APAC's Climate Transparency Journey — Uneven Progress

In line with global trends, there has been a steady increase in emissions-disclosure rates across the Asia-Pacific (APAC) region. Differing progress in the individual markets may however point to varying levels of preparedness for a low-carbon transition. Specific drivers of these differences may include company size, regulatory frameworks and levels of investor engagement.

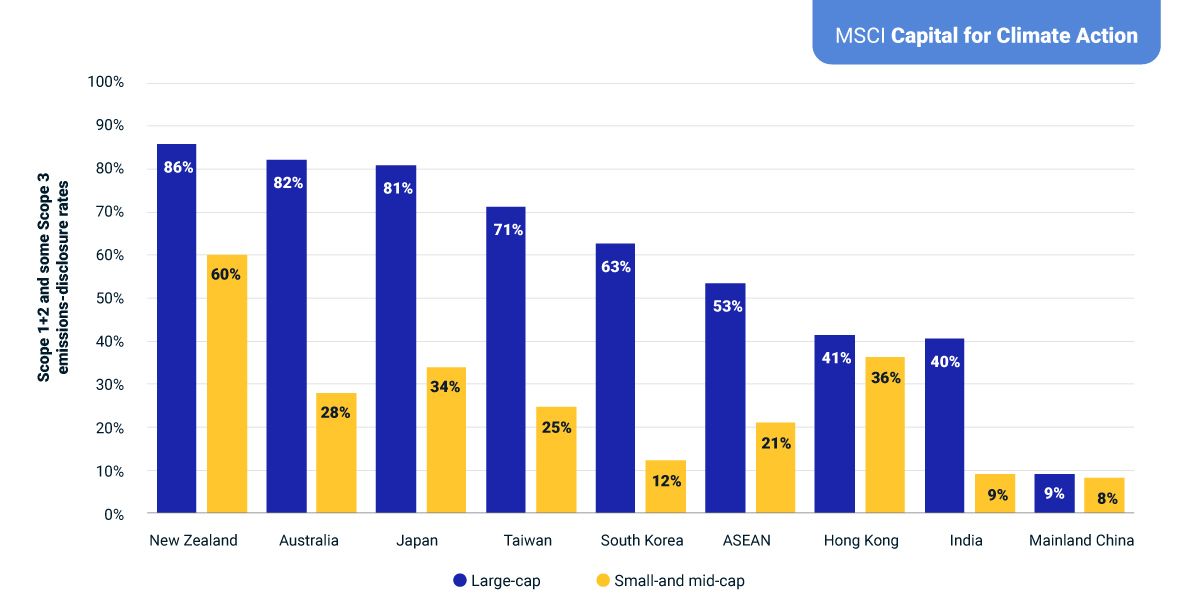

To assess reporting rates, we analyzed disclosed Scope 1, 2 and 3 emissions of the MSCI AC Asia Pacific Investable Market Index (IMI) constituents. We found that across most markets (except Hong Kong and China), small- and mid-cap companies lagged their larger counterparts by more than 25%. In Australia and South Korea, this gap exceeded 50%. Mandatory climate disclosures could place a disproportionate burden on these smaller companies that are not already measuring and disclosing climate data.

We also found that emerging-market companies lagged developed-market peers. Divergent regulatory landscape may be one factor underpinning these differences. New Zealand has mandated climate-related disclosures with some alignment to the International Sustainability Standard Board (ISSB) standard.1 Australia has proposed detailed ISSB-aligned disclosure requirements.2 Comparable disclosure frameworks are expected to become mandatory in Singapore and Hong Kong in 2025, South Korea in 2026 and Taiwan and Japan in 2027.3

As regulations evolve, investor engagement could become a supplementary pressure. Listed companies may see growing demand for emissions disclosures as investors look to quantify climate-transition risks and opportunities in their portfolios.4

Corporate disclosure of Scope 1, 2 and 3 emissions in APAC markets (2021)

Corporate emissions disclosures in 2021 were the latest and most consistently available data at the time of this research. We considered any disclosure of Scope 3 emissions, without necessarily covering each Scope 3 category. We followed the MSCI methodology for market-cap indexes to define large-, mid- and small-caps. ASEAN includes Indonesia, Malaysia, the Philippines, Singapore and Thailand. Data sourced from constituents of the MSCI AC Asia Pacific IMI as of Feb. 1, 2024. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

MSCI Capital for Climate Action APAC Conference

MSCI Capital for Climate Action APAC Conference is coming to Singapore, where investment and financial leaders from across the region will bring clarity to the low-carbon transition and the challenges and opportunities ahead.

Tracking APAC ESG Corporate Disclosure Frameworks Against International Developments

The development of corporate sustainability disclosure frameworks is well underway in APAC, but the absence of standardized and harmonized frameworks may result in misaligned disclosures across markets, posing challenges for companies and investors.

Making the Most of Mandatory Climate Disclosures

As TCFD reporting grows more sophisticated, investors may be able to use climate data to make meaningful disclosures across their firms. We explore three key topics: choice of metrics, internal consistency and cross-functional applications.

1 “Aotearoa New Zealand Climate Standards and IFRS Sustainability Disclosure Standards,” External Reporting Board, October 2023.2 “Climate-related financial disclosure: exposure draft legislation — Policy Statement,” Australia Department of the Treasury, Jan. 12, 2024.3 “Financial Services Agency Working Group on Sustainability Information Disclosure and Assurance,” Financial Service Agency, May 14, 2025.

“Consultation Paper on Sustainability Reporting: Enhancing Consistency and Comparability,” SGX Group, April 5, 2024.

“Exchange Publishes Conclusions on Climate Disclosure Requirements,” Hong Kong Exchange, April 19, 2024.

“The Financial Supervisory Commission releases the roadmap for Taiwan listed companies to align with IFRS Sustainability Disclosure Standards,” Financial Supervisory Commission Republic of China (Taiwan), August 17, 2023.

“Authorities Meet to Discuss ESG Disclosure Standards,” Financial Services Commission, Feb. 14, 2024.4 Collective investor engagement such as Climate Action 100+ saw more than 80% of about 170 companies on the list disclosed emissions from Scope 1, 2 and 3 boundaries, based on our research.

“Consultation Paper on Sustainability Reporting: Enhancing Consistency and Comparability,” SGX Group, April 5, 2024.

“Exchange Publishes Conclusions on Climate Disclosure Requirements,” Hong Kong Exchange, April 19, 2024.

“The Financial Supervisory Commission releases the roadmap for Taiwan listed companies to align with IFRS Sustainability Disclosure Standards,” Financial Supervisory Commission Republic of China (Taiwan), August 17, 2023.

“Authorities Meet to Discuss ESG Disclosure Standards,” Financial Services Commission, Feb. 14, 2024.4 Collective investor engagement such as Climate Action 100+ saw more than 80% of about 170 companies on the list disclosed emissions from Scope 1, 2 and 3 boundaries, based on our research.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.