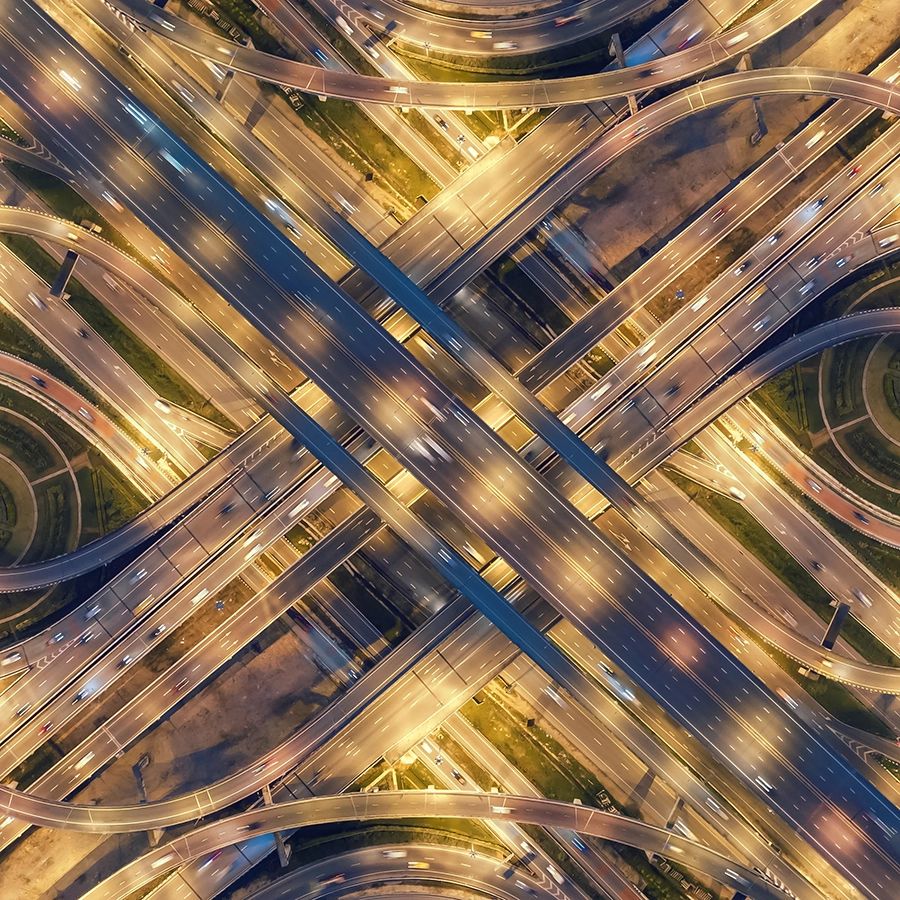

Where insight meets opportunity

Connect with the only global partner in data, portfolio services and insights for investments in commercial real estate investing. We deliver deep insight into real asset performance which provides the foundation so you can find new opportunities, take action and navigate the real estate market with confidence.

Better understand the drivers of investment performance for your portfolios across sectors and markets to make informed asset allocation decisions.

Access one of the largest private commercial real estate databases to explore and vet investment opportunities around the world.

Evaluate the physical and transition risks of climate in your owned assets and potential investments, and test how your portfolio decisions impact your risk exposure.

Gain confidence with deeper insight

Make informed decisions with clarity from one of the industry’s leading sources of data and tools for commercial real estate.

Global coverage

We harness information from over 170 countries to equip you with extensive insights into market transactions, properties and players in the global real-estate universe.1

Robust verification

Our research analysts rigorously verify the data we collect from clients, third parties and public sources to help ensure it is broad, in-depth and high quality.

A consistent view

We offer a coherent view of risk and performance from portfolio/fund to granular asset level. Directly compare and reconcile investments for informed and strategic decisions.

Industry expertise

Our insights draw on more than 40 years of experience as a leading source of commercial real estate data.2 Our seasoned research team in the Americas, EMEA and APAC provides deep local market knowledge.

Our performance dataset

Bringing greater transparency to property markets with extensive commercial real estate data.3

$50 trillion+

Transactions

$2 trillion+

Private real estate assets covered4

120,000+

Investor and lender profiles

80+

Performance indexes

Featured productsExplore tools to help you identify opportunities and take action

Real Capital Analytics

One of the industry’s leading global databases for all global commercial properties, transactions, investors and loans.

Index Intel

Analyze real estate fund and portfolio performance using one of the most extensive private real estate databases in the world.

Mortgage Debt Intelligence

One of the largest loan databases of its kind, linking properties, loans, lenders and borrowers for a connected view of debt and distress.

Income Insights

Proactively measure and manage tenant and income risk across your portfolio and the real estate lifecycle.

Performance Insights

Better understand performance, risk and opportunities across your entire portfolio.

Property Intel

Your window on expansive data for properties, owners, tenants and location data in Finland, Norway and Sweden.

Real Estate Climate Risk

Assess your portfolio’s climate impact and test how your decisions impact your portfolio’s risk exposure.

Supporting the entire real estate investment lifecycle

Get the latest real estate intelligence from MSCI.

Discover MSCI research

Real Estate in Focus

Get a holistic picture and stay on top of global real estate markets with our quarterly view of investment trends.

Real Estate research and insights

Better understand real estate markets and the opportunities ahead with our applied research and actionable market commentary.

Charting private assets

Stay ahead of private markets with the latest trends in performance and capital dynamics.

Private Real Estate Indexes

Gain a consistent view of the financial and operating performance of investments in commercial and residential property in more than 30 countries.

1 As of June 30, 2024.

2 Based on MSCI’s acquisition of IPD Group Limited, founded in 1985, and Carbon Delta AG, Real Capital Analytics and The Burgiss Group.

3 All data as of March 2025 unless otherwise noted.

4 As of June 2024.