Sustainability Due Diligence for Banks

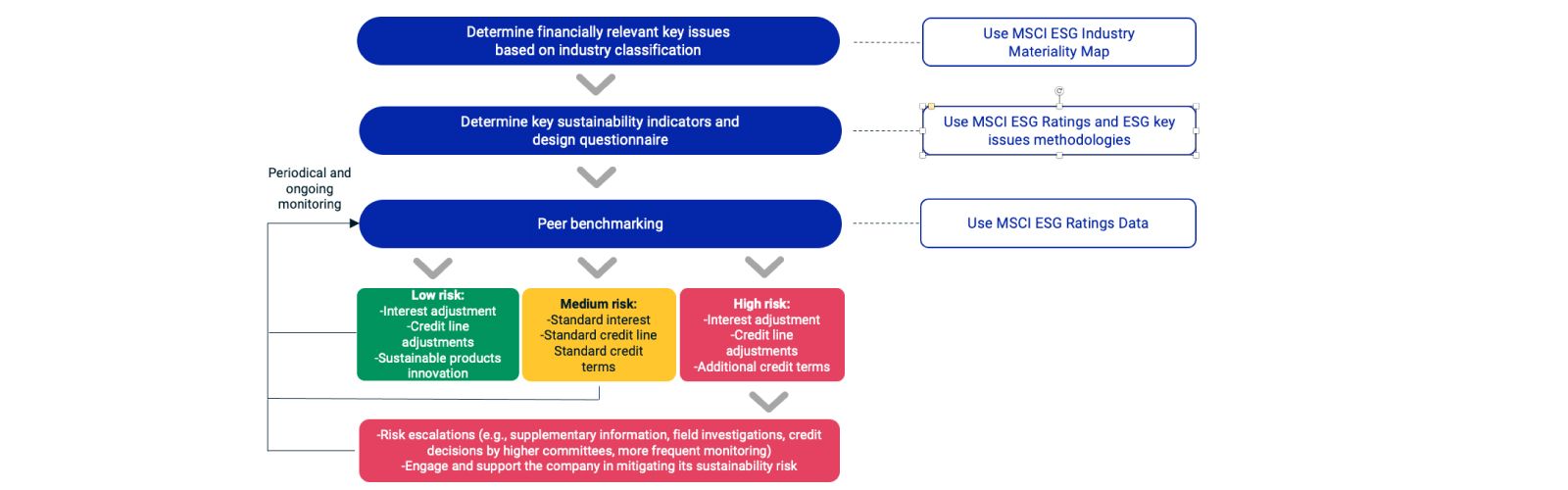

A 2024 survey conducted by Stanford University and the MSCI Institute showed that more than 90% of the world's largest institutional investors considered sustainability criteria important in their overall investment decisions. For sustainability due diligence on private companies, however, the lack of accessible and consistent data complicates matters, as these firms are not subject to the same level of reporting requirements as listed companies. Banks are particularly exposed to this challenge because a significant portion of their lending counterparties are private. In this paper, we describe the best practices in sustainability due diligence observed among global banks, leveraging their comprehensive disclosures and experience in integrating sustainability risk and opportunity assessment into financing activities. We also provide guidance on how banks can apply MSCI ESG Ratings methodology and data to help manage financially material sustainability risks.

Read the full paper

Provide your information for instant access to our research papers.

Carbon Footprinting for Banks

How ESG Affected Corporate Credit Risk and Performance

Human-Rights Due Diligence: Companies’ Preparedness for the EU’s CSDDD

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.