Is the Energy Trade Running Out of Energy?

Energy stocks have posted double-digit gains recently as oil and gas prices have climbed steadily since their pandemic lows. The MSCI ACWI Investable Market Index (IMI) Energy Index has widely outperformed all other sectors this year, gaining over 30% while the broad equity market has fallen 20%.

Less is more

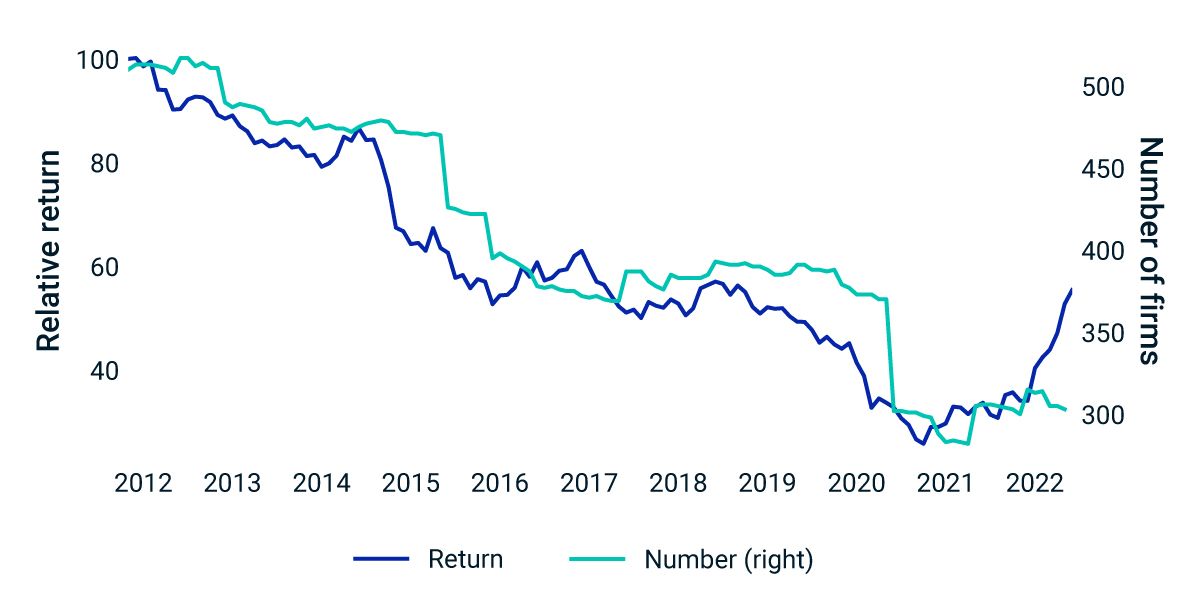

Yet the size of the energy sector is a fraction of what it was just a decade ago. Beset by bankruptcies, delistings and firms going private, the number of energy firms has fallen by 60% from its peak in 2012. In line with this trend, only 300 of the more than 9,000 firms in the MSCI ACWI IMI Index are in the energy sector.

Recipe for a crowded trade

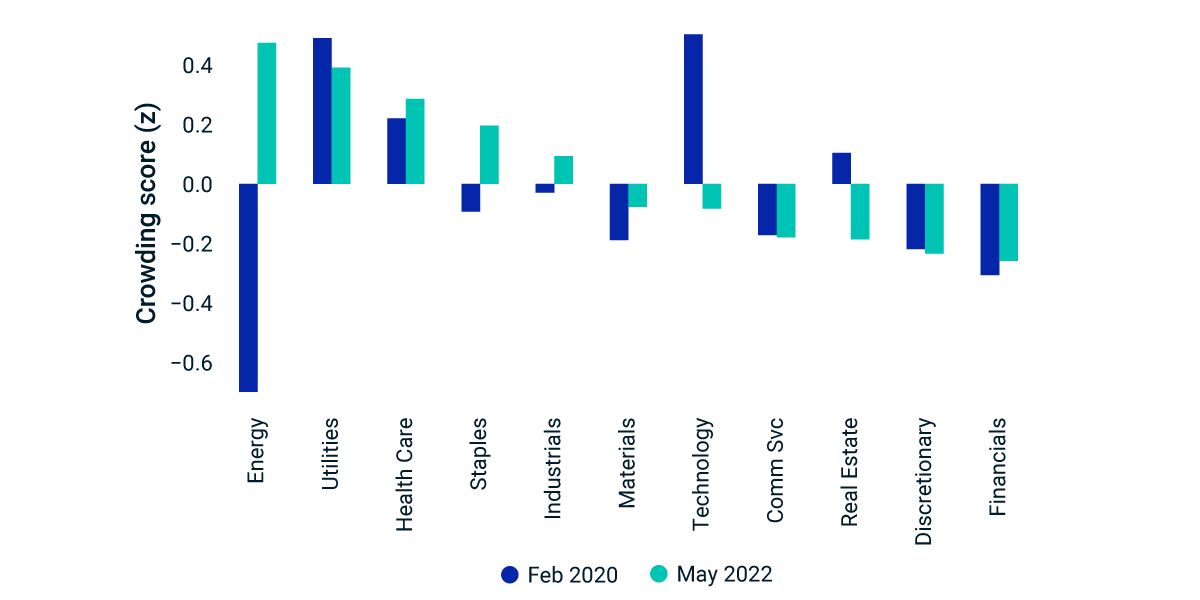

Lofty returns and a shrinking opportunity set could be a recipe for a crowded trade. According to the MSCI Security Crowding Model, energy is the most crowded of all sectors, largely due to rising valuations and short interest. That is quite a turnaround for a sector that was shunned by investors just two years ago at the onset of pandemic-related demand destruction.

We found that equipment servicers, storers and transporters and coal producers were the most crowded firms within the energy sector. This could have implications for investors, particularly the net-zero aware, if the crowds were to disperse in the ensuing months.

The energy sector has soared while its size contracted

Returns are in gross USD for the MSCI ACWI IMI Energy Index relative to the MSCI ACWI IMI.

Once shunned, energy is now the most crowded sector

Crowding scores are capitalization-weighted and use the MSCI Security Crowding Model. A higher score indicates more crowding.

Subscribe todayto have insights delivered to your inbox.

Energy-Sector Drivers

Looking at sectors through a factor lens may provide additional insights for investors in terms of explaining performance.

Net-Zero Alignment: Objectives and Strategy Approaches for Investors

Net-zero investing means implementing a decarbonization pathway for a portfolio, using its “emissions budget” to achieve a temperature scenario well below 2°C.

Hotter Inflation Set Some Styles and Sectors on Fire

We evaluate the performance of the MSCI World Factor and Sector Indexes conditioned on high inflation and varying growth environments since the 1970s.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.