Debt IntelligenceAssess commercial real estate debt from every angle.

Master debt market dynamics

Access the data, tools and insights to help spot distressed assets quickly, identify upcoming maturities and manage risk in your portfolio. Powered by one of the largest CRE loan databases and the industry’s standard in indexes, Debt Intelligence equips banks, asset owners and managers with actionable insights to navigate debt markets and make confident decisions.

Understand debt exposure through investor profiles that link loans to properties to reveal the holdings, transactions and mortgage debt of asset managers.

Find deals that align with your investment strategy by analyzing market trends, troubled properties and key loan attributes.

Model and assess borrower, lender or investor exposure across property types and markets.

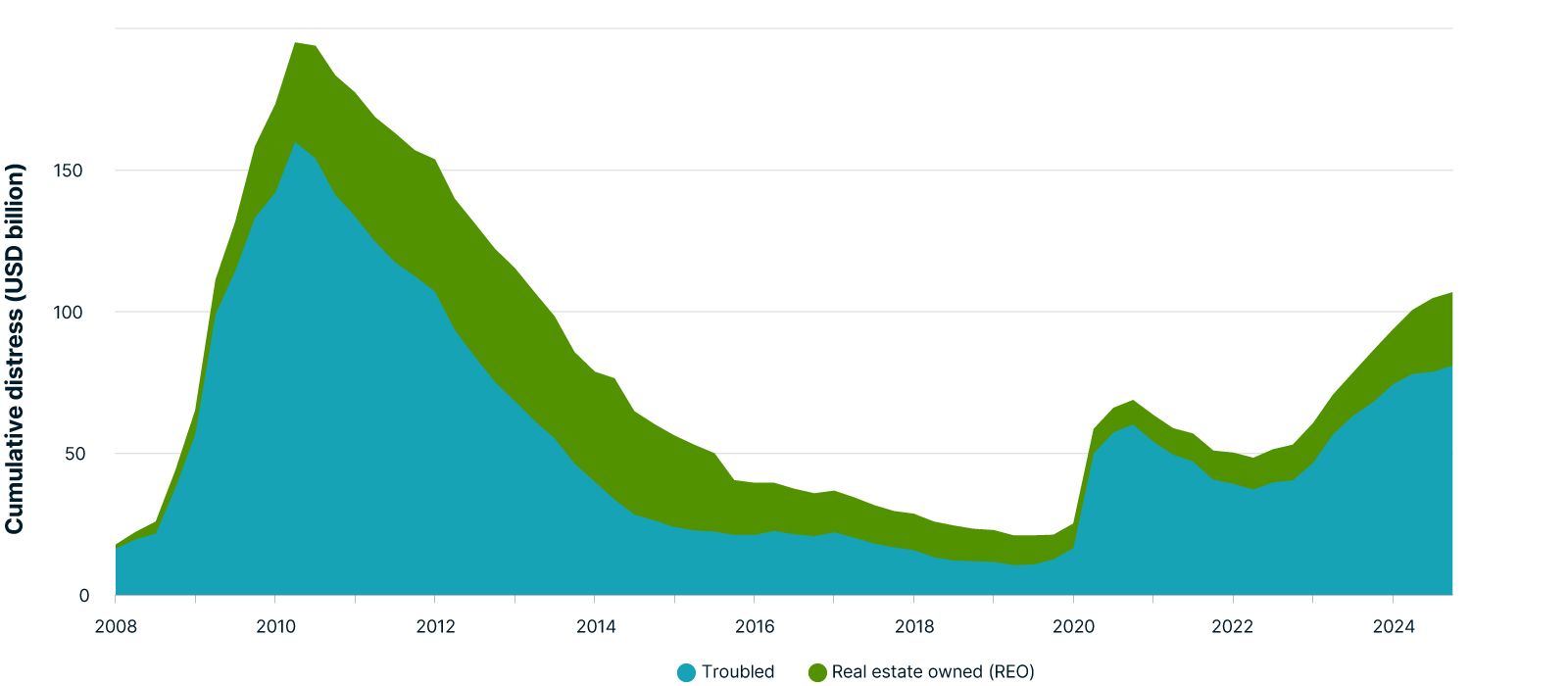

Mortgage Distress in US Commercial Real Estate

Cumulative distress in US commercial real estate published in MSCI’s quarterly Distress Tracker.

Data as of 4Q 2024.

Featured products

Mortgage Debt Intelligence is the largest searchable database linking properties, loans, borrowers and lenders. It offers a comprehensive view of property debt and distress using over 20 years of securitized and private loan data.

Data integration

Integrate global loan data, including private loans, into your workflow through the Real Capital Analytics platform or Snowflake cloud delivery.

Decision support

Conduct due diligence, identify refinancing options and receive real-time alerts to drive timely decisions across the debt market.

Broad coverage

Access data on more than 400,000 commercial real estate loans and 1 million transactions to analyze trends and validate investment opportunities.¹

Enhance your debt intelligence.

MSCI Private Capital Indexes

MSCI’s suite measures net-of-fees aggregate performance in unlisted closed-end private capital fund vehicles.

1 All data as of February 2025.

2 As of June 2024.