Can ESG Add Alpha?

Blog post

June 17, 2015

Interest in Environmental, Social and Governance (ESG) mandates has grown considerably over the past few years, but some institutional investors remain concerned that inclusion of ESG factors may come at the cost of weaker risk-adjusted returns. Our research shows that this is not necessarily the case.

In "Optimizing Environmental, Social, and Governance Factors in Portfolio Construction," we analyzed the effect of ESG ratings on portfolio performance on three optimized ESG-tilting strategies for the period of February 2007 through December 2012, and the effect of ratings changes starting in February 2008. For the ratings, we used MSCI ESG Ratings (formerly Intangible Value Assessment scores) that evaluate sector-specific ESG material risks and opportunities. The MSCI World Index served as our performance benchmark and as the universe for the optimized portfolios. The Barra Global Equity Model (GEM3) was used to build and analyze three optimized ESG-tilting strategies.

We found that:

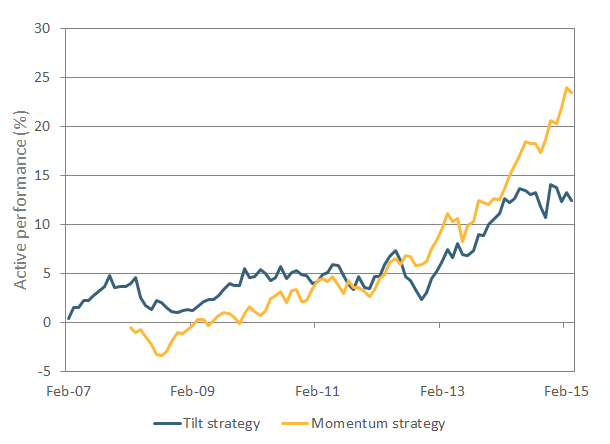

- An ESG momentum strategy delivered the best risk-adjusted performance.

- An ESG "worst-in-class" exclusion strategy that eliminated low-rated companies before applying the ESG tilt led to a small improvement in ESG scores and negative performance results.

- A "simple ESG tilt" strategy that overweights stocks with high current ESG ratings and underweights those with low current ratings while maintaining other portfolio exposures very close to benchmark exposures resulted in an excess return that was generally small and slightly negative.

- We extended the time series by two more years.

- We deliberately treated ESG data as an indicator of potential outperformance (or alpha) in the portfolio construction process.

- We studied higher risk strategies, as implied by our alpha-seeking stance. These higher risk strategies allow for larger active weights, and can help uncover the relationship of ESG ratings with other factors.

ESG Tilt and Momentum Strategy Active Performance versus MSCI World Index

A significant part of this outperformance was not explained by style factors alone; our research shows that ESG factors were also drivers of return.

These results suggest that investors with the tolerance to take some active risk, while at the same time looking to improve the ESG profile of their portfolios on a systematic basis, could have incorporated such strategies as part of their investment process.

Read the paper, "Optimizing Environmental, Social, and Governance Factors in Portfolio Construction."

Read the paper, "Does ESG add Alpha?."

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.