Powering up Energy Storage

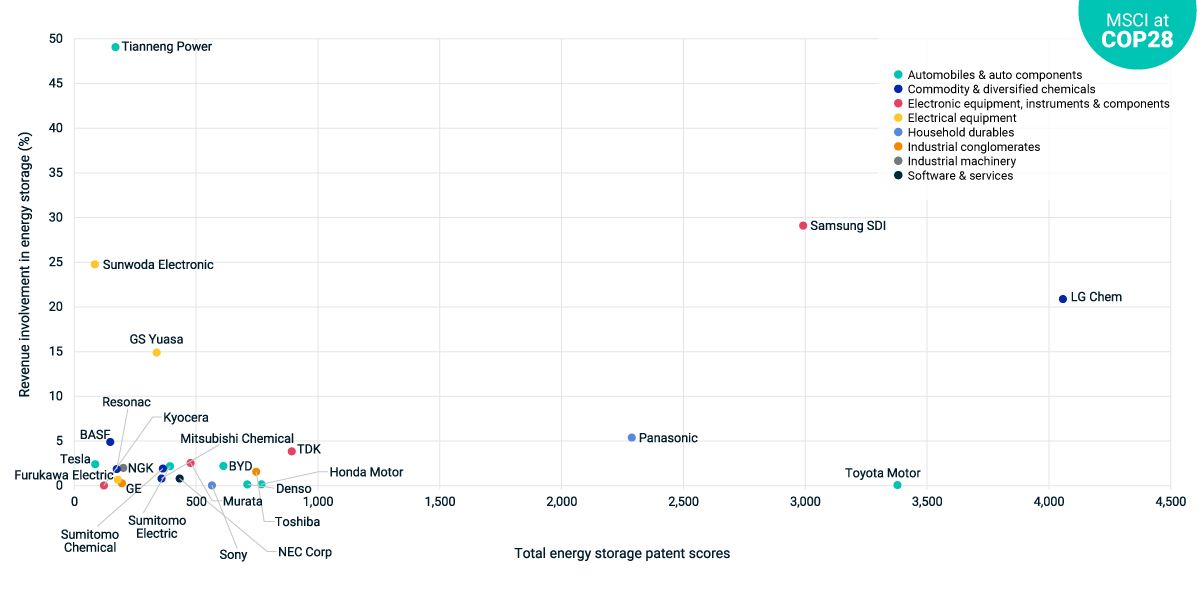

If the world is to scale up its adoption of variable energy sources like solar and wind at a net-zero-aligned pace, the demand for grid-scale battery storage may need to increase 35-fold between 2022 and 2030 to nearly 1 terawatt hour.1 Companies involved in advancing battery storage solutions span several industries, from chemicals and electronics to vertically integrated electric vehicle (EV) manufacturers. Other than the established EV battery players — such as Samsung SDI Co. Ltd. or LG Chem Ltd. — a cluster of other chemical and electronics companies scored highly in terms of the quality and quantity of energy-storage-related patents.2 Whether these companies are revenue-generating already or yet to commercialize their research and development results (as measured by energy storage revenue involvement3 and patent scores), they present different ways of supporting the electrification of transportation and the power sector.

Resources, recycling and risks

The minerals and metals needed to craft batteries can face significant resource constraints, as well as social risks.4 Battery value-chain participants may need to strengthen supply-chain due diligence on mineral sourcing. The ability for companies to commercialize patents for alternative battery chemistry with low- or no-cobalt content will also be crucial to reduce dependency on key minerals. Another approach to alleviate resource constraints is to improve the economic circularity of minerals and metals — recycling and repurposing end-of-life EV batteries into utility-scale batteries, further reducing costs.

While governments have dedicated funds to support the growth of EV battery recycling businesses,5 short-term headwinds caused by heightened costs have crippled construction progress of manufacturing-based ventures.6 Even for established auto and battery manufacturers, capacity expansion plans have experienced other disruptions such as workforce-related stoppages in the U.S.7 For clean tech solution providers like battery companies to be successful, they will also need to take the lead and manage operational risks tied to their businesses.

Discovering players with R&D potential in energy storage

Top 25 companies ranked by patent scores in energy storage. Companies had to have revenue involvement in energy storage to be included. Data as of Nov. 20, 2023. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Assessing Clean Tech for ‘S’ and ‘G’

The U.S. Inflation Reduction Act has ignited interest in developers of clean tech and low-carbon solutions. But what do the differences in the abilities of these firms to manage financially-relevant social and governance risks imply?

The Climate Transition Is Increasingly About Opportunity

Climate-friendly policies and regulations and the massive reallocation of capital needed in the coming years to ensure a successful shift to a net-zero economy should continue to expand the range of opportunities for both companies and investors.

How Canadian Asset Owners Are Seizing Investment Opportunities as Risks Evolve

Attendees at the recent MSCI Canadian Institutional Investor Forum discussed and debated the challenges and opportunities created by massive structural, macroeconomic, societal and technological shifts in the investment landscape.

1 Max Schoenfisch and Amrita Dasgupta, “Grid-scale Storage,” Interactional Energy Agency, July 11, 2023.2 Read more about low carbon patent scores in “MSCI ESG Climate Change Metrics – Methodology and Definitions,” MSCI ESG Research, October 2023 (client access only).3 Read more about environmental impact metrics in “MSCI Sustainable Impact Metrics Methodology,” MSCI ESG Research, August 2021 (client access only).4 Sam Block and Mathew Lee, “The ESG of Metals for the Clean Energy Transition,” MSCI ESG Research, February 2022 (client access only).5 “Bipartisan Infrastructure Law: Battery Materials Processing and Battery Manufacturing Recycling Selections,” Department of Energy, accessed on Nov. 27, 2023.6 “Li-Cycle Announces Review of the Rochester Hub Project,” Li-Cycle press release, Oct. 23, 2023.7 Michael Wayland, “Ford to scale back plans for $3.5 billion Michigan battery plant as EV demand disappoints, labor costs rise,” CNBC, Nov. 21, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.