Sector Leaderboard Changed as Inflation Picked Up

U.S. Fed Chairman, Jerome Powell, has made it official: We can no longer label the period of current inflation as transitory. The Fed left interest rates unchanged in January, and Chairman counselled patience about next steps.

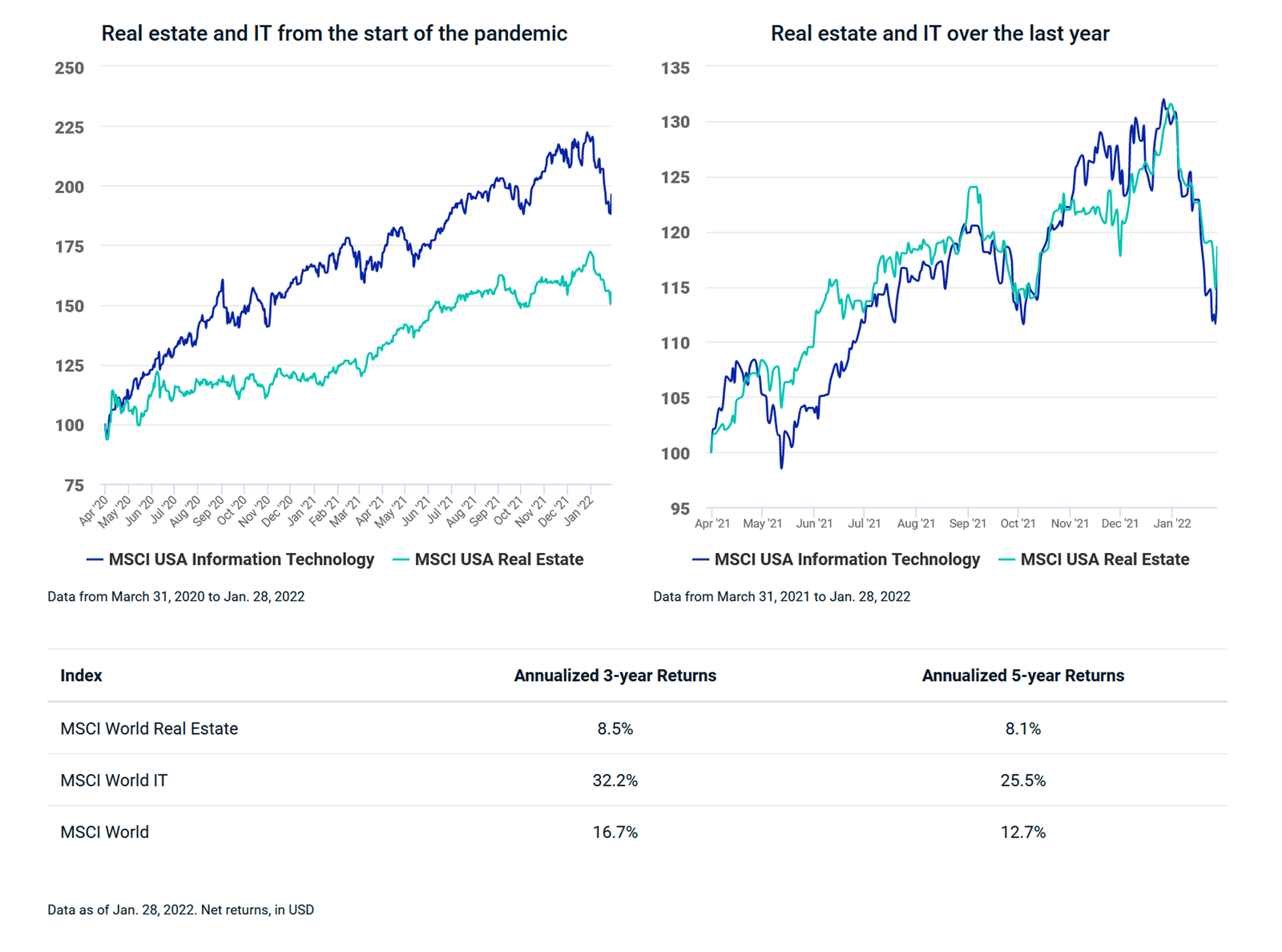

This impact of inflation is becoming apparent in sector performance. The first chart, below, shows the performance of the MSCI USA Information Technology (IT) and MSCI USA Real Estate Indexes from the end of March 2020 through Jan. 28, 2022. As the pandemic took hold, the IT sector stormed ahead as the demand for their products grew due to lockdowns and work-from-home restrictions.

As economies and societies began to emerge from the pandemic and consumer demand picked up again, along with concerns about inflation. Real estate has traditionally been seen as a possible inflation hedge, as companies in this sector have been able to increase income-growth levels from increasing rents. Since the end of March 2021, the U.S. real estate sector has kept pace with the faster moving IT sector, as you can see in the second chart.

Our research (1) also showed that more defensive sectors like healthcare and consumer staples outperformed in rising inflation environments. In December 2021, both outperformed IT and the broader U.S. market.

USA Real Estate and IT Sector Performance

Data from March 31, 2020 to Jan. 28, 2022. Data as of Jan. 28, 2022. Net returns, in USD

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Have Sectors Driven Stock Returns?

In this chart below, we can see the decomposition of the common factor contribution to the CSV of the MSCI Europe Investable Market Index (sum of sectors’, countries’ and factors’ contribution will equal 100%).

The Regional Breakdown of Market Sectors Over Time

The composition of the global stock market has changed substantially over the last 10 years.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.