Your Portfolio’s Carbon Footprint May be Smaller Than You Think

Blog post

In recent years, many institutional investors have committed to measure and lower exposure to carbon emissions in their portfolios. But that presents a challenge: how to estimate such exposure, given the lack of disclosure by most companies about their carbon emissions?

Last year, 277 companies in the MSCI ACWI IMI Index disclosed their 2013 carbon emissions for the first time. These disclosures enabled MSCI ESG Research to test which of two competing methodologies came closer to estimating emissions from 2013.

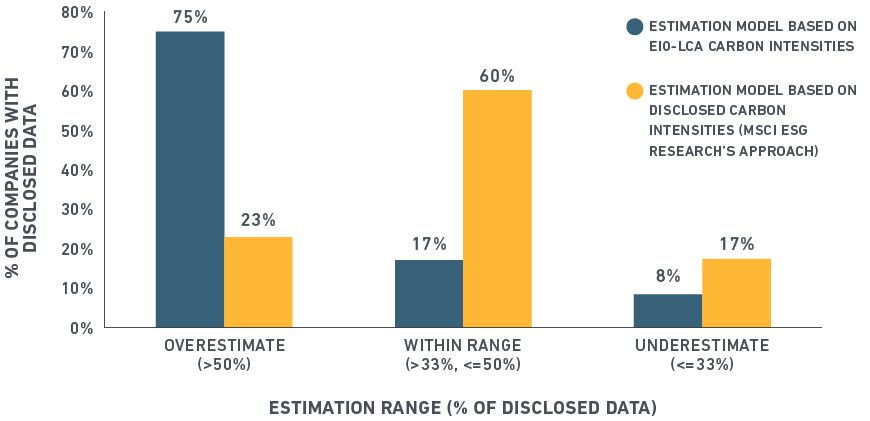

Our analysis shows that a method based on Economic Input Output Life Cycle Analysis (EIO-LCA) models that investors have long used to estimate carbon emissions overstated such emissions, on average, by 208%. Three quarters of the estimates overstated carbon emissions greater than 50% compared with the disclosed data.

The overstatement could stem from reliance on dated economic and environmental data by some EIO-LCA models to estimate carbon intensities. If so, these models may fail to account for technological advancements in the areas of carbon mitigation. The result: some investors may think they have greater exposure to carbon than they actually have.

In contrast, an alternative approach developed by MSCI ESG Research produced estimates of carbon footprints within 7% of the figures disclosed by the companies. This approach relies on historical data reported by the company or recently reported data by a sample of comparable companies to estimate the carbon emissions for companies with no disclosure, and may lead to better estimates by reflecting more precisely recent trends in carbon mitigation.

MSCI ESG Research's model shows that 60% of companies in the sample had carbon footprints that fell within a range of their targets (below chart). By comparison, 17% of companies achieved their target based on the estimation model relying on EIO-LCA data.

Comparing disclosed carbon data with estimation models

Source: MSCI ESG Research, % of companies by their extent of over/underestimation, based on 2013 carbon emissions data

With only 20% of companies in the MSCI ACWI IMI (8,721 large, mid and small cap companies, as of June 30) disclosing their emissions, institutional investors continue to rely on estimates to fill in the blanks for the remainder of their portfolios.

Unreliable or outdated carbon estimation models may significantly miscalculate or overstate emissions. In addition, the inconsistency of company disclosures also highlights a need for robust quality checks. MSCI ESG Research reviews the quality of disclosed data at multiple levels to address that concern.

The author thanks Dr. Manish Shakdwipee for his contribution to this post.

Further reading:

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.