Are Audit Firms Spread Too Thin?

Key findings

- Global shifts in demographics and employment preferences may reduce the number of practicing accountants, challenging the beleaguered auditing field.

- In our global analysis of more than 900 audit firms, 36.3% of them relied on one public-company client for 100% of auditing revenue, and a further 9.5% relied on one company for 50% or more.

- We found 8.6% of audit firms were outliers due to a low number of chartered accountants relative to the size of their engagement portfolio.

Financial statements are essential to everyday investment decisions, and investors rely on external auditors to confirm their accuracy.[1] Our recent research highlighted challenges impacting the global audit industry, including overreliance on a small group of audit clients.[2] An emerging threat — a decline in practicing chartered accountants[3] amid falling interest in accounting as a career — may exacerbate these problems. For this blog post, we looked at audit firms across both developed and emerging markets to assess the current state of play in the industry, and to identify potential areas of concern and the impact these could have on investors.

In the U.S., roughly 75% of certified public accountants are at or approaching retirement age.[4] Simultaneously, interest in this career appears to be tumbling, with the American Institute of Certified Public Accountants missing membership targets in four of the last five years.[5] This shortage is not specific to the U.S. and is made worse in some jurisdictions by stricter reporting rules in both public and private accountancy.[6]

Audit-fee concentration

Overreliance on a single client may impede an audit firm's ability to conduct an independent audit, potentially preventing problematic accounting practices or outright fraud from being discovered.[7] We found that 36.3% of audit firms included in our study relied on a single client for all revenue from public-company audits, while a further 9.5% of audit firms relied on a single client for 50% or more.[8]

Stiffening competition for talent may further hinder these highly concentrated audit firms from exercising independence in their engagements. Some may hesitate to jeopardize existing relationships with companies by providing anything other than a clean audit opinion.

Audit firms in emerging markets were significantly more concentrated than in developed markets. Brain drain, or the efforts by audit firms in developed markets to attract chartered accountants from developing markets, may make this situation worse.

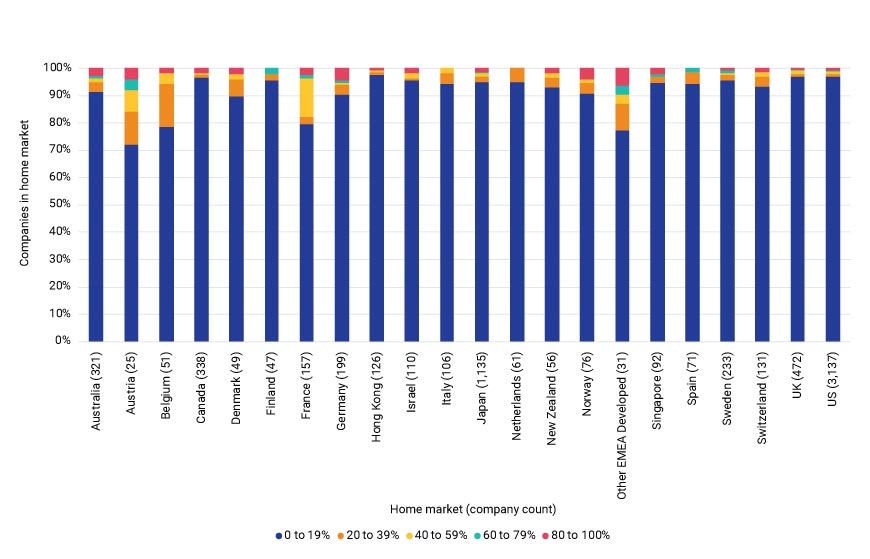

Audit-fee concentration in developed markets

Audit-fee concentration in emerging markets

This exhibit displays the proportion of companies, by market, audited by an audit firm relying on a single engagement for 'X'% of their fee base from public-company audits. Data as of Nov. 27, 2023. Source: MSCI ESG Research

Auditor size

Chartered accountants are essential to the audit process but, as their number falls, audit firms could struggle to meet their engagement obligations. Those unable to adequately meet their staff requirements may not be able to consistently complete quality audits across their portfolio.[9]

Determining if an audit firm has the right staff to successfully address its engagement portfolio is challenging. Total dollars of assets and revenue audited across an audit firm's entire book of work may serve as a proxy for the complexity of the assessment process.[10] This value can then be compared against the audit firm's total number of employed chartered accountants.

