Equity Analysts Get Sentiment-al

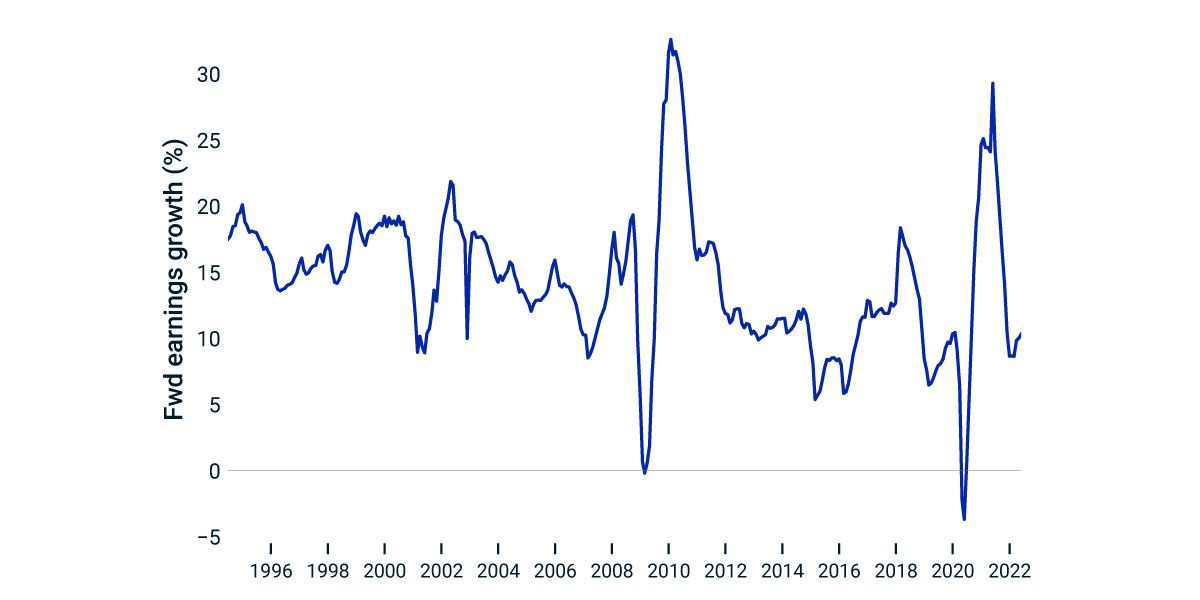

Earnings estimates have fallen for U.S. firms recently with a slew of downward revisions,1 possibly indicating that recession fears may be influential. Equity analysts anticipate that U.S. corporate earnings will increase by about 10% this year, which is a sharp departure from last year's growth spurt (as shown below).

If growth continues to erode, analysts could be faced with trying to identify those firms that can continue to grow despite the difficult environment. They could also be challenged by so-called "growth traps," which involve companies that were able to grow earnings recently but offered disappointing future guidance.

Earnings and ratings

Earnings estimates and ratings have long been valued financial instruments of the stock picker's toolkit. Our research indicates that firms whose earnings and ratings have been revised upward (bullish analyst sentiment), tended to outperform the broad market. Yet, historically these firms have been rare gems.

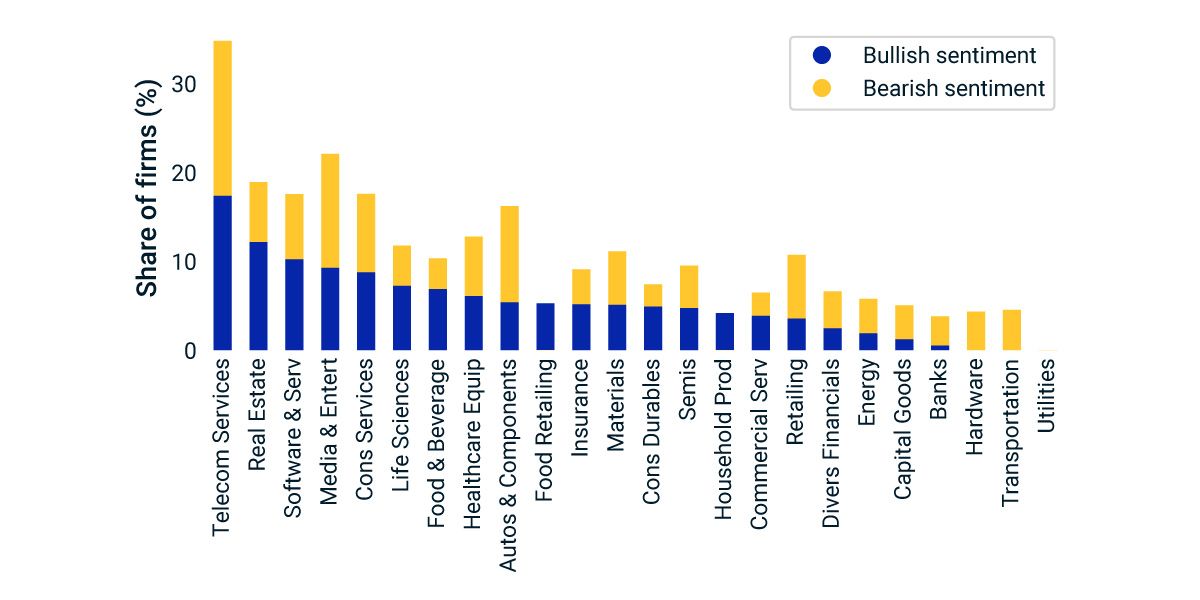

We found that certain industry groups, such as telecommunications, real estate and media and entertainment, had a relatively high share of companies where analysts were currently most bullish. To be sure, these industry groups also had a high share of firms that analysts were most bearish on, which may be a ripe opportunity for stock picking.

Small, but mighty?

In addition, we found that most of the companies with the highest (and lowest) sentiment were small-cap stocks, highlighting that analysts may expect the rewards (and risks) in the coming year to expand beyond blue chips.

Earnings estimates declined in the US equity market

Forward EPS growth rate is the growth rate between index 12-month backward EPS and the 12-month forward EPS for the MSCI USA IMI Index.

Industries with a wide range in analyst sentiment

We use the analyst sentiment factor from the MSCI Global Equity Factor Trading Model to determine those firms with the most positive or negative sentiment, as of May 31, 2022.

Subscribe todayto have insights delivered to your inbox.

Is the Energy Trade Running Out of Energy?

Energy stocks have posted double-digit gains recently as oil and gas prices have climbed steadily since their pandemic lows.

Index Options Indicated Negative Market Sentiment

In the face of continued global equity-market volatility, we turn to the listed-options market to gauge the perception of market risk over the coming months for EAFE, emerging markets (EM) and the U.S.

Value’s Lost Decade

After more than a decade of unattractive performance and “neglect,” value strategies became a favorite in 2021 and remained so in early 2022. We saw a rotation from growth to value, and value investments posted some long-awaited outperformance.

1 Malik, Hamza Fareed. “Snap's profit warning shocked stock investors this week. Morgan Stanley lays down why more are coming that could drive markets 10% lower.” Business Insider, May 29, 2022.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.