Signals on Private Real Estate amid Trade Turmoil

Commercial-property investors are assessing the potential impact of trade turmoil on directly held investments following the April 2 U.S. announcement on tariffs and subsequent extreme volatility in equity and fixed-income markets.

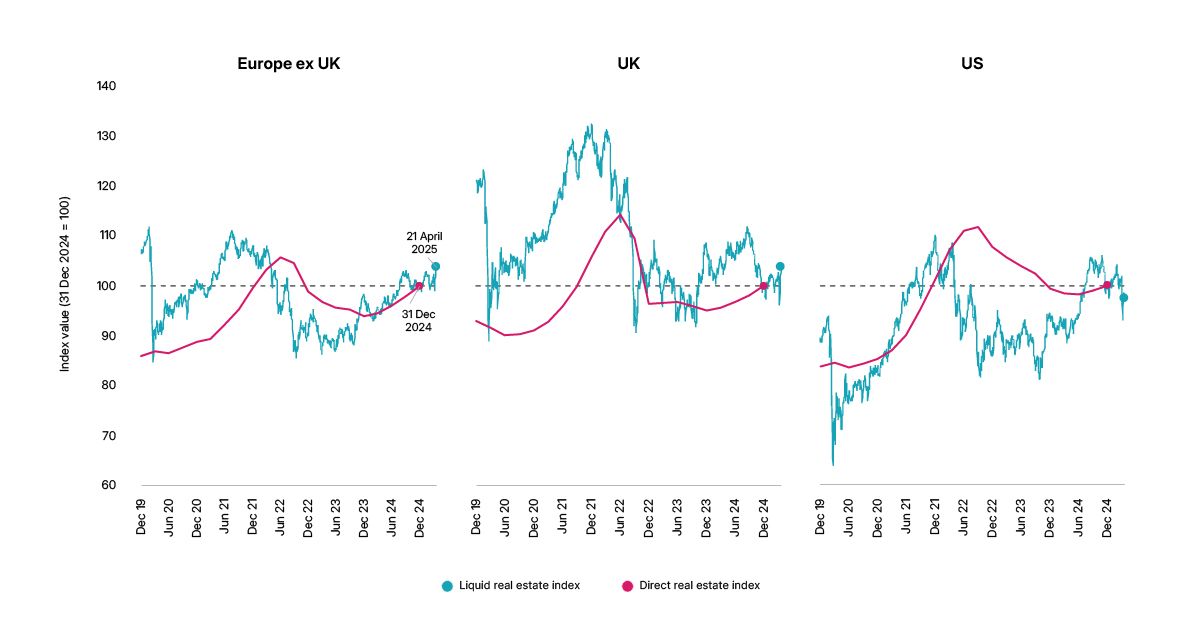

Direct investments in commercial real estate (CRE) are slower to react to market shocks, due to less frequent valuations and the smoothing effects of appraisal-based pricing. Using a daily priced liquid real-estate index may provide an early signal on valuation trends in direct CRE into the rest of 2025, as over the last two decades these liquid indexes have generally served as a leading indicator.1

Clues on valuation shifts

Between April 2 and April 8, the MSCI USA IMI Liquid Real Estate Index fell by 8.9% and even after the April 9 announcement of a tariff pause remained 4.6% down by the close of April 21. The indexes for the U.K. and Europe also posted notable declines, of 6.4% and 3.3%, respectively, but have since regained all lost ground.

As tariff policies remain in flux, asset owners and managers can monitor faster-moving indicators on real estate for a potential guide to lower-frequency direct performance indexes.

Liquid indexes for real estate reacted sharply

The direct real-estate indexes shown are the MSCI U.S. Quarterly Property Index, MSCI UK Quarterly Property Index and the MSCI Europe ex. UK Quarterly Universe dataset. The liquid indexes are the MSCI USA IMI Liquid Real Estate Index, MSCI UK IMI Liquid Real Estate Index and MSCI Europe ex UK IMI Liquid Real Estate Index.

Subscribe todayto have insights delivered to your inbox.

Private-Credit Fundraising May Face Testing Times

Economic fallout from shifting U.S. trade policy and heightened market volatility could prove a headwind for fundraising in private credit amid early signs of a slowdown in the asset class.

An Inconvenient Call: Capital Calls During a Crisis

Even amid a market downturn, investors in private-capital funds should be aware of the risk of a surge in capital calls. We chart the trends across asset classes at the onset of the COVID-19 crisis.

1 The liquid indexes are designed to blend the long-term return characteristics of private real estate with the immediacy of listed markets. The MSCI Liquid Real Estate Index is derived from the MSCI Core Real Estate Index by reducing index volatility and equity beta and removing leverage to achieve a risk/return profile similar to direct real-estate indexes. See MSCI Liquid Real Estate Indexes Methodology.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.