Changing Sectors, Changing Correlations

When considering new sector exposures in their portfolios, investors can review correlations between existing and potential allocations to better understand whether these sectors' returns moved in the same direction or if exhibited a differentiated return pattern. The correlation measure ranges from -1 to +1; the closer it is to +1, the more correlated the investments being measured.

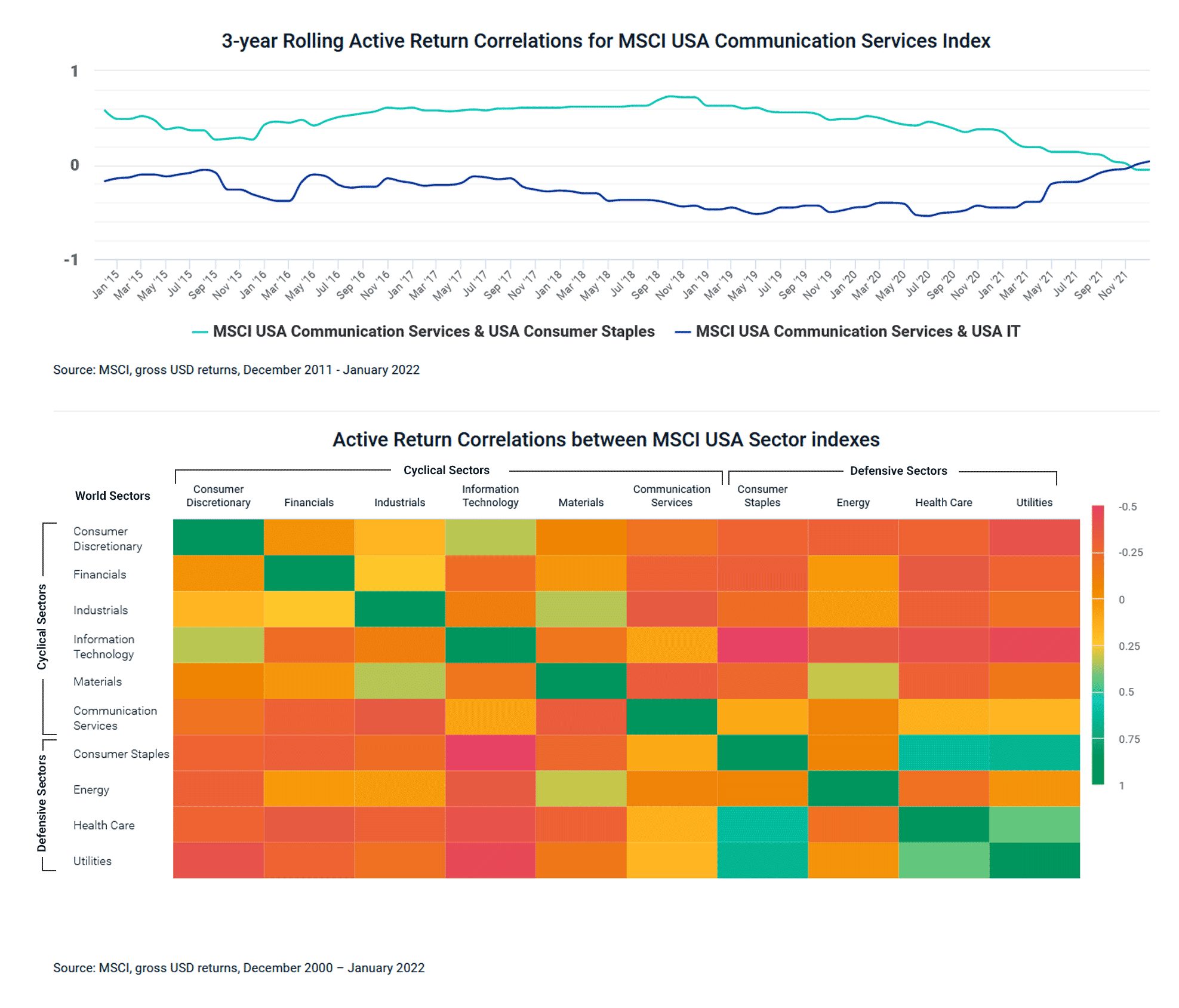

The first chart below shows the long-term active-return correlation between the MSCI World Sector Indexes for the last 20-plus years. The sectors are grouped into cyclical — those that have been highly correlated with the macro economy — and defensive—those that have had lower correlations with the macro economy — sectors. Perhaps not surprisingly, sectors within each group tended to be more correlated to each other while sectors across groups had lower correlations.

However, one sector does stand out. Communication services sector index showed more negative correlations for sector indexes within the cyclical group, than it did with defensive sectors.

If we look at rolling 3-year correlations for communication services, we can actually see it changing. The second chart shows the correlation of communications services' excess returns between compared to information technology (IT) and consumer staples. While the former correlation shifted from negative to positive, the latter was positive (even above 0.60 at one point) but turned negative. Why is this?

In September 2018, the Global Industry Classification Standard (GICS®)1 underwent its biggest structural change since its creation, when the telecommunication services sector was significantly broadened and was renamed communication services. This change reflected the fact that the way people communicate, share information and entertain themselves has fundamentally changed as a result of the rapid convergence between technology, media and telecom. At that time, the new communication services sector moved from the defensive to the cyclical category, and out of the MSCI's Defensive Sector Indexes to the MSCI's Cyclical Sector Indexes. Illustrating the impact of this shift: While in August 2018, the top two stocks in the telecommunication services sector were Verizon and AT&T, in December 2018, the top two stocks in the communication services sector were Alphabet and Facebook.

While this is an extreme example, the takeaway of this analysis is that investors need to be mindful how sectors may evolve through time and how that may affect their behavior. While most of the excess return correlations retained the same direction (positive or negative), they have fluctuated over time. Investors looking into these correlations may want to complement their analysis with a time dimension.

Correlations Over Time

Correlations Over Time

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Sector Leaderboard Changed as Inflation Picked Up

U.S. Fed Chairman, Jerome Powell, has made it official: We can no longer label the period of current inflation as transitory. The Fed left interest rates unchanged in January, and Chairman counselled patience about next steps.

Have Sectors Driven Stock Returns?

When investors construct portfolios, they may do so based purely on bottom-up stock selection, or they may incorporate an element of top-down construction by adjusting the portfolio’s allocation to sectors, countries or factors.

1 GICS, the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.