond market. The Netherlands leads other countries in its issuance of green bonds whose proceeds are tied to climate adaption projects. An unsurprising fact as the Dutch are famous for their ability to live in harmony with their many in-land rivers. Yet the chart below may soon change, as the UN estimates that the annual amount spent globally on adapting to climate-change needs to be five to 10 times higher than current spend,² and countries continue to contend with more aggressive weather caused by climate-change.

Source: Bloomberg MSCI Green Bond Index, MSCI ESG Research; Aggregate data as of Nov. 1, 2021. Note that numbers for bonds which have not released their green bond annual reports as of Nov. 1, 2021 are based on approximations.

1 Lustgarten, Abrahm. "The Great Climate Migration." New York Times, July 23, 2020. 2 "The Gathering Storm: Adapting to climate change in a post-pandemic world." United Nations Environment Programme, Nov. 1, 2021.

Subscribe todayto have insights delivered to your inbox.

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Greenwashing Recedes as Common ESG Language Emerges

As ESG's star rises, so do questions about its credibility. The good news? An emerging common vocabulary that should aid transparency and clarify choice.

The Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.