Are US Treasurys Sensing a Risk Equities Aren’t?

One measure of the equity risk premium — the spread between the three-month U.S. Treasury bill yield and the U.S. equity market's earnings yield — was trading at a two-decade low, as of Feb 29, 2024. Coupled with an inverted yield curve,1 such an unusually low yield spread has historically presaged an economic slowdown in the U.S. and a spike in U.S. equity volatility.

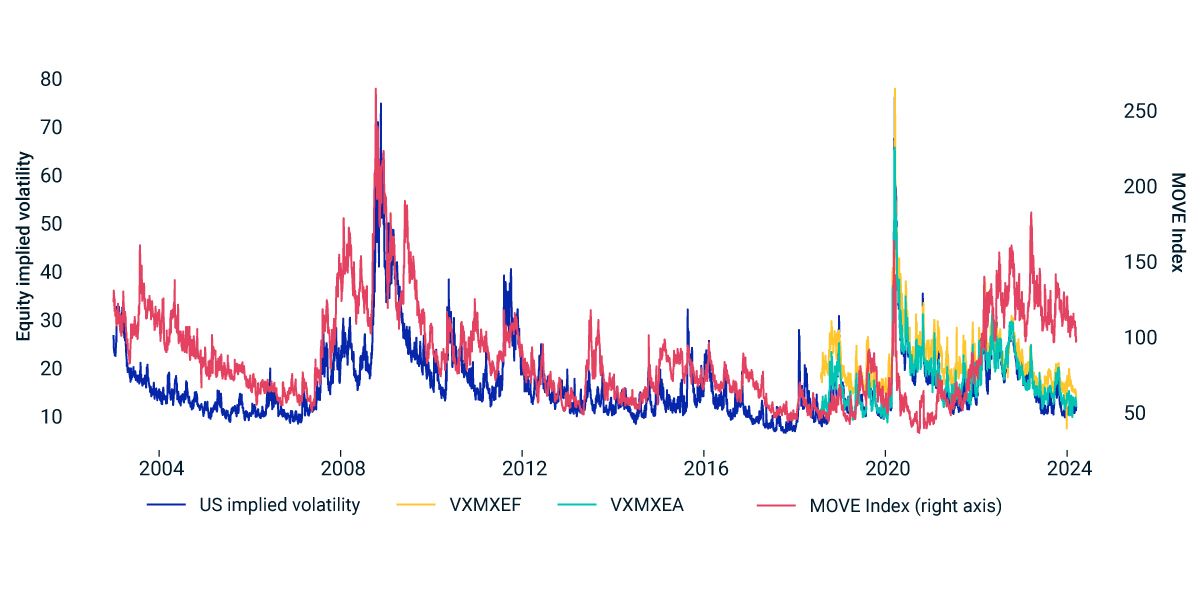

The spread between U.S. Treasury volatility and equity volatility, has also remained wide since the regional banking crisis in 2023. The MOVE Index,2 a measure of implied U.S. bond volatility, has remained elevated compared to history, while U.S. equity volatility has been historically low. The disparate volatility of the two markets appears to reflect varying perceptions of their risk.

Equity volatility in other regions has been low as measured by the Cboe MSCI Emerging Markets Volatility (VXMXEF) and Cboe MSCI EAFE Volatility (VXMXEA) Indexes. The VXMXEF and VXMXEA were in the bottom quintile of volatility based on the past five years, as of March 15, 2024. At the same date, put-option premiums were at lower deciles than over the last five years, implying a lower cost to insure against higher volatility.

Historically high equity valuations, heightened market concentration in equity markets around the world and uncertainty surrounding rate cuts could present the risk of equity-market drawdowns, particularly in the U.S. In the past, some investors apprehensive about the possibility of increasing volatility and drawdowns have viewed a low hedging premium as an opportunity to gain downside protection against the risk of rising equity volatility.

Divergence in US Treasury and equity volatility continued after the 2023 regional banking crisis

Implied-volatility skew and put-option premiums are low versus last five years

Loading chart...

Please wait.

Data is from March 1, 2019, to March 15, 2024. We calculate the implied-volatility skew using the five-day moving average of the put-call implied-volatility spread of 91-day 20-delta strikes. The "put option as a percentage of the spot price" shows the premium of a three-month 95% put option. We calculate the implied-volatility skew and option premiums for EAFE, emerging markets and the U.S. using options linked to the MSCI EAFE, MSCI Emerging Markets and S&P 500 Indexes, respectively. Source: OptionMetrics

Subscribe todayto have insights delivered to your inbox.

Low Volatility Today. Concern or Opportunity for Tomorrow?

The cost of hedging downside equity exposure has fallen substantially versus eight months ago, markedly lowering the price of insurance against rising equity volatility.

Markets in Focus: Concentrating on Diversification

Higher equity and bond correlation combined with increased index concentration suggest now is a good time to revisit allocations across regional, country, sector, style and thematic exposures for adequate portfolio diversification.

1 We refer to the negative interest spread of the 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity. Source: Federal Reserve Bank of St. Louis2 The MOVE Index is the ICE BofAML Market Option Volatility Estimate Index. The index measures implied U.S. bond market volatility calculated using the volatility of options on U.S. Treasury obligations.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.