The Futures of Emerging Markets in Asia

Emerging Markets (EM) Asia is projected1 to grow at a higher near-term pace than other emerging economies. With an average projected growth rate of 6.5% over the next five years,1 India is expected to lead the expansion of EM in Asia as one of the world's fastest-growing major markets.2 The Chinese economy, which recently lifted its zero-COVID-19 policies, is expected to grow by 4.7% over the same period.2 Taiwan and Korea, with a significant portion of their economic revenues linked to the U.S. and China, are expected to grow at about 2%,3 mainly due to weakening export prospects.

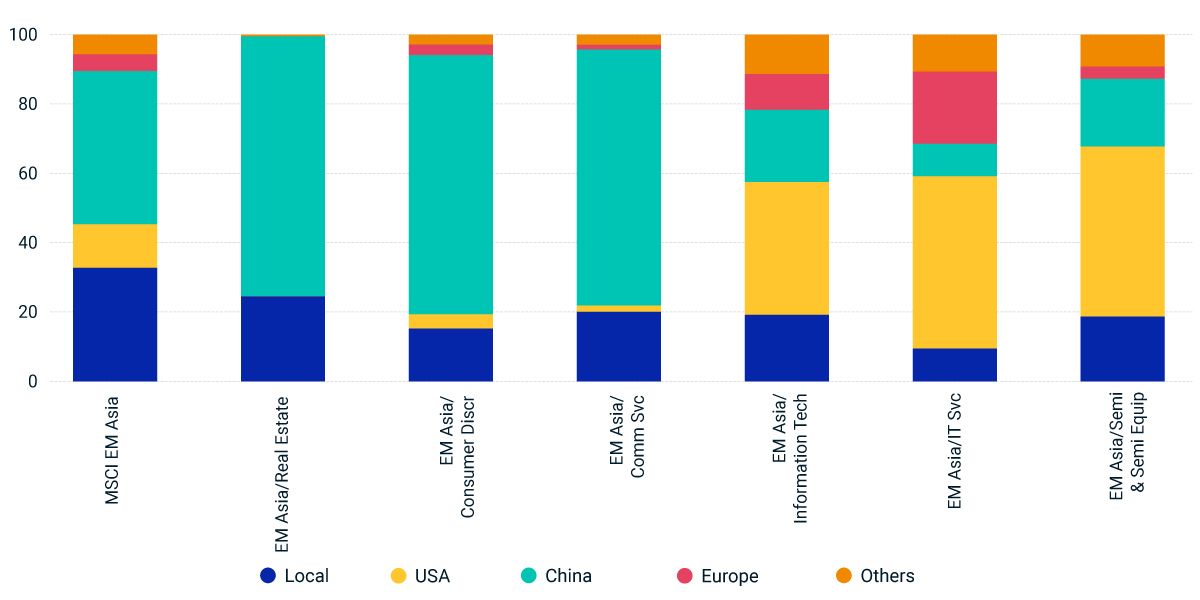

However, risks to EM Asia exposure include adverse health outcomes in China, which could deter the recovery, U.S. quantitative tightening and the Russia-Ukraine conflict, which continues to impact energy prices. As shown below, the MSCI Emerging Markets Asia Index has more than 40% of its revenues tied to Chinese companies. And sectors such as real estate, consumer discretionary and communication services have more than 70% of their revenues linked to China. Conversely, the information technology sector, which accounted for almost a quarter of the MSCI EM Asia Index,4 has about 40% of its revenues linked to U.S. firms (mainly in IT services and semiconductors).

Listed futures linked to the MSCI EM Asia Index and single-country indexes

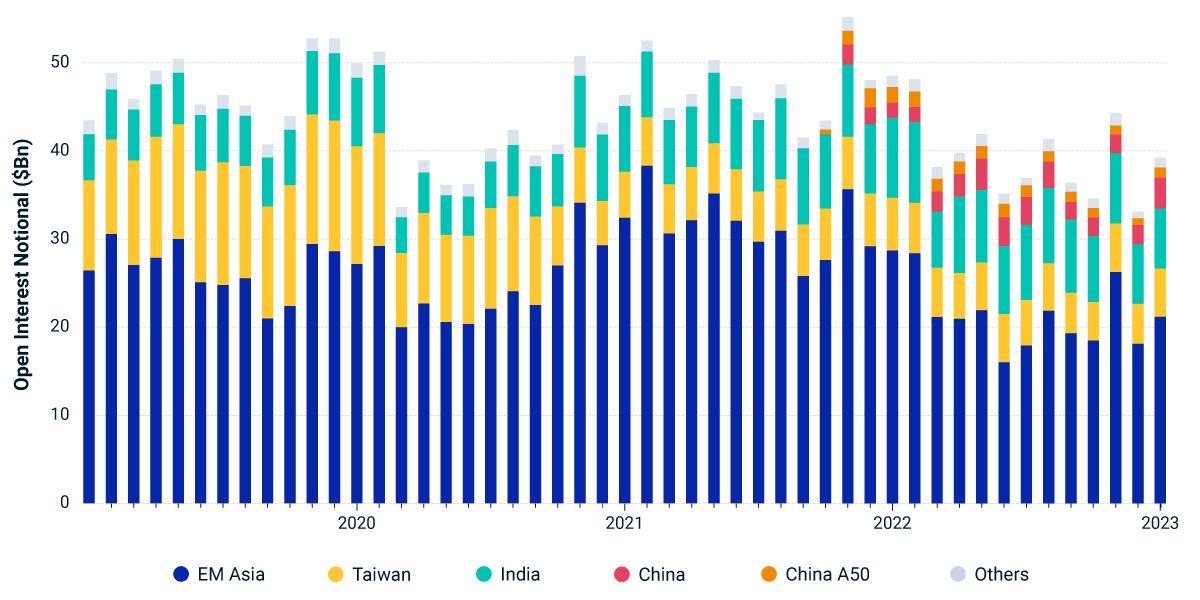

Investors looking to gain exposure to the MSCI EM Asia Index without constructing a tracking basket can look to EM Asia futures, which may be an effective path for asset allocation, tactical adjustments and risk-management purposes. Since 2019, there have been more than USD 40bn of notional open-interest trades on futures linked to EM Asia and its associated countries on average (as shown below). Investors managing China risks separately may consider listed futures linked to the MSCI EM Asia ex China and MSCI China A50 Indexes.

EM Asia economic exposures

As of Jan. 31, 2023.

Futures linked to the MSCI EM Asia Index and its single-country indexes

Month-end open interest notional in USD Bn. Others include futures linked to MSCI Malaysia, Indonesia, Thailand and Philippines indexes. As of Jan. 31, 2023.

Subscribe todayto have insights delivered to your inbox.

The Futures of Emerging Markets Decoupled

Investors in emerging markets (EM) begin 2023 with historically low valuations and softened U.S. dollar strength.

Market Reactions to China's Reopening

China reopened its borders and eliminated COVID-19 quarantine requirements on Jan.

India Equity Futures for the World

India, which is the world’s fifth largest economy and one of the fastest-growing major markets, is projected to become the world’s third largest economy by the end of the decade.

1 Source: IMF, World Economic Outlook Database, October 2022. World Economic Outlook Update, January 2023.', 'China, India, Korea and Taiwan forms more than 90% of MSCI EM Asia index as of Dec 30, 2022.', 'As of Jan. 31, 2023.', 'As of Jan. 31, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.