Private-Company Emissions Under Public Scrutiny

Video

December 2, 2021

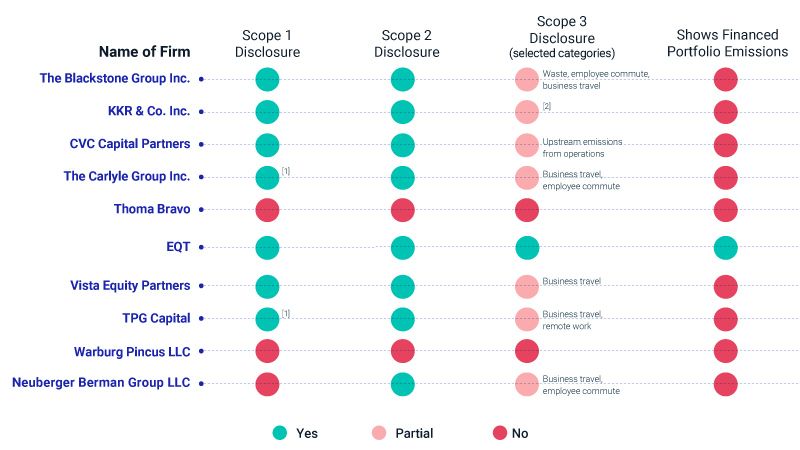

Critics argue that privately held companies are becoming an opaque refuge for carbon-intense fossil fuel assets.¹ But are those charges true? The case for the "prosecution" goes something like this: Private equity funds have raised capital totaling almost USD 557 billion in the energy and utilities sectors from 2010 to Nov. 11, 2021.² Meanwhile, the "defense" argues that growth in private-equity funds hasn't been in the most-carbon-intensive sectors. Who wins out is yet to be seen since, as the last column of the table below shows, all but one of the largest private-equity funds have not revealed the emissions footprint of their portfolios; though many have provided data on their operational footprint (Scope 1 and Scope 2 emissions), with a bit of business travel thrown in (Scope 3).

Data as of Nov. 18, 2021.1 Company stated they have no material Scope 1 emissions. ²Categories included are "numerous" but unspecified. See page 17 of "KKR Climate Action Report," November 2021. For Carlyle, see page 53 of "Impact Review," June 2021. For TPG, see "ESG Performance Report," September 2021. Source: MSCI ESG Research LLC

1 Tabuchi, Hiroko. "Private Equity Funds, Sensing Profit in Tumult, Are Propping Up Oil." New York Times, Oct. 13, 2021. 2 MSCI ESG Research used a dataset from S&P Capital IQ of 121,797 transactions from Jan. 1, 2010, through Nov. 11, 2021, where private equity was a buyer. Transaction values were available for about 70% of transactions.

Subscribe todayto have insights delivered to your inbox.

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

The Coal Conundrum: Rethinking Divestment

If the goal is a net-zero portfolio, divesting may seem the optimal path, especially for coal. But it may hardly advance us toward the goal of a net-zero economy.

The Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.