Retail, Hotels and Restaurants Face Labor Challenges

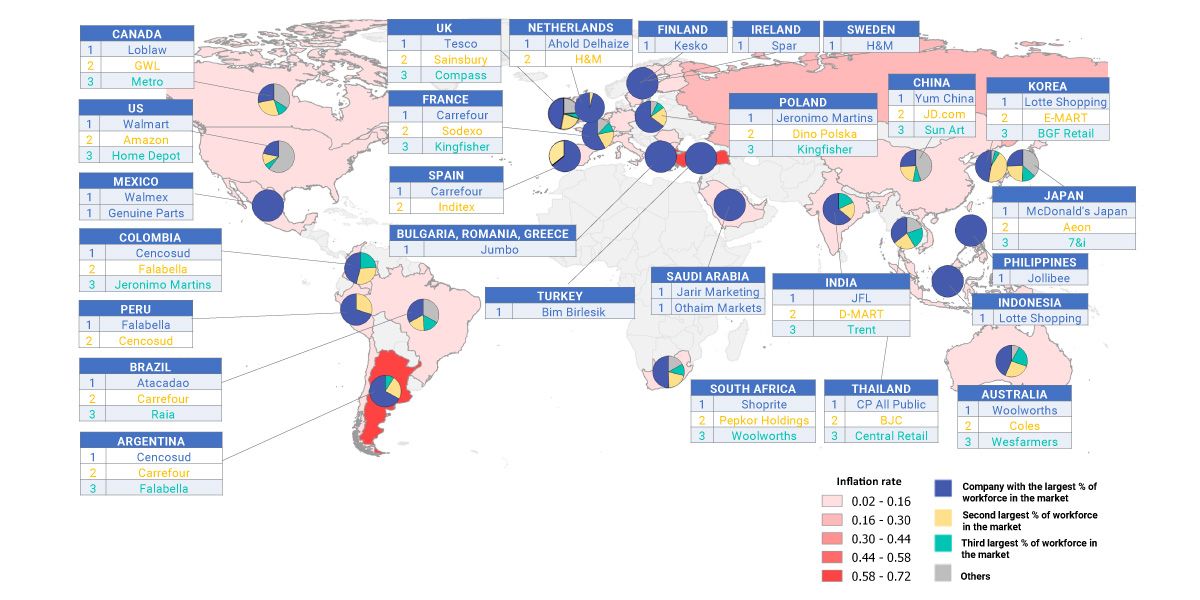

Retailers, hotels and restaurants rely on a large workforce with relatively low wages. Now, inflationary pressures and looming labor shortages might escalate two major challenges: squeezed profit margins and rising demands for a living wage.1 In the map below, we identified 53 companies that might be particularly sensitive to these challenges.

We projected some of the highest additional employee costs for companies operating in countries with double-digit inflation (Turkey, Argentina, Bulgaria, Poland and Brazil), as of June 2022.2 But we found little evidence that these companies were planning to raise wages above statutory levels.

The combination of a tight labor market and rising inflation offers both investors and workers a chance to differentiate between companies.

Companies facing tight profit margins and rising demands for a living wage

Source: MSCI ESG Research LLC, company disclosures, OECD, International Monetary Fund (IMF) Repository, as of June 2022. The pie chart for each country represents the total number of employees of all retail, food retail, hotel and restaurant constituents of the MSCI ACWI Index as of June 2022. The number of employees per country was estimated — unless reported — based on the percentage of FY 2020 revenue and may include employees of franchise operations.

Subscribe todayto have insights delivered to your inbox.

Railroad Strikes and How Institutions Go Net Zero

A labor dispute in the freight rail industry that brought the US to the brink of a potential economic catastrophe was averted this week, as unions and rail companies came to an agreement

Human capital risks in a changing world

In a changing world, companies’ ability to recruit, retain, develop and engage their workers is more central to value creation than ever.

ESG Ratings

Measuring a company’s resilience to long-term, financially relevant ESG risks

1 Kestenbaum, Richard. “Retail Wages are a Growing Problem That Will Only Get Worse.” Forbes, July 13, 2021.', 'Among the 53 companies, Bim Birlesik (97.2%), Cencosud (10.5%), Carrefour (9.8%), Falabella (6%), Jeronimo Martins (15.4%), Dino Polska (15%), Raia (7.4%) have operations in those five countries (projected additional costs are in parentheses). For further reading, see Houston, Liz, Kim, S.K. and Toader, Aura. “Bargaining with Labor – the New Normal.” MSCI ESG Research Thematic Report, Aug. 25, 2022 (client access only). Source: OECD, IMF Repository. Data as of June 2022.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.