Based on this, we found that 8.6% of audit firms in our universe were extreme outliers for understaffing relative to peers.[11] The interactive exhibit below highlights markets and specific audit firms that may be particularly susceptible to the talent crunch.[12]

Audit-firm chartered accountants vs. engagement portfolio

Loading chart...

Please wait.

How to interact with this chart: Along the top, select either assets or revenue and then use the drop-down menu at the bottom to select the region. Zoom in/out for a closer view and hover over the dots for more detailed information about each auditor firm.

This exhibit displays the number of chartered accountants employed at a particular audit firm, as reported by the Public Company Accounting Oversight Board, against the total value of the firm's engagement portfolio in assets and revenue (in USD billions). Included in this chart are the 10 largest auditor groups, by number of companies audited, covered by our analysis, ordered by % of companies audited from largest to smallest. Excludes auditors based in Bermuda, Cayman Islands, Jersey and Panama. Data as of Nov. 27, 2023. Source: MSCI ESG Research

This exhibit displays the number of chartered accountants employed at a particular audit firm, as reported by the Public Company Accounting Oversight Board, against the total value of the firm's engagement portfolio in assets and revenue (in USD billions). Included in this chart are the 10 largest auditor groups, by number of companies audited, covered by our analysis, ordered by % of companies audited from largest to smallest. Excludes auditors based in Bermuda, Cayman Islands, Jersey and Panama. Data as of Nov. 27, 2023. Source: MSCI ESG Research

Moving forward

Investors may be exposed to additional risks as audit firms navigate this human-capital challenge and thus may wish to expand audit-related diligence. Our proposed framework of audit-quality scores may be leveraged to identify companies for which audit quality may be compromised due to characteristics of their audit firm. Audit quality may be assessed by considering an audit firm's expertise, capacity, track record and relationships with its clients. Investors may use this approach to support engagement with portfolio companies on the basis of audit and risk oversight, or to provide further insight when considering an audit firm's (re-)appointment.

Subscribe todayto have insights delivered to your inbox.

1 Walid Soliman, “Investing the effect of corporate governance on audit quality and its impact on investment efficiency,” Investment Management and Financial Innovations 17, no. 3 (2020): 175-188.2 Also see “Introduction to Audit Quality Scores,” MSCI Research, December 2023 (client access only).3 In the U.S., chartered accountants are more commonly referred to as certified public accountants.4 Stan Sterna, JD, and Amy Massaro, “Succession Planning: A Tale of Two Exit Strategies,” AICPA, April 17, 2018.5 Stephen Foley, “Dire shortage of accountants prompts calls for shake-up,” Financial Times, Jan. 4, 2024.6 Erica Alini, “Need an accountant? It may be hard to find one this tax season,” Globe and Mail, Feb. 5, 2024.7 Linda Elizabeth DeAngelo, “Auditor size and audit quality,” Journal of Accounting and Economics 3 (1981): 183-199.8 Our analysis covered 11,467 companies in corporate-governance research coverage, audited by 910 unique audit firms (e.g., BDO USA LLP and Grant Thornton Sweden A.B.), 419 of which are part of a larger audit group (e.g., Ernst & Young and KPMG).9 International Auditing and Assurance Standards Board, “A Framework for Audit Quality. Key Elements that Create an Environment for Audit Quality.” International Federation of Accountants, February 2014.10 Indira Januarti and Mutiara Sukma Wiryaningrum, “The Effect of Size, Profitability, Risk, Complexity, and Independent Audit Committee on Audit Fee,” Jurnal Dinamika Aktuntansi 10, no. 2 (2018): 136-145.11 We consider a firm to be an extreme outlier when total audited revenue per accountant is >= USD 6 billion or total audited assets per accountant >= USD 20 billion. In our study, 85.5% of companies were audited by a firm where these ratios were < 4 and < 10, respectively. In the case of joint auditors, this ratio is calculated by using the target company's full asset value relative to each audit firm's number of accountants.12 French companies account for a significant proportion of outliers given the country's joint-audit regime, in which two audit firms are appointed to jointly audit financial statements. Given the absence of clarity on how responsibilities and the review processes are divided, each audit firm was assessed independently, rather than as a pair, for each French company.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.