Global Issuer Engagement on MSCI ESG Ratings Continued to Rise

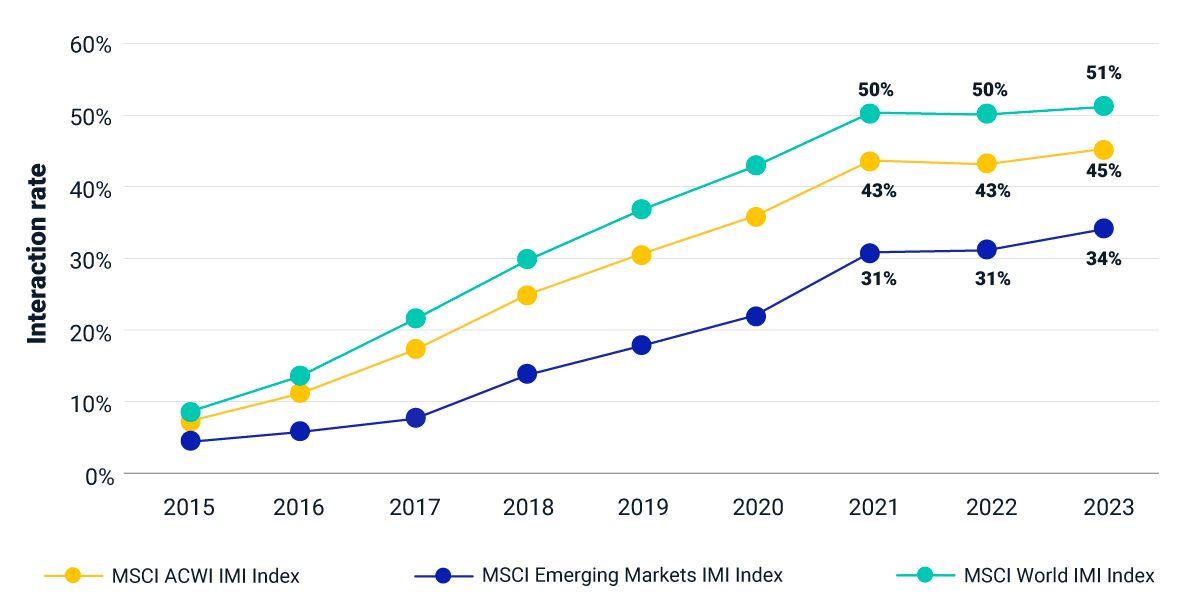

Amid escalating demand from capital-market participants, regulators and other stakeholders, we have witnessed a marked increase in corporate issuers' interactions with MSCI ESG Research. Nine years of data (2015-2023) show a notable and ongoing trend: Issuers across all market-capitalization ranges, regions, countries and sectors are making more inquiries, giving more feedback and providing more updates to their sustainability, governance and climate data.

Rise in emerging-market and climate-related interactions

In 2023, 45% of issuers that were constituents of the MSCI ACWI Investable Market Index (IMI) proactively contacted MSCI ESG Research with inquiries, up from 7% in 2015. While emerging-market issuers still lag their developed-market peers, 34% of issuers in the MSCI Emerging Markets IMI interacted with us in 2023, up from just 4% in 2015.

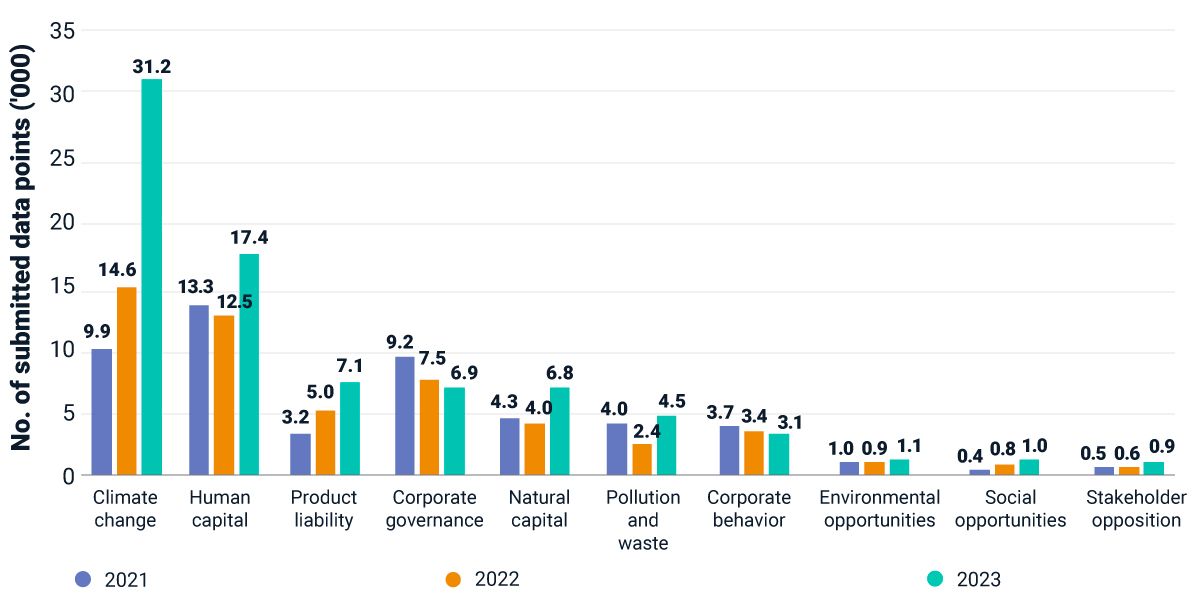

Climate-related data points received the most issuer feedback in 2023, covering around 31,200 climate data points — 3.2 times more than in 2021. Overall, this rise in feedback across both sustainability and climate topics might be pointing to greater pressure from investors and regulators as well as companies' inherent interest in these issues.

Issuers across sectors held steady or increased their data-verification rates

At a Global Industry Classification Sector (GICS®)1 level, the top three most active sectors in 2023 in terms of data-verification rates were financials, utilities and communication services. The utilities sector saw the biggest jump, up to around 32% of issuers sharing data feedback — up from 17% in 2022.

Issuer-interaction rate in the MSCI ACWI IMI universe

Number of data points submitted by issuers across 10 themes

Data-verification rate by sectors

Loading chart...

Please wait.

Subscribe todayto have insights delivered to your inbox.

Understanding Institutional Investors’ Perspective on ESG Ratings

Understanding ESG risks and opportunities from the perspective of investors could be invaluable for issuers. We examine how investors think about ESG factors and how they incorporate them into their investment processes.

ESG Ratings

ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks.

What MSCI’s ESG Ratings are and are not

MSCI’s ESG ratings are designed for one purpose: to measure a company’s resilience to financially material environmental, societal and governance risks.

1 GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.