Private-Credit Fundraising May Face Testing Times

Fundraising cycles in private credit have been remarkably stable over the last two decades, in line with returns for the asset class, but the economic fallout from shifting U.S. trade policy has the potential to spoil that record. For comparison, buyout fundraising has historically been strongly procyclical, with general partners (GPs) taking less time between fundraises when a strategy is performing well, but sitting on the sidelines longer when returns are poor. Preliminary Q4 2024 data from the MSCI Private Capital Universe suggests senior-debt funds posted their first negative quarterly return since 2022, and given recent tariff-induced market volatility, private credit is now at risk of entering its first fundraising slowdown.

A delicate position

Private credit was balanced on a knife's edge in 2024: Floating-rate loans generated income from high interest rates, but the asset class also faced the growing risk of nonperforming loans. Recent turmoil in public equites and looming recession fears may upset private credit's delicate position.1 Falling interest rates in response to economic distress could turn countervailing forces into two headwinds as interest income falls and loans get written down.

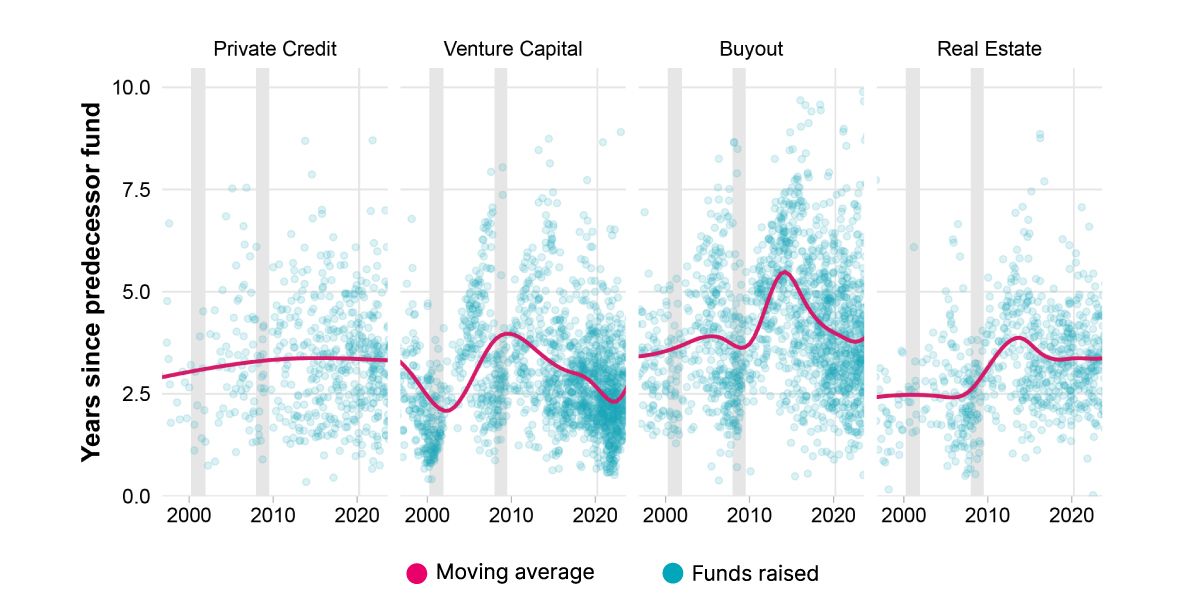

Historically, private-credit GPs have averaged slightly more than three years between funds, but private credit as a strategy has not experienced the kinds of prolonged losses faced by buyout funds in the era of the 2008 global financial crisis, or venture funds in the wake of the dot-com bust. These downswings created a fundraising hangover, where GPs waited longer — sometimes much longer — than usual to raise their next funds. That may be the fate awaiting if a severe economic contraction sparks private credit's first credit cycle.

Cyclical fundraising gaps for venture capital, buyout and real estate

Closed-end funds in the MSCI Private Capital Universe. Vertical grey bars denote U.S. recessions. Moving average of the gaps in fund formation is a smoothed average.

Subscribe todayto have insights delivered to your inbox.

Cues from Public Markets for Private-Credit Distress

Could distress trends in leveraged loans offer a glimpse of future distress rates in private-credit senior loans? We chart the path for these loans, and private-credit mezzanine debt, since interest rates began to surge.

1 Siddarth S, “Global brokerages raise recession odds; J.P.Morgan sees 60% chance,” Reuters, April 5, 2025.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.