Machine Learning Factors: Capturing Non Linearities in Linear Factor Models

Research Paper

March 26, 2021

Preview

The linear factor model has been a workhorse for understanding portfolio exposures, risk and performance for many years. But the idea that relationships between factor exposures and returns must be linear is not etched in stone. We investigate the extent to which machine-learning (ML) algorithms can detect significant nonlinearities and interactions in these relationships after the linear components have been removed.

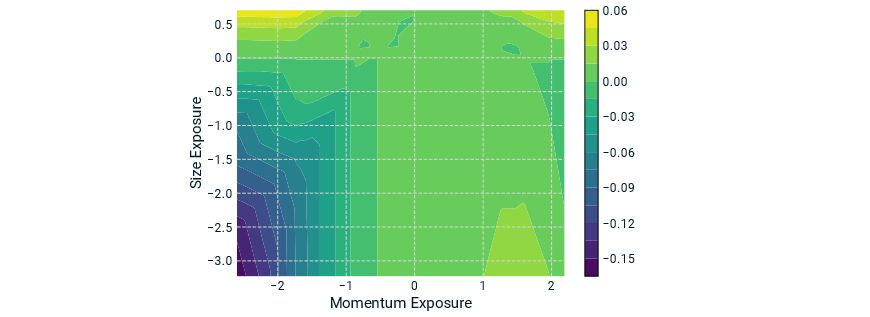

We shine a light inside the "black box" to gain insight into the relationships the ML algorithms identified. For example, we found that interactions between style factors had a significant influence on the ML models' output, particularly those factors that showed strong feature importance, including the interaction between momentum and size, as shown below.

Momentum-Size Interaction

We defined bi-variate interaction as the ML model's predicted response minus the univariate partial dependence contributions from each of the two inputs, which is plotted in the contours.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

The Many Faces of Sentiment

There are many dimensions of sentiment — some are based on the actions or views of influential and potentially well-informed market participants, such as short sellers, options traders, sell-side analysts, institutional investors and corporate insiders.

How Did Sentiment Factors Perform in Different Regions?

Sentiment factors attempt to measure various groups' views on a company.

The Hunt for Pandemic-Related Investment Factors

We explore the hunt for pandemic-related factors that have affected markets and portfolios. How did AI help George Bonne and team spot them and quantify their impact?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.