MSCI Business Involvement Screening ResearchCustomize portfolios with transparency and precision.

How we can help youPower customization and resilience

Institutional investors face mounting pressure to demonstrate that their portfolios align with evolving client mandates, fund guidelines and broader policy objectives. Meanwhile, increasing scrutiny around controversial activity screening can raise reputational risks. MSCI Business Involvement Screening Research (BISR) provides data-driven, company-level insights that enable customizable portfolio management. With BISR, investors can manage risks with confidence, enhance performance and better align with client expectations.

Customize portfolios to reflect specific criteria, client mandates or fund guidelines, including faith-based, sustainable or exclusionary approaches.

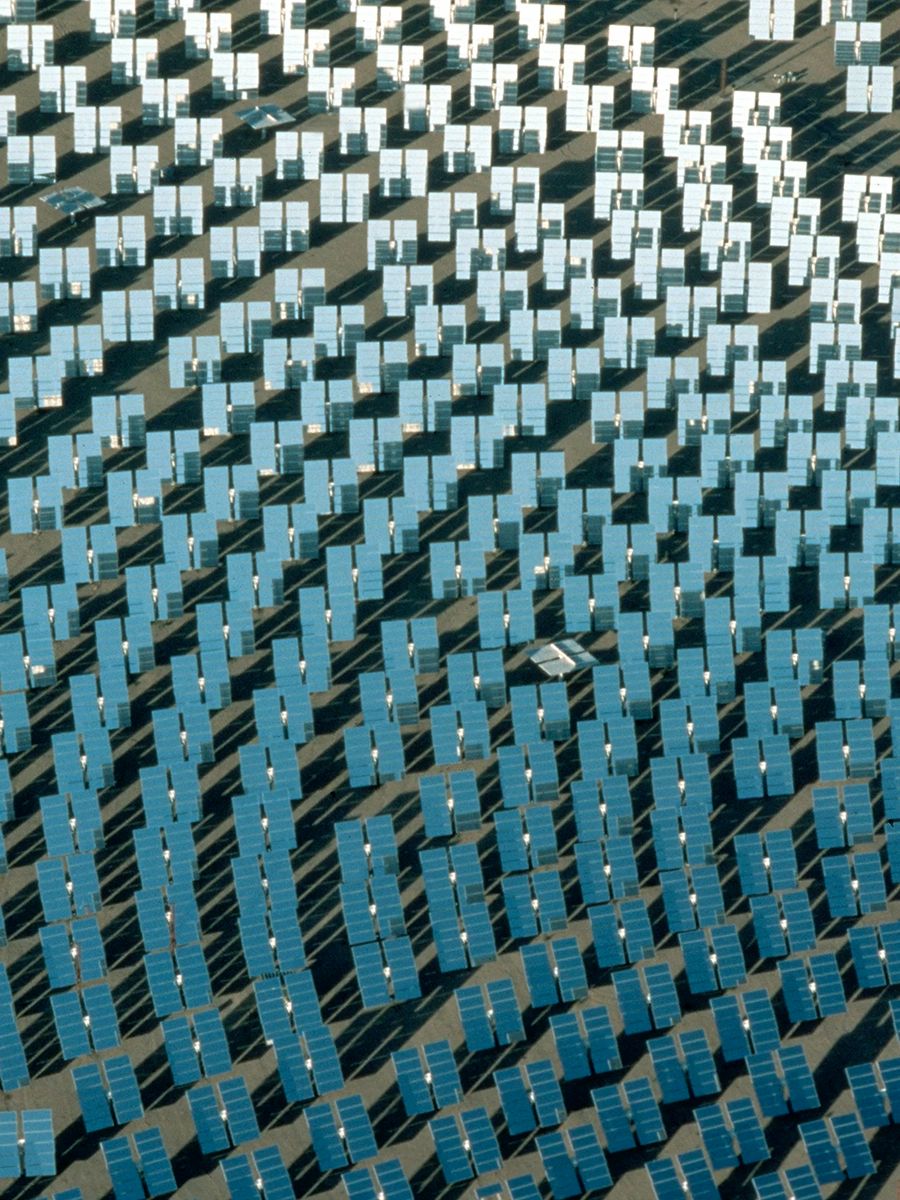

Identify and manage exposure to companies with involvement in certain activities, such as weapons, fossil fuels or human rights violations.

Monitor and report portfolio alignment with client mandates and objectives, and strengthen engagement strategies through company-level signals.

Incorporate data into portfolio construction, pre-trade checks, risk models and post-trade monitoring to support portfolio design and ongoing oversight.

Enabling tailored portfolio management

Built on a robust methodology, BISR provides detailed company-level insights, offering transparency and flexibility beyond standard classifications.

Evidence-backed insights

Flags only companies with verified involvement, reducing noise and false positives through transparent methodology.

Rigorous quality assurance

Multi-step reviews — automation, analyst checks and company feedback — help strengthen data quality and reliability.

Seamless integration

Easily embeds into existing workflows, streamlining portfolio construction, compliance and regulatory reporting.

Scalable expertise

Drawing on 50+ years of index expertise, we have developed 600+ indexes that apply BISR company data to define inclusion rules, shaping USD 700 billion+ benchmarked assets.1

Featured productsWays to customize.

MSCI BISR cover equity issuers and fixed income issuers for most screens including bond-issuing subsidiaries, corporate bond issuers, and government-owned entities that operate as corporations.

MSCI in Practice

Resources and research

Looking for a demo?Request one now.

1 World’s largest pensions as determined by the report “Global top 300 pension funds” — a Thinking Ahead Institute and Pensions & Investments joint study. AUM and rankings calculated as of December 2023. Report published in September 2024. MSCI clients as of September 30, 2024. World’s largest asset managers as determined by the report “The world’s largest 500 asset managers” — a Thinking Ahead Institute and Pensions & Investments joint study. AUM and rankings calculated as of December 2023. Report published in October 2024. MSCI clients as of September 30, 2024. World’s largest banks as determined by the report “The world’s 100 largest banks, 2024”, S&P Global Market Intelligence’s annual ranking of the 100 largest banks by assets at the end of 2023. Report published in April 2024. MSCI clients as of September 30, 2024.

2 MSCI ESG Research as of April 2025.