More to Revival of Listed US Real Estate Than Rate Cuts

Listed U.S. real estate emerged as the second-best performing sector behind utilities in Q3 2024. The sector posted a 17.3% return versus 6.2% for the broad-market MSCI USA Investable Market Index (IMI), a sharp reversal after months of poor performance following the Federal Reserve's rate hikes that began in March 2022.1 The recent shift toward more favorable rates has likely boosted the appeal of listed real estate, but a more fundamental and compositional shift may be behind investors' renewed attention.

Sector changes — keeping up with the times

Since its split from financials into a stand-alone sector eight years ago, the GICS® real-estate sector has continued to evolve.2 In 2023, the specialized category of real-estate investment trusts (REITs) was replaced by new constituent sub-industries. One of these, data-center REITs, which has been supported by the rise of AI, accounted for 9% of the MSCI USA IMI Real Estate Sector Index as of Sept. 30. Similarly, telecom-tower REITs, linked to the growing demand for mobile and broadband infrastructure, has become the second-largest sub-industry at 12% of the index. In contrast, office REITs, in line with lower occupancy rates after the COVID-19 pandemic, made up just over 3% of the index at quarter-end, down from 9.5% at year-end 2019.

Deeper rate declines, better performance

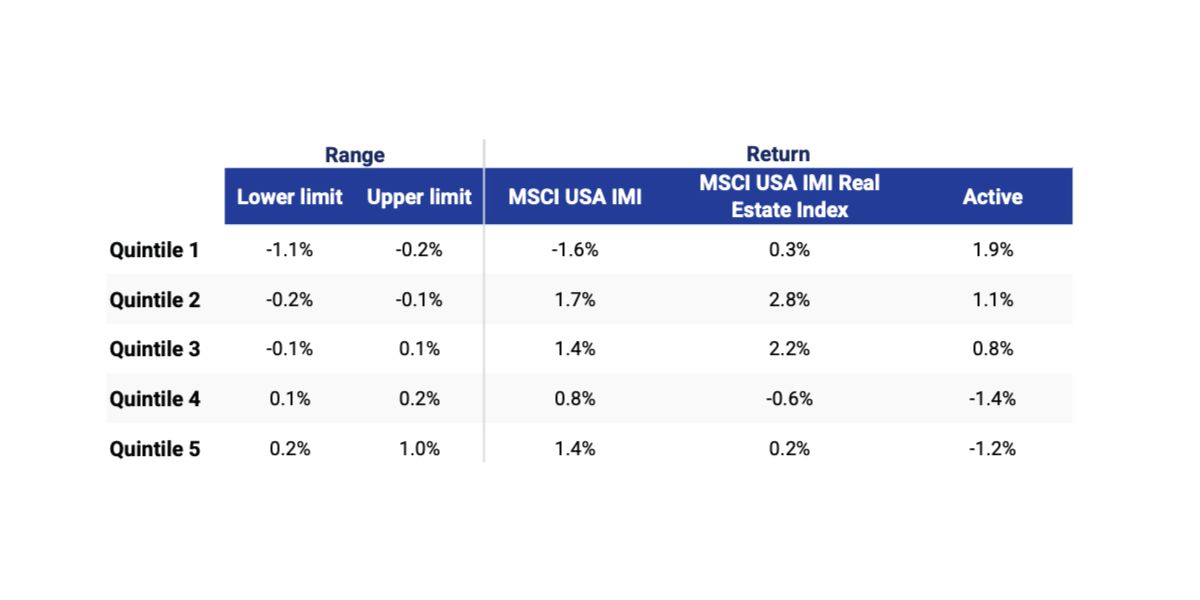

Historically, interest-rate changes have led to pronounced differences in sector performance. Our focus here is on how the U.S. real-estate sector has responded to rising and falling rates over the last 25 years. Our findings align with intuition: the sector has outperformed the broader U.S. equity market during periods of declining rates. Moreover, on average, the deeper the rate decline, the stronger the sector's relative performance has been.

Evolution of the real-estate sector: Top 10 sub-industries over time

Loading chart...

Please wait.

Data from Dec. 31, 2016, to Sept. 30, 2024. Bars show the weights of the top 10 sub-industries in the MSCI USA IMI Real Estate Index as of the respective year-end. For 2024, data is as of Sept. 30.

Real estate outperformed the MSCI USA IMI in falling-rate environments

Data from Dec. 31, 1999, to Sept. 30, 2024. Index returns are gross in USD. Interest-rate quintiles have been calculated based on monthly changes in the U.S. Treasury 10-year bond yield. History of the MSCI USA IMI Real Estate Index prior to Aug. 30, 2016, was simulated using industry-level data for real estate in the GICS financials sector. Source: Federal Reserve of St. Louis Economic Data (FRED)

Subscribe todayto have insights delivered to your inbox.

As Fed Rate Hopes Shift, So Too Does Real-Estate Sentiment

Real estate has been rocked by a rapid rise in interest rates that has stymied deal activity and put downward pressure on asset values. If the Fed lowers rates, will it raise investors’ spirits? Or is this a case of “be careful what you wish for?”

Real Estate in Focus: Signs of Recovery After the Shocks

The second quarter provided glimmers of hope that the downturn in global commercial real estate is nearing its end. We discuss our latest findings on deal activity and pricing.

Real Estate Indexes

MSCI is a leading provider of real estate investment tools providing critical business intelligence to institutional investors, real estate owners, managers, brokers and occupiers worldwide. MSCI's comprehensive suite of real estate product is unique in the industry. We have the full public to private index lens leveraging MSCI´S leading indexes, the strength of Barra performance and risk analytics and the IPD market data engine.

1 Q3 returns in gross USD from July 1, 2024, to Sept. 30, 2024. The MSCI USA IMI Real Estate Index was down 9.3% from Feb. 28, 2022, to June 28, 2024, in contrast to the positive 26.4% performance of the MSCI USA IMI over the same period.2 The global industry classification standard (GICS) is the industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.