The Impact of China’s Reopening

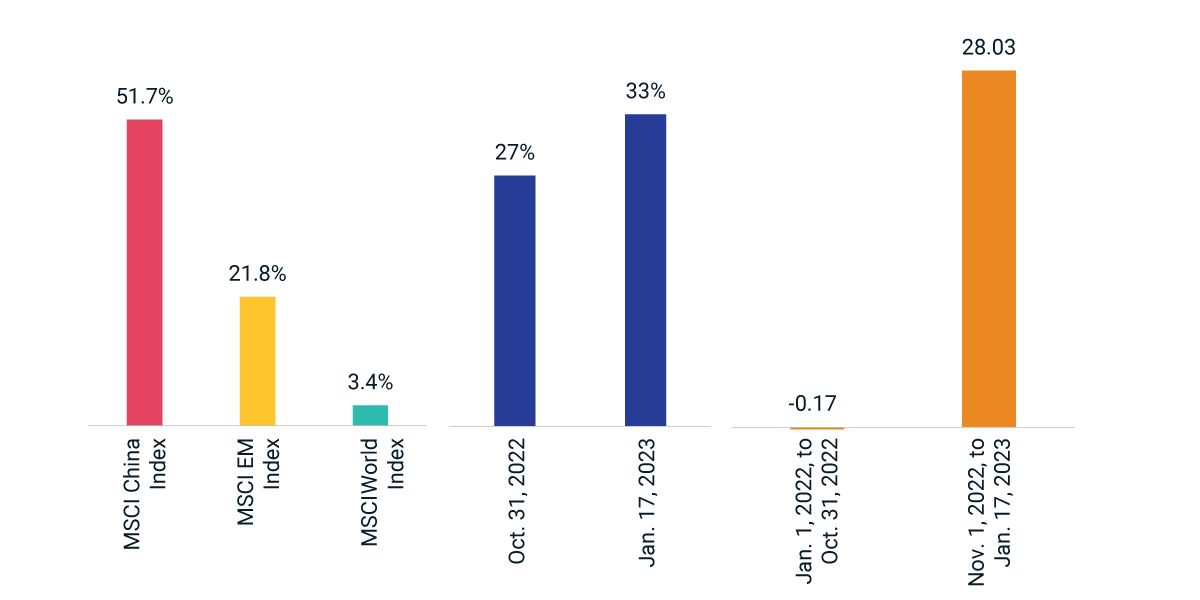

China reopened its borders and eliminated COVID-19 quarantine requirements on Jan. 8, which appears to be the end of its three-year-long, "zero-COVID" policy. Markets clearly took China's recent reopening positively: From Oct. 31, 2022 (recent market trough), to Jan. 17, 2023, the MSCI China Index was up 51.7%, contributing to the 18.3% outperformance of the MSCI Emerging Markets Index relative to the MSCI Developed Markets Index. Concurrently, China's weight in the MSCI Emerging Markets Index rose from 27% to 33%, and the Stock Connect Northbound Channel1 recorded USD 28 billion of inflows as international investors gained confidence in China's economy.

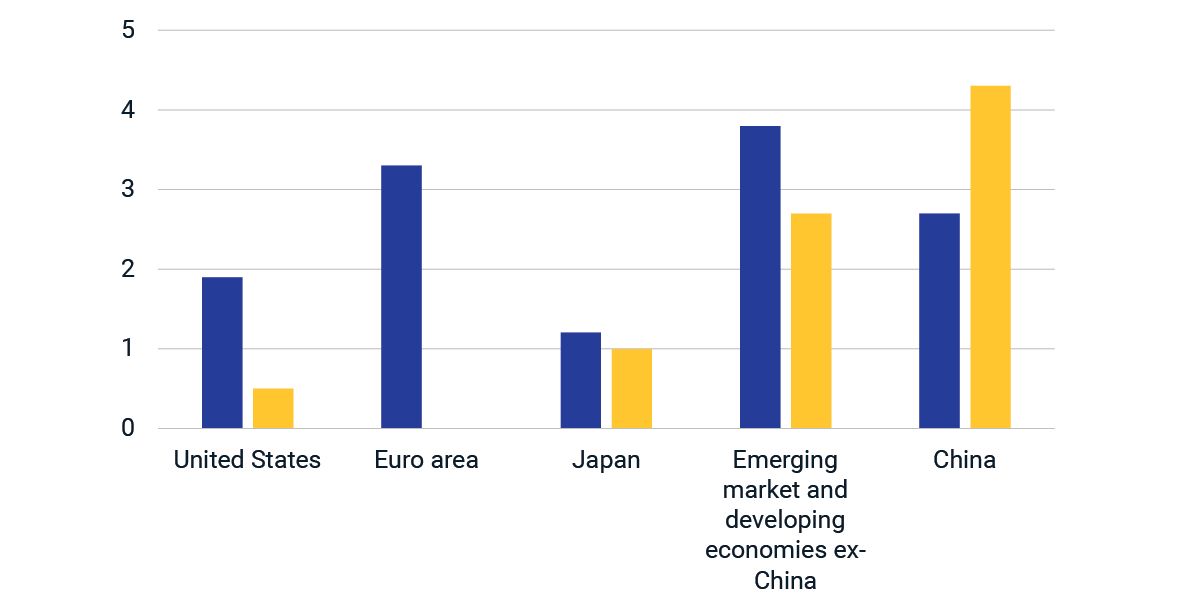

China's change to its restrictive policy could also provide significant support to the global economy. The growth rates of developed economies and emerging economies (ex-China) are projected to slow from 2.5% and 3.8%, respectively, in 2022, to 0.5% and 2.7% in 2023. Conversely, China's growth is projected to significantly advance from 2.7% in 2022, to 4.3% in 2023.2 Within China, the advancement of logistics and mobility signals since Nov. 2022, such as flight numbers, traffic indicators and the shipment of core materials, could suggest an acceleration of activities in key sectors across manufacturing, consumer and services.

Uncertainties remain amidst progress

While China's reopening provides a silver lining to the lack of global economic growth projected for 2023 and beyond, a smooth path towards recovery is by no means guaranteed. For instance, uncertainties around how future COVID-19 waves could impact labor participation and consumer spending persist. China may also need to strike a fine balance by reversing policies in key sectors (real estate tightening and internet platform regulation) and promoting a more sustainable growth model.

Global GDP growth projections

China market reactions

Gross total in USD. Source: MSCI Research, WIND data.

Subscribe todayto have insights delivered to your inbox.

Markets in Focus: Investors Look to Capture Big Market Shifts

The new year starts with the prospect of lower global economic growth, softening inflation and continued monetary tightening.

Diversification for Home-Biased China Investors

The U.S. and China represent two of the largest and complementary global-equity markets.

The Return Dispersion of China Onshore and Offshore Equities

While the MSCI China Index declined 21.8% in 2022 and underperformed the MSCI EM ex China Index by 3%, the return dispersion within the Chinese equity market was also noticeable.

1 The Stock Connect program facilitates trading and clearing between mainland China’s (Shanghai and Shenzhen) and Hong Kong’s securities markets. Northbound Trading enables international investors to trade eligible securities in mainland China through the Hong Kong Exchange.', 'The World Bank, “Sharp, Long-lasting Slowdown to Hit Developing Countries Hard,” Jan. 10, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.