The Many Faces of Sentiment

Research Paper

December 4, 2020

Preview

There are many dimensions of sentiment — some are based on the actions or views of influential and potentially well-informed market participants, such as short sellers, options traders, sell-side analysts, institutional investors and corporate insiders. Others may be different types of influencers, such as news and social media, company employees and consumers of a company's products.

In this paper, we extend our previous research on sentiment measures by introducing several more traditional and alternative datasets. We examined the historical coverage of these datasets and formulated factor definitions. We analyzed the historical and recent pure performance of these factors and an equal-weighted combination of all of them while controlling for the influence of industry and equity style-factors. And, we explored two ways of constructing long-only hypothetical portfolios, aimed at addressing the high-factor exposure/high investment capacity tradeoff.

Our analysis indicates that sentiment factors may provide additional transparency into sources of risk and return and an avenue for potential positive risk-adjusted returns as compared to traditional factors.

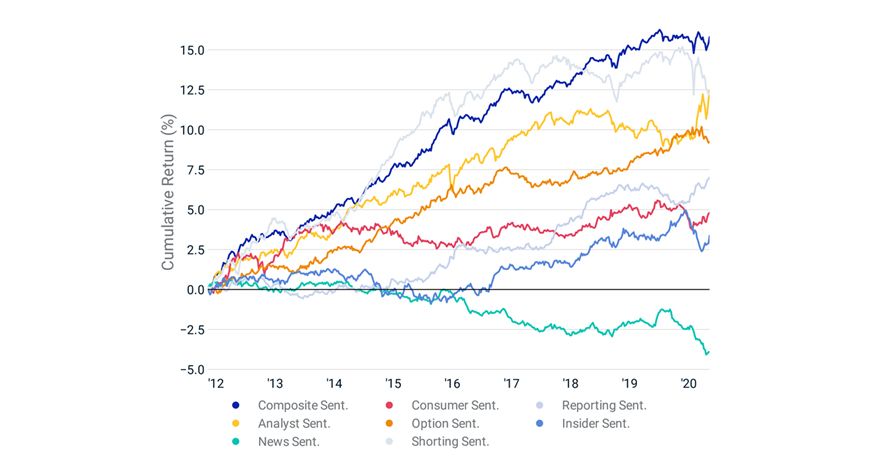

Performance of Sentiment Measures in the MSCI USA IMI Universe

Factor return is computed via multivariate cross-sectional regression at weekly frequency. Cumulative return is the arithmetic cumulative sum of weekly factor returns. The computation is done on the MSCI USA IMI universe. The period of calculation is between January 2012 and June 2020.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